Recommended

Introduction

As the Biden administration turns its attention to a $2.3 trillion infrastructure legislation in the United States, it is important to focus on the role investment in infrastructure financing can play in the recovery. As the IMF notes in its most recent World Economic Outlook, “emerging market economies and low-income developing countries have been hit harder and are expected to suffer more significant medium-term losses.” The losses have been larger for economies dependent on tourism and commodity exports—a condition that applies to most sub-Saharan African economies, where the economic impact of the pandemic has been most severe. Despite the impact that infrastructure plays in reducing poverty and increasing productivity, however, the global infrastructure gap remains in the trillions and exceeds traditional sources of funding. Nowhere is this gap more pronounced than in Africa, which has the fastest growing population in the world yet lags every other region in infrastructure coverage. The economic impact of COVID-19 will only exacerbate this deficit as public revenues fall across the continent.

There is thus an urgent need to expand the sources of infrastructure financing, especially targeting private capital as a source. While private finance regularly introduces new financial asset classes, development finance has remained largely conservative. Research from the Center for Global Development shows that even in an emergency, the World Bank has not pivoted to flexible loan products to get money out quickly, relying on slower, more restricted investment projects. The plan to leverage development finance to attract private capital in infrastructure finance has underperformed its promise.

This note covers a policy proposal for a credit enhancement instrument, using concessional financing, from development finance institutions to enable low-income countries (LICs) to attract private finance in infrastructure. It is an incremental iteration of the World Bank’s ambitious “billions to trillions” campaign. “Billions to trillions” envisions using development finance to “strategically unlock, leverage, and catalyze private flows and domestic resources.” While the instrument proposed here may not deliver trillions, it could leverage tens of millions of development finance to attract hundreds of millions from the private sector.

The problem

I argued in 2018, that billions to trillions as imagined, had limited applicability in Africa. A 2019 ODI report came to the same conclusion, observing that “Instead of going as planned to low-income countries, most concessional finance being provided to blend with private money is going to middle-income countries. And instead of addressing market failures and taking on more risk, the funds are directed toward relatively low-risk investments.”

Research from S&P Global Ratings provides some context for why this occurs in its description of countries which qualify for G20 Debt Service Suspension Initiative (DSSI). The report notes that the “73 sovereigns that qualify for the DSSI mostly show weak credit metrics, with many experiencing fiscal pressures…Their credit quality often reflect low average income and relatively weak institutions.” To the private sector, the attractiveness of a jurisdiction for investment comes down to these two factors—average income and institutional strength. Average income here is a measure of GDP and countries with low average income are poor countries. Institutional strength is a measure of the quality of governance—the rule of law, sanctity of contracts, predictability of the regulatory environment. Governance matters, since infrastructure procurement and development is rife with opportunities for corruption. “Two-thirds of foreign bribery cases involve infrastructure deals.” Both average income and institutional strength are proxies for a country’s ability to repay since that is the primary concern of creditors. Because the life cycle of infrastructure tends to be long (20 to 100 years) private investment requires stability over the long term and the fragile institutional structures of low-income countries are an obvious red flag. Another confounding factor is the nature of African projects. Unlike in developed and other emerging markets, most African infrastructure projects are greenfield projects which come with their own risks.

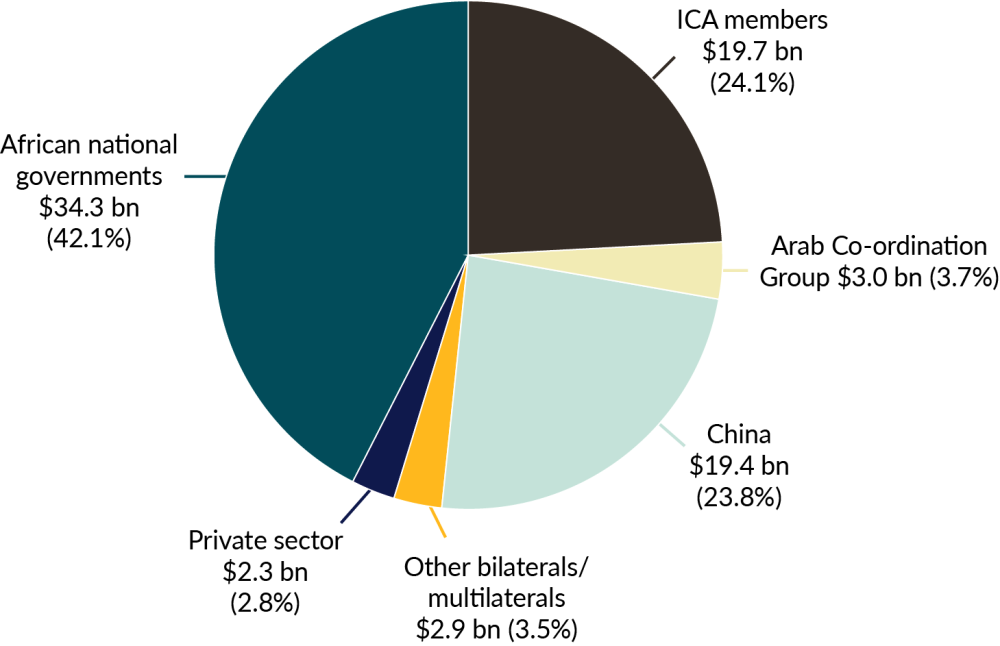

As a result, the private sector has largely avoided African infrastructure. A 2017 Infrastructure Consortium for Africa (ICA) report on infrastructure financing in Africa finds that the proportion of infrastructure financing from the private sector was a meager 2.8 percent that year (figure 1).

Figure 1. Infrastructure financing in Africa by source, 2017

Source: Infrastructure Financing Trends in Africa – 2017, The Infrastructure Consortium of Africa

Low-income, African governments face an unrelenting perception of being high-risk borrowers. even though a Moody’s report on global project finance default rates found that only Western Europe and the Middle East had lower default rates than Africa. Africa’s actual low project finance default risk has not been enough to overcome its perceived risks. Private sector participation, however, is critical as both a source of capital and for its influence on governance, since “projects with private investors tend to be managed better.”

The opportunity

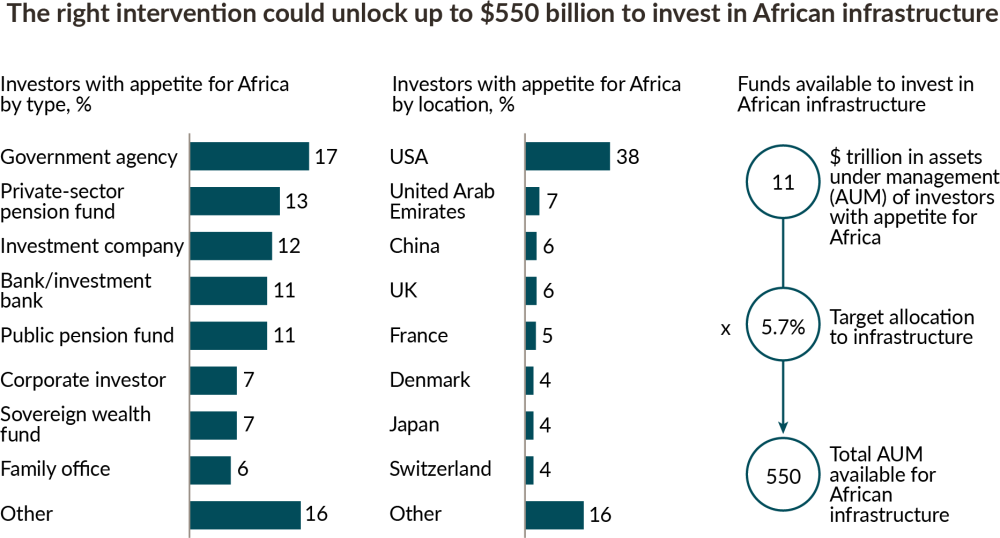

McKinsey reports that investors with up to $11 trillion in assets under management (AUM) have an appetite for Africa. Yet “regulation, risks and cross-border investment rules often limit investor appetite for infrastructure projects.” Bilateral lenders, like China, deal with this risk using a blunt instrument—the sovereign guarantee. But sovereign guarantees are effectively contingent liability as is evidenced in China’s dominant position among bilateral lenders. Relying on sovereign guarantees, China extended between 45 percent in 2014 and 56 percent in 2018 of total official bilateral debt stock. The unfolding, pandemic-induced debt crisis will significantly undermine the utility of debt-financing of infrastructure in the short to medium term. It also appears that China has already begun to draw back from such large-scale financing. Boston University Global Policy Center has tracked a broad, global slowdown of Chinese lending. Funding for infrastructure will therefore have to turn to the private sector, especially institutional capital (figure 2).

Figure 2. Potential investors in African infrastructure

Source: McKinsey and Company, Solving Africa’s infrastructure paradox, 2020

The length of time it would take for low-income African sovereigns to grow average income and build institutional strength is incompatible with the current demand for infrastructure. For example, it has taken Africa over 30 years, to go from a single country with a sovereign rating to twenty-one. It is also impossible to increase average income without functional infrastructure. Low-income countries, therefore, require a credible and adequate proxy for ability to repay, one that is instantly trusted and lowers the risk premium that would otherwise exist.

A partial solution

Even within the scope of development finance, the target countries of this note are ineligible to borrow from the International Bank for Reconstruction and Development—the interest-charging arm of the World Bank. Most of these countries, because of their relative poverty, can only borrow from the International Development Association—which offers loans with a grant element. Understandably, due to the favorable terms of these loans—demand far exceeds supply. The policy proposed here seeks to leverage this limited concessional finance to attract more capital through private sector participation.

Multilateral and bilateral development finance institutions (DFIs) already have a long credit history and the confidence of the private sector. In the short to medium term, they can provide credit enhancement products through the innovative use of existing instruments. This process allows LICs to enjoy the benefit of a positive credit history while developing its own. The DFIs can provide such synthetic credit at significantly lower costs than a comparable product from a bilateral or multilateral insurance agency.

While such synthetic credit may function as insurance, it is primarily an innovative governance instrument. Its goal is to ensure improved public finance governance, better quality of project selection, and building a positive credit history by keeping long-term financial commitments. In exchange for this valuable, but cost-competitive synthetic credit, DFIs should outline a series of qualifying criteria for low-income sovereigns seeking these financial products. Below are recommended elements for what those criteria should cover.

The process

Qualifying countries based on eligibility criteria is now a standard practice of international development, especially where the intervention is intended to improve governance. Below are preliminary recommended criteria.

The primary requirement for any LIC seeking these products from DFIs must be the establishment, by legislation, of a single purpose, long-term institution, a National Infrastructure Trust Fund (NITF) or its equivalent, with stringent governance to plan and design infrastructure projects. The ideal type would be Mexico’s Fondo Nacional de Infraestructura (FONADIN). The NITF, like its Mexican counterpart would plan national infrastructure, conduct project preparation, create a project pipeline, maintain a public platform for projects in the pipeline, and mobilize private capital for infrastructure projects. NITF staff and leadership would be professionally recruited, with leadership tenured.

As I explained here, the idea that one could establish a well-governed entity in low-income countries that outperforms societal institutional weakness comes from the experience of fragile states and conflict-affected countries. Institutional fragility in these jurisdictions spurred a governance innovation called the “implementation unit.” Implementation units are isles of competence in oceans of institutional fragility.

A qualifying NITF must have completed at least two, but preferably three, years of operation to be eligible for this instrument. It may, however, engage DFIs immediately for support in establishing systems and launching the platform. The NITF may then execute state-funded projects using its processes. It will ensure that core positions are filled, including but not limited to project evaluation, risk assessment, procurement, social safeguard etc. NITFs may also contract these roles out on a project-by-project basis.

Financing the NITF could take many forms. It could comprise concessional loans, user fees, and budgetary transfers. For example, countries could impose a two percent tax on digital and mobile money transactions (exempting transactions below a certain dollar value). The tax could also apply to remittances. Each NITF could launch a fundraising campaign, seeking matching funds, contributions from development partners and the Diaspora. If the NITF demonstrates quality governance and convinces contributors that the funds will be administered judiciously, it could attract support. Bilateral development finance initiatives like the Millennium Challenge Corporation (MCC) could also provide funding to NITFs as a reward for governance compliance with MCC criteria for national and sub-national entities.

This proposal imagines the conversion of IDA credits, grants, and guarantees or their equivalent at other bilateral and multilateral DFIs with the objective of leveraging limited concessional financing to attract private capital for a two or threefold increase in total available resources.

Each beneficiary NITF or its equivalent would engage the DFI from project conception and submit every phase of the project development process to the DFI for “no objection,” giving the private sector further confidence of the quality of project preparation. The DFI approval of synthetic credit should be based on the total governance history of the NITF, not on a project-by-project basis. NITFs should, where possible, adapt the Output and Performance-based Infrastructure Contract model and design infrastructure contracts to pay for agreed service-level performance with milestone-linked availability payments. The private sector should be invited to compete on both construction competence and superior financing terms.

Role of DFIs

For impact, synthetic credit requires widespread adoption and diffusion and the World Bank, as the premier DFI has the convening power to design a template that other DFIs can adapt and apply to their concessional finance windows—leveraging existing resources to expand total available resources by attracting the private sector. More importantly, to limit the risk of sovereigns reneging on commitments, DFIs should share information on de-risking instruments dispensed, to ensure collective compliance enforcement.

To provide widespread credit enhancement/risk mitigation products, the World Bank and other DFIs will have to commit resources into developing standard “project preparation and evaluation, by, for instance, using common risk assessment frameworks and documentation.” That each infrastructure project requires bespoke documents, preparation, and risk assessment increases the cost in time and other resources that reduce the overall attractiveness of the sector. Developing plug-and-play documents for the sector, would increase their attractiveness vis-à-vis other asset classes.

Through its Global Infrastructure Facility, the Bank should encourage other DFIs to deploy the resources of their project preparation facilities to support NITFs with project preparation resources to both create project pipelines and improve governance. These project preparation facilities would provide training, project preparation software, systems, and processes to improve NITF governance. In Liberia’s experience with project preparation resources from both the African Development Bank and the World Bank, it was demand driven. An optimal use of these facilities is to be supply driven.

Examples

On establishment of an NITF, the country office of DFIs should arrange a presentation, with accompanying documentation of available project preparation tools. Below are variations of the process described in this brief.

Nigeria

The Nigerian government has set in motion plans to establish an NITF equivalent—the Infrastructure Corporation of Nigeria, Ltd. (InfraCorp). The Federal Government of Nigeria has approved 1 trillion naira ($2.6 billion) as seed capital. InfraCorp’s other shareholders are the Central Bank of Nigeria, the Nigerian Sovereign Investment Authority, and Africa Finance Corporation. InfraCorp will attempt to raise as much as $39 billion dollars and is now focused on its governance. Its shareholders have hired KPMG as transaction advisors to help manage the company’s capital-raising plan. The competitive process included bids from other reputable firms including PricewaterhouseCoopers LLP, Boston Consulting Group, and McKinsey & Co.

As described in our proposed NITF, InfraCorp will plan and fund infrastructure projects and mobilize private capital to help address Nigeria’s $3 trillion infrastructure gap over the next 30 years. An institution like InfraCorp will be able to leverage and deploy synthetic guarantees from either the Africa Finance Corporation or other multilateral development banks to attract private capital into Nigerian infrastructure.

Liberia

In 2016, Liberia established a National Road Fund (NITF equivalent) to finance construction/rehabilitation and maintenance of the country’s road network. The Fund is financed through road user fees that are levied on fuel sales. The government sought and acquired an IDA loan to use along with the Road Fund and attract private financing for a road project. In 2019, the World Bank Board approved Liberia’s request to use IDA credit as a mobilization payment and payment guarantee for the private sector to invest in the road project. Repayment of the private finance was designed to occur through milestone-linked availability payments drawn from the National Road Fund. The total IDA credit was insufficient to finance the project, but leveraged as guarantees, it capitalized the private sector to complete the finance. This was the first time IDA products had been used to create a PPP in a low-income country.

Islamic Development Bank and Regional Islamic Supranational Entity (RISE)

Reflecting the reality that its Ordinary Capital Resources were inadequate to meet the infrastructure and social spending needs of its members, the Islamic Development Bank creating an innovative structure called a RISE (regional Islamic supranational entity). Each RISE is a developer that plans the project pipeline, structures the projects, and mobilizes private capital. RISE is the NITF equivalent and uses the OCR as a “resource mobilization catalyst” to attract private finance. This is the equivalent of the seed capital from the Nigerian government to InfraCorp or the IDA loan to Liberia for the project under the Road Fund. For governance, RISE includes both sovereign and private sector interests.

Conclusion

As with most innovation, there is no guarantee that the credit extension facility described here will work or that the proposed NITFs will function as they should. The use of synthetic credit, however, carries promise. Governed properly, NITFs could eventually obtain a higher credit score than the sovereign, reducing its borrowing costs and expanding the universe of private capital available. The sheer scale of Africa’s infrastructure deficit, inadequate development finance, and declining revenue across the continent’s poorest markets require creative tinkering with existing development finance products to increase the total amount of resources available. This might not convert billions to trillions, but it could translate tens of millions into hundreds of millions and that is a good start.

With the coming into force of the AfCFTA, it provides a framework for NITFs to collaborate on regional infrastructure—transport links, energy generation and transmission, and ICT. These collaborations would spread risk and ensure compliance. The scale of the infrastructure gap in Africa and the cost of closing that gap requires innovation on the margins of development finance—we can start here.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.