Ideas to action: independent research for global prosperity

Finance and Investment

More from the Series

Blog Post

March 05, 2018

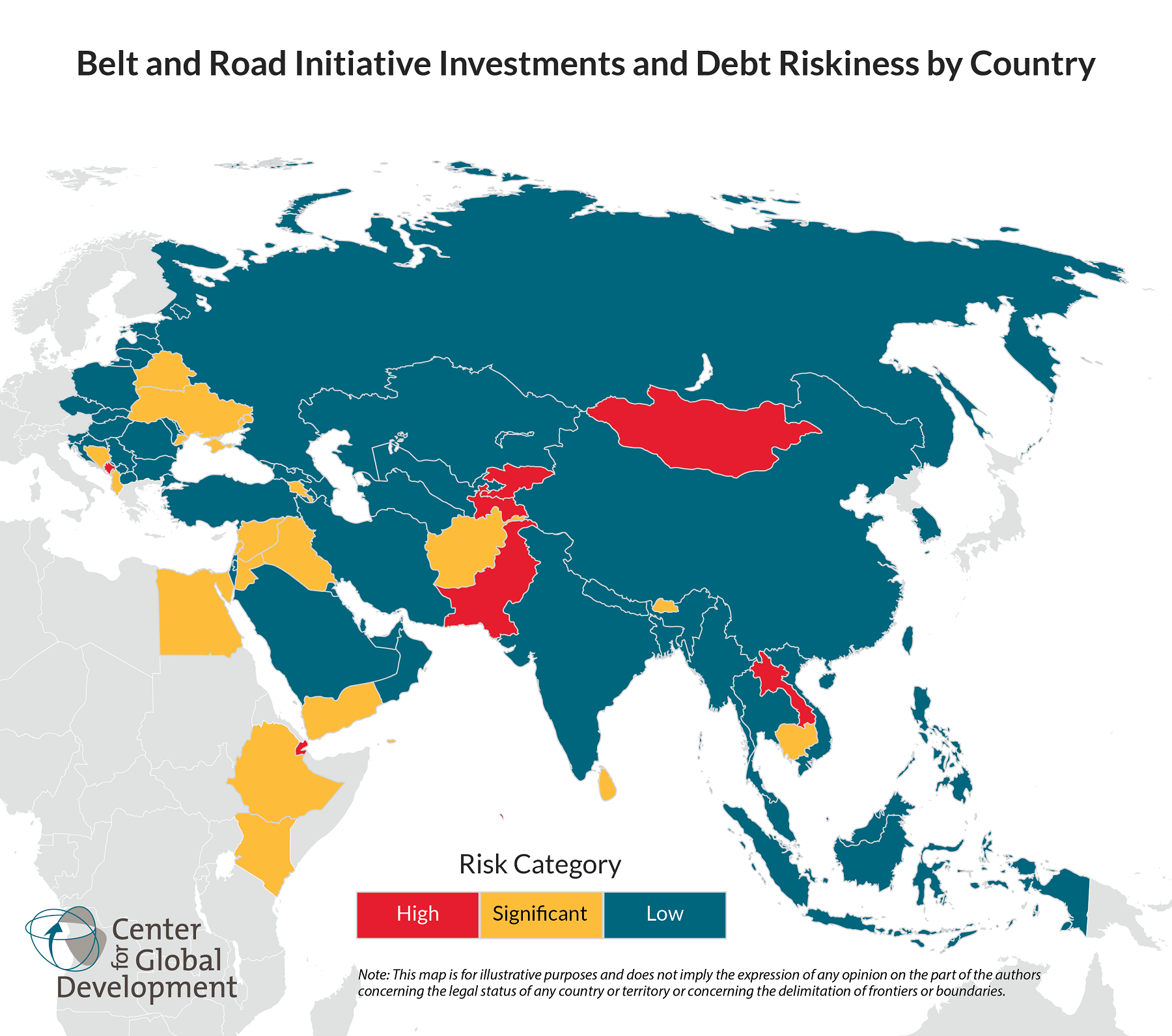

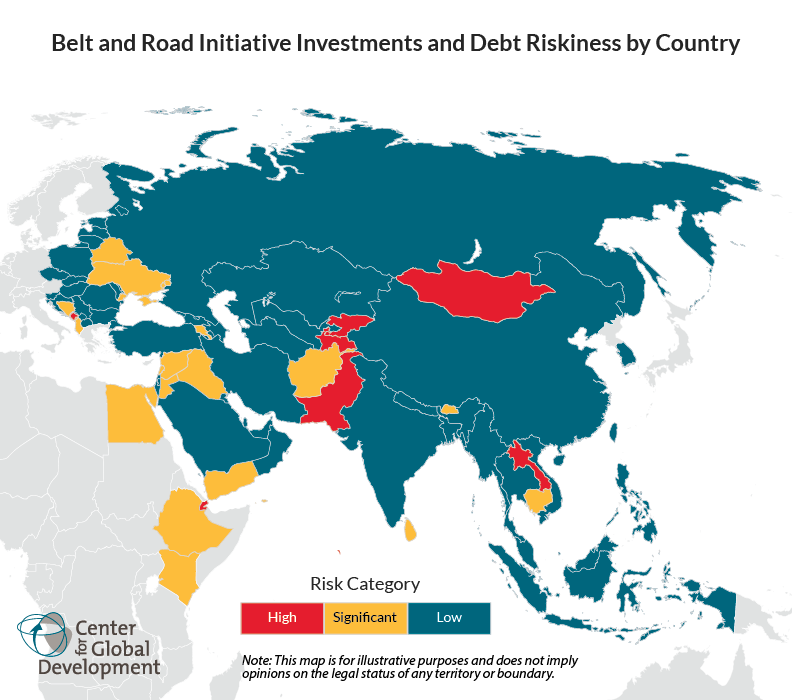

In a new CGD paper, we assess the likelihood of debt problems in the 68 countries we identify as potential BRI borrowers. The big takeaway: BRI is unlikely to cause a systemic debt problem, yet the initiative will likely run into instances of debt problems among select participating countries—...

POLICY PAPERS

March 04, 2018

China’s Belt and Road Initiative hopes to deliver trillions of dollars in infrastructure financing to Asia, Europe, and Africa. This paper assesses the likelihood of debt problems in the 68 countries identified as potential BRI borrowers. We conclude that eight countries are at particular risk of de...

Blog Post

March 01, 2018

In advance of adopting a new Policy on Public Information, the AIIB is inviting suggestions on how it could best align public disclosure with its guiding principles of “promoting transparency, enhancing accountability and protecting confidentiality.” The adoption of the new pol...

Blog Post

February 26, 2018

CGD and the Centre for Finance and Development are teaming up to bring together international finance practitioners who are thinking about how to marry public and private international financing for development (so-called blended finance) and researchers who are rethinking government strat...

Blog Post

February 21, 2018

Policies put in place to counter financial crimes have unfortunately had a chilling effect on banks’ willingness to do business in markets perceived to be risky—due in part to the high price of compliance. Even as changes are being made to address this problem, financial institutions are...