Ideas to action: independent research for global prosperity

taxes

More from the Series

Blog Post

April 30, 2019

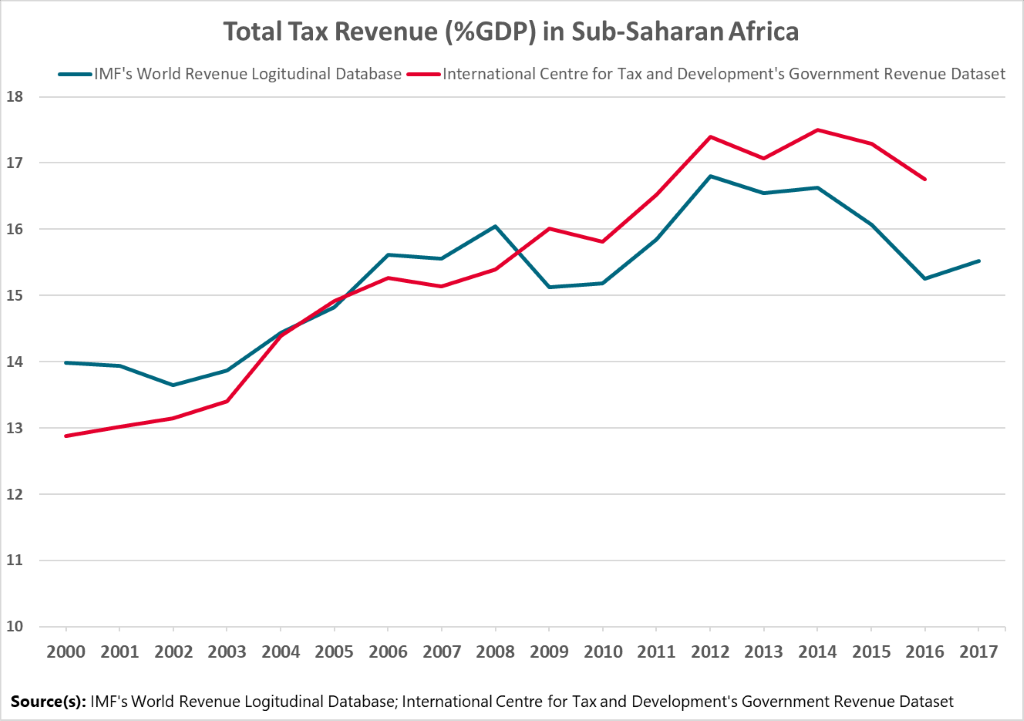

At the Center for Global Development, we recently initiated a project to develop more effective and equitable strategies for domestic resource mobilization in low-income countries in sub-Saharan Africa (SSA). The impetus for the project is the Addis Ababa Action Agenda for financing d...

Blog Post

April 10, 2019

The Task Force on Fiscal Policy for Health, co-chaired by Michael Bloomberg and Lawrence Summers just launched a report calling on governments to substantially raise taxes on tobacco, alcohol, and sugary beverages. Such policies could avert an estimated 50 million premature deaths while raising...

Blog Post

March 01, 2019

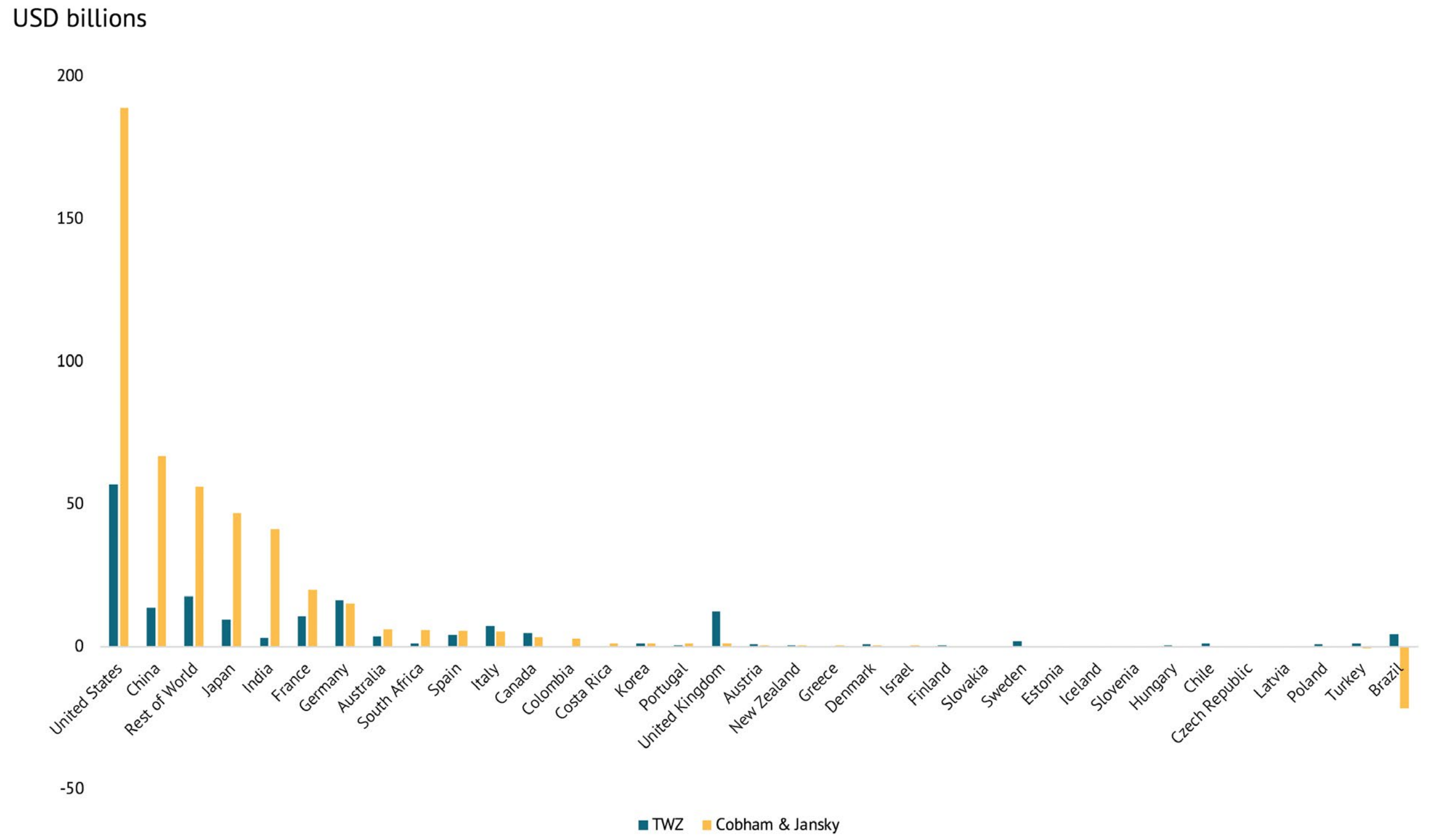

Matti Kohonen of Christian Aid holds out the enticing prospect that African countries could collect an additional 1.5 percent of gross domestic product in tax if only big multinationals would stop dodging. The problem is that this estimate is (still) based on wishful thinking. Multinationa...

CGD NOTES

November 16, 2018

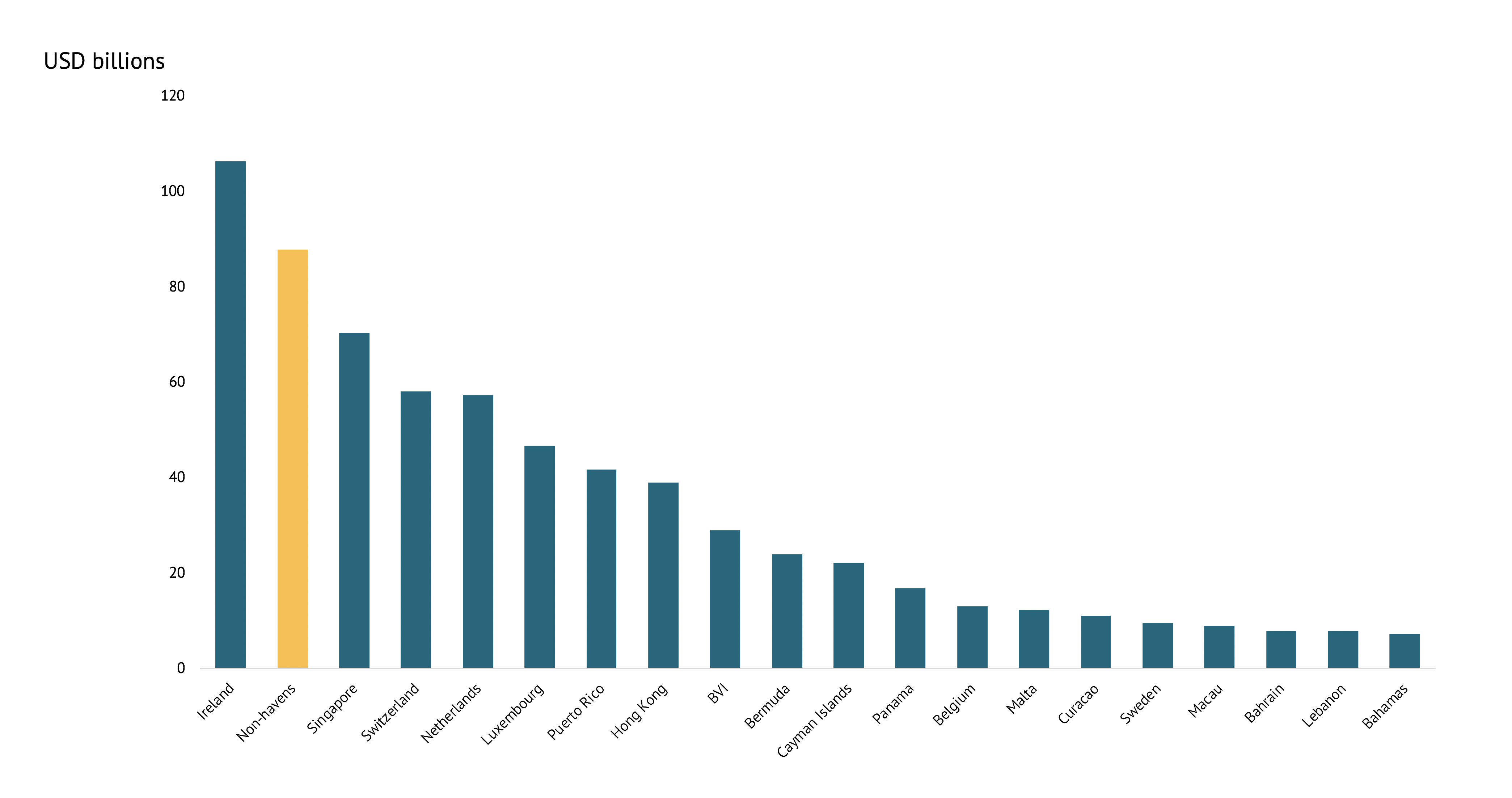

“The Missing Profits of Nations,” by Thomas Tørsløv, Ludvig Wier, and Gabriel Zucman is a recent high-profile study seeking to assess profit shifting by multinational corporations. Headlines such as “40 percent of multinational profits are shifted&rdquo...

POLICY PAPERS

November 13, 2018

The Multilateral Instrument (MLI) is a groundbreaking mechanism to update the network of thousands of bilateral tax treaties that make up the international tax system. This paper argues that developing countries should sign up to the MLI, but that they can afford to take a wait-and-see approach to s...

Blog Post

August 01, 2018

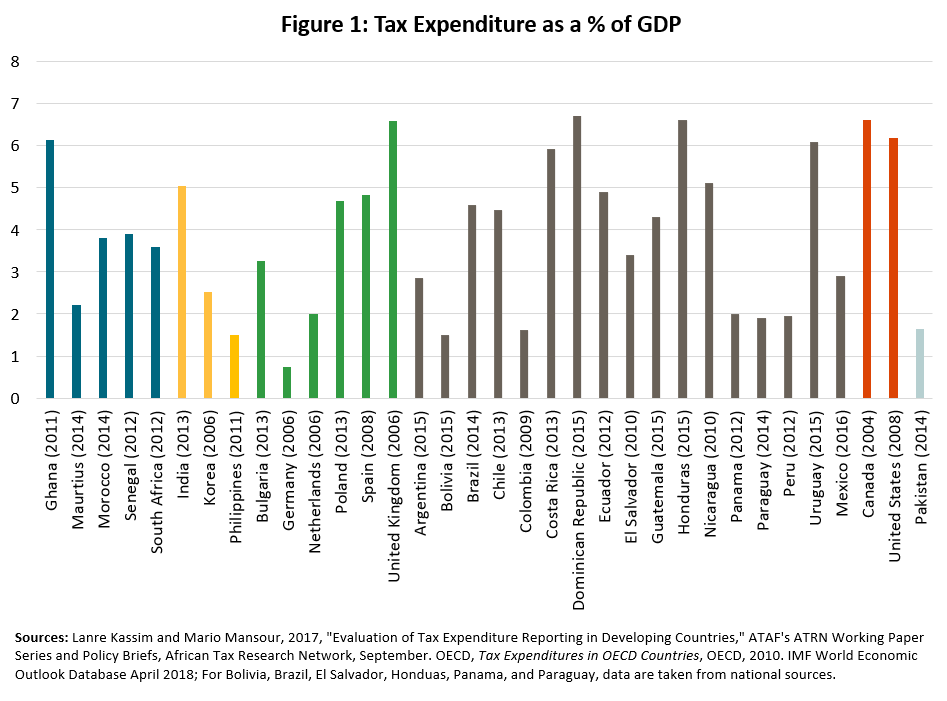

It is time that donors and technical assistance providers turn their attention to tax concessions provided by developing countries struggling to raise more taxes from domestic sources. The granting of tax concessions is not only mostly opaque and prone to corruption, but these concessions are furthe...