Ideas to action: independent research for global prosperity

debt

More from the Series

CGD NOTES

August 05, 2020

Two out of five low-income countries were in the grips of, or moving rapidly toward, unsustainable debt levels before the global pandemic. But the economic, financial, and fiscal effects of the pandemic have brought the day of reckoning for many countries much closer. The global financial commu...

Blog Post

July 27, 2020

The latest G20 finance ministers meeting concluded with no major progress on debt relief for the world’s poorest countries, and a few setbacks. To date, no country eligible for the G20’s Debt Service Suspension Initiative has requested a moratorium on their private sector debt. We are at an impasse....

Blog Post

October 24, 2019

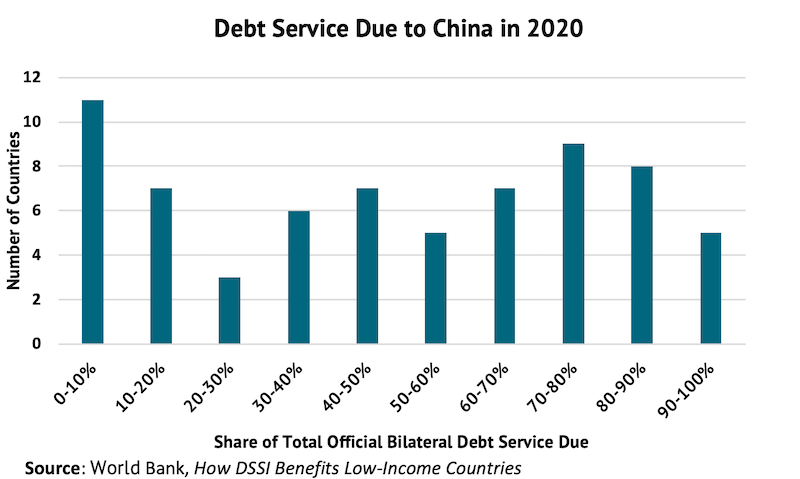

Concerns about rising debt risks in developing economies were front and center at the annual meetings. HIPC is a useful reference point as we talk about a new round of debt crises. But thanks to the rise of China as a lender, the creditor community today looks much different from the HIPC creditor c...