Ideas to action: independent research for global prosperity

taxes

More from the Series

Blog Post

August 20, 2019

The establishment of universal health coverage is one of the key pillars of progress toward the Sustainable Development Goals (SDGs), particularly SDG3. What impact could taxing tobacco, alcohol and sugary beverages have on reducing the burden of noncommunicable diseases as we strive to achieve...

Blog Post

August 13, 2019

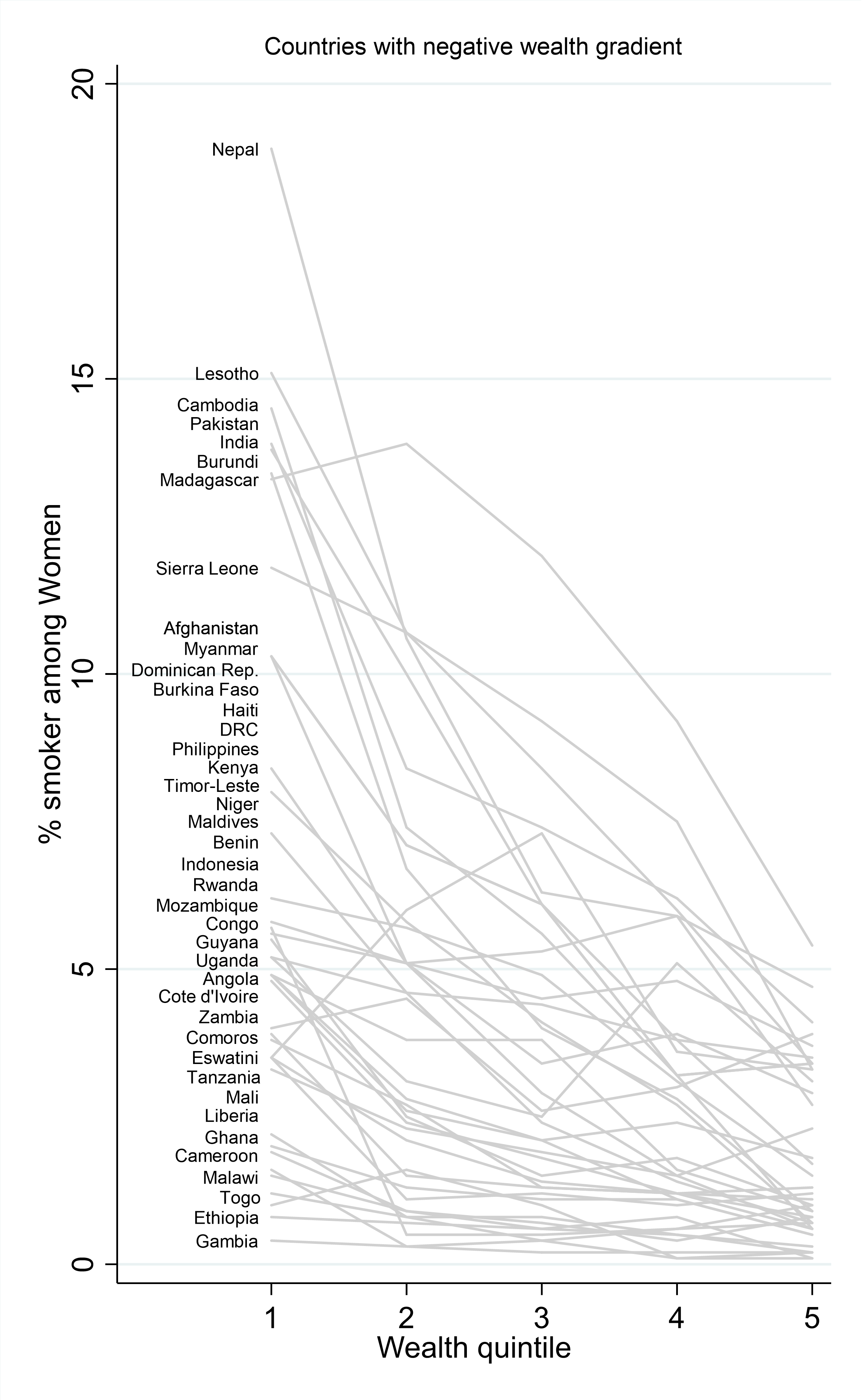

Are “sin taxes” regressive? This is a common criticism of proposals to increase taxes on “bads” such as tobacco, alcohol, and sugar. There are a number of reasons not to be too concerned by the answer to this question. But still, we were curious, so we took a look at the data...

POLICY PAPERS

July 11, 2019

Reforming inefficient and inequitable energy subsidies continues to be an important priority for policymakers as does instituting “green taxes” to reduce carbon emissions. The paper outlines how the use of digital technology can help accomplishing those reforms, drawing on four country c...