Recommended

CGD NOTES

Blog Post

Blog Post

This note is part of a body of research that examines the current state of play on COVID-19 treatments. These pieces provide a deep dive into key cross-cutting areas—demand, voluntary licensing for generic supply, and deployment—and offer policy actions for 2023 and beyond. See here for more from CGD on COVID-19 treatments.

Introduction

Nearly a year has passed since the public release of promising clinical trial results for COVID-19 treatments, yet access remains concentrated in high-income countries (HICs). To date, innovator products are the only versions on the market despite there being voluntary licensing agreements in place since late last year for nirmatrelvir/ritonavir combination, developed by Pfizer and sold under the name Paxlovid, and molnupiravir, developed by Merck and sold under the name Lagevrio. The limited supply and high price of these patented products leaves the promise of increased access to COVID-19 treatments in low- and middle-income countries (LMICs) unfulfilled.

Voluntary Licensing

Innovators have sought to expand access to lifesaving treatments in LMICs by issuing voluntary licenses—i.e., granting permissions to manufacturers to produce generic versions.

The Medicines Patent Pool (MPP) is the standard channel for issuing voluntary licenses. MPP, a United Nations-backed organization created in 2010 to expand access to patented HIV/AIDS medicines in LMICs, has over a decade of experience negotiating licenses with patent holders and facilitating markets for generic medicines. To date, MPP has signed agreements with 18 patent holders for 37 health products, including molnupiravir and nirmatrelvir/ritonavir. MPP has extensive experience overseeing voluntary licensing and a record of success, making it the common model for voluntary licensing. However, as with other approaches, MPP is not without shortcomings. For example, despite claiming transparency, MPP has not made public the criteria it used to select licensees or the current breakdown of licenses for active pharmaceutical ingredient versus finished pharmaceutical product.

This failure is associated with key design features included in the licensing agreements. This note explores key features with positive, negative, and uncertain implications for access to COVID-19 treatments and their lessons for access to medical countermeasures during this pandemic and future health emergencies. The latest agreement, signed in October 2022 between Shionogi and the Medicines Patent Pool (MPP) for ensitrelvir fumaric acid, a new COVID-19 treatment, indicates that innovators will continue to turn to voluntary licensing to expand global access to medical countermeasures during health emergencies—making these lessons all the more important to heed.

Key features of voluntary licensing agreements with Pfizer and Merck

Voluntary licensing agreements for generic versions of nirmatrelvir/ritonavir and molnupiravir contain a mix of features, including some that will likely speed up the production and distribution of generic treatments, some that will likely limit and hinder access, and some that must be assessed further.

Features likely to accelerate access to COVID-19 treatments

1. Early agreements with innovators

Earlier discussions with patent holders about generic manufacturing help to bring generic products to market more quickly. The MPP agreements with Pfizer and Merck were both signed in 2021, ahead of the release of phase III clinical trial results and before HIC regulators issued recommendations for wider use and emergency use authorization in 2022. This sequence aligns with the broader trend of starting licensing discussions with innovators earlier in the product development process.

Earlier discussions on voluntary licensing are helping to embed generic production in the rollout process for new drugs. This timeline helps reduce the lag between the introduction of new drugs in lower-income countries, compared to more lucrative markets. Especially during health emergencies like COVID-19, timing is of the essence to ensure medical countermeasures are deployed rapidly.

2. Licenses for active pharmaceutical ingredient

Both the Pfizer and Merck agreements with MPP issue licenses specific to the production of active pharmaceutical ingredient (API) in addition to finished pharmaceutical product (FPP). Under these agreements, some companies are licensed to produce only API, while others are licensed only for FPP or for both API and FPP. Of the 23 molnupiravir licensees included in this analysis[1], five companies received only a license to produce API, and another 13 received API licenses in addition to FPP licenses. Of the 34 nirmatrelvir/ritonavir licensees included in this analysis, 6 companies received only a license to produce API, and another 20 received API licenses in addition to FPP licenses.

These specific licenses allow manufacturers to specialize, meaning they can produce according to their comparative advantage and do not have to invest in manufacturing capacity for both API and FPP. This specialization can reduce barriers to entry and help companies scale-up production quicker. Separating the production of API from FPP can also create a market specific to API, which can help to manage supply, demand, and price.

Features that limit and hinder access to COVID-19 treatments

1. Restrictive coverage

Even though MPP agreements with Pfizer and Merck cover all low-income countries and nearly all lower-middle-income countries, the majority of upper-middle income countries (UMICs) are left off. Of the 56 UMICs, as defined by the World Bank, only 25 (45 percent) and 13 (23 percent) are included on the molnupiravir and nirmatrelvir/ritonavir agreements, respectively.

Innovators often leave UMICs off voluntary licensing agreements to maintain market control in larger middle-income countries like Brazil and Mexico. While the exclusion of UMICs is not surprising, it can reinforce barriers to access in the 27 UMICs that are not included on either agreement, which represent 30 percent of the global population. This coverage is comparable to previous voluntary licensing deals, such as the MPP deal with the most licensees prior to nirmatrelvir/ritonavir (dolutegravir—an HIV antiretroviral) that excludes the majority (75 percent) of UMICs as well. Exceptional circumstances such as a pandemic highlight the need for broader, more inclusive worldwide licensing norms to encourage manufacturers to scale up and supply affordable medical countermeasures to all countries without income restrictions.

2. Overreliance on WHO prequalification and Stringent Regulatory Authorities

Generic versions of nirmatrelvir/ritonavir and molnupiravir must achieve approvals from Stringent Regulatory Authorities (SRAs) or the World Health Organization (WHO) prequalification (PQ) program to be sold, per the conditions of the MPP agreements. Enforcing these regulatory standards ensures that generic products are safe, effective, and quality assured. SRA or WHO PQ approval is also a condition for purchasing with money from the Global Fund and/or UNICEF—significant suppliers of medicines for LMICs. However, this condition centralizes the regulatory pathway on the WHO and a small network of SRAs—mature HIC regulators—which lack specific pathways for all licensed products. Routing all generic products through these regulators for review can create bottlenecks and delays. This centralization also leaves alternative and potentially viable regulatory pathways for these low-risk products (as oral solid drugs), such as functional and WHO-listed regulatory authorities as per the WHO Global Benchmarking tool, untapped.

3. R&D restrictions

In contrast to previous generic licensing deals, the MPP agreement for generic molnupiravir and nirmatrelvir/ritonavir grant the innovators tight control over research and development (R&D) involving the antivirals and their main active components. To date, Merck and Pfizer have not permitted any studies proposed by licensees.

This stipulation constrains the continual evaluation of co-formulations and can hamper R&D, potentially preventing the development of key marginal innovations with promising health and economic benefits. Research is also critical to assess the effectiveness of these treatments in settings where innovators are not running trials, especially LMICs.

In addition, current licensing agreements do not demand that innovators provide comparator products to facilitate bioequivalence studies—a key step in the approval of generic products. As a result, there could be delays in completing the bioequivalence studies that could hamper the regulatory process, ultimately postponing access to these treatments in LMICs.

4. No co-formulation or co-packaging

The MPP agreements with Merck and Pfizer do not allow for co-formulation—the packaging of more than one drug into a pill—or co-packaging—the packaging of multiple, separate drug ingredients into a single dosage form. This condition contrasts with previous voluntary licensing agreements for antiretrovirals, which have enabled co-formulation and co-packaging. Although prohibiting co-formulation and co-packaging may not directly restrict access in the short term, it represents an unrealized pathway with the potential to expedite and increase access and appropriate use.

Co-formulation and co-packaging support patient compliance, can limit the buildup of antimicrobial resistance, and ease procurement. For example, packaging multiple HIV drugs into a single product, such as a blister pack, has helped to increase patient adherence and facilitate global distribution while maintaining the effectiveness of the drugs. By prohibiting co-formulation and co-packaging, the MPP agreements create avoidable, negative consequences for the generics market for oral antivirals, including non-compliance, faster increases in resistance levels, and further delays in access due to procurement inefficiencies.

Features requiring further assessment

1. Innovator supply rights

Under the terms of the MPP agreements, Merck and Pfizer maintain the right to purchase supply from generic producers. For example, either innovator can demand supply from generic producers if it faces an API shortage from its regular suppliers or if generic producers are able to sell API at a lower price.

If Merck or Pfizer work directly with licensees to obtain supply, licensees may benefit from key resources, including data, obtained while working with the innovators. Also, purchases by innovators can increase demand for generic products, potentially increasing the volume of sales and generating more revenue. Both agreements include a markup on the unit price when supplied to innovators, which would create additional profit. This increased profit potential could incentivize additional companies to seek voluntary licenses.

On the other hand, this condition renders the generics market secondary to the supply of innovator product. Access in LMICs covered by the MPP agreements may be slowed down or undermined if supply is diverted to produce innovator products.

2. Number and spread of licensees

MPP issued an unprecedented volume of licenses to produce generic versions of nirmatrelvir/ritonavir and molnupiravir—38 and 23 at present, respectively. Prior to these deals, no more than 16 licenses had been issued for an MPP agreement. As with its previous agreements, MPP accepts all qualified applicants rather than restricting licensing to a pre-set total. A large number of manufacturers can support an efficient ramp up of generic manufacturing in large markets, ultimately producing more on a shorter timeline. However, too many manufacturers can create problems, including by limiting returns and financial viability for companies.

Diversifying the market across the value chain—including API and FPP production—with many manufacturers based beyond the usual locations, namely India and China, also reduces risk and increases supply chain security and resilience. The overall market will be less impacted when one company confronts challenges or delays or in the face of potential disruptions, including future pandemics and export bans. Prior to the MPP agreements with Pfizer and Merck, licensees for the largest MPP agreement (dolutegravir) were spread across just five countries: India, China, South Africa, South Korea, and the United States. The Merck agreement expands geographical spread to 10 countries, including companies based in Indonesia, Kenya, and Pakistan. The Pfizer agreement establishes a manufacturing base that spans 14 countries, including Brazil, Mexico, and the Dominican Republic.

An open approach that works for larger, more stable markets like HIV medicines may not be best suited for smaller or more uncertain markets—such as the markets for these oral antivirals. Such a high number of licensees may make the market for generic nirmatrelvir/ritonavir and molnupiravir unviable. Low profit projections may deter companies from investing in manufacturing capacity and bringing products to market. The announcement from CHAI earlier this year of a $25 per course price ceiling for nirmatrelvir/ritonavir—a 95 percent decrease from the price the US government paid—promised to expand access in LMICs by making the treatment affordable, but it may have also indicated limited profit potential for companies.

The outflux of a few initial licensees is an early warning sign. Indeed, since licenses were initially granted in January 2022 to produce molnupiravir, four companies are no longer included in the deal. Similarly, one company initially issued a license in March 2022 is no longer included in the nirmatrelvir/ritonavir deal.

Increasing the number of manufacturers without increasing regulatory capacity may also mean generic versions of molnupiravir and nirmatrelvir/ritonavir will take longer to come to market. Regulatory capacity within WHO and authorities in LMICs are already stretched thin. Therefore, the regulatory process will likely cause delays in access.

3. Previous experience with licensing and regulation of finished pharmaceutical product

Companies that have previously received voluntary licenses and have demonstrated success in establishing manufacturing capacity and bringing products to market can make good candidates for future licensing[2] . These companies may be able to more efficiently ramp up their manufacturing capacity and better navigate the bureaucratic and regulatory hurdles, compared to companies receiving voluntary licenses for the first time.

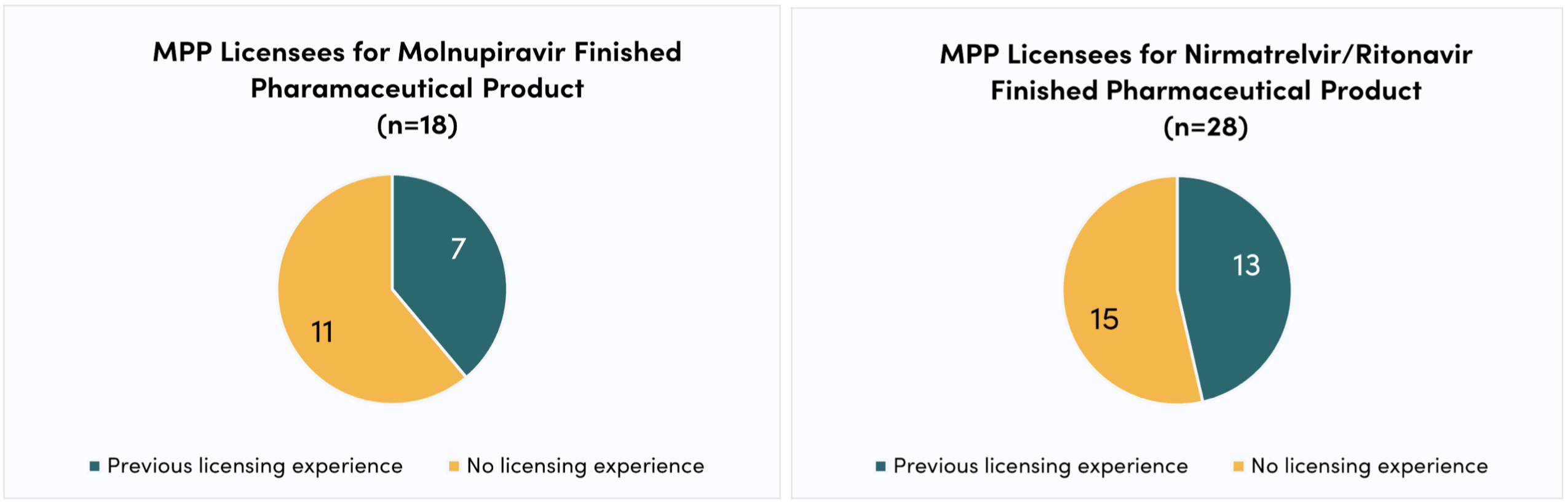

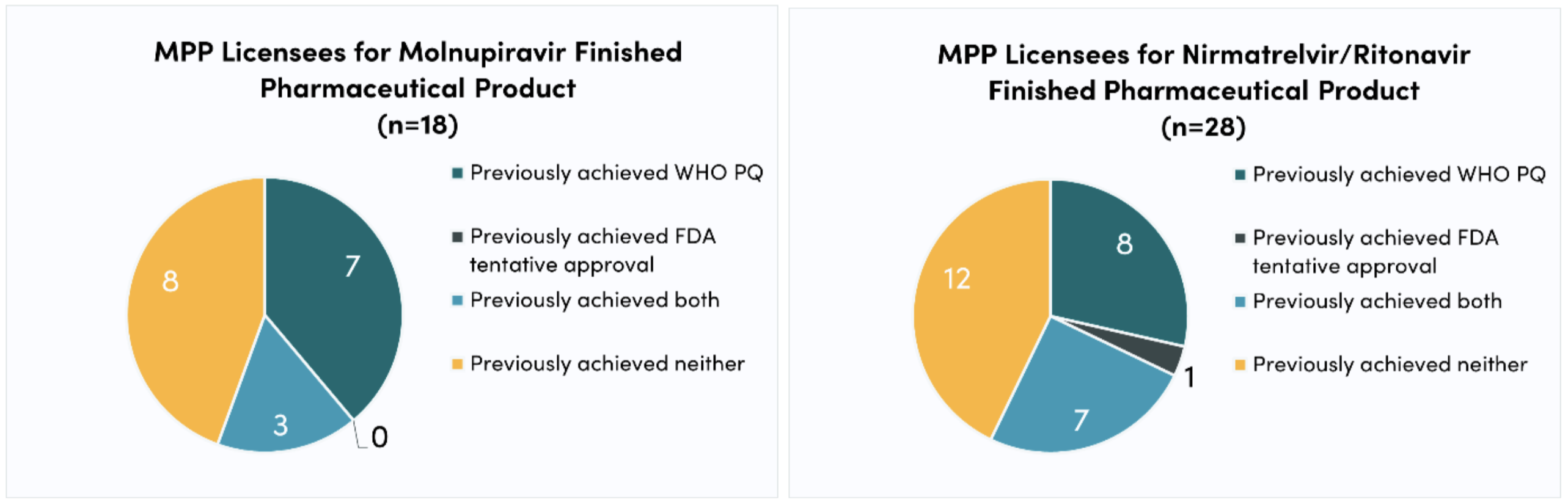

In the case of COVID-19 oral antivirals, 11 (of 18; 61 percent) of molnupiravir FPP licensees and 15 (of 28; 47 percent) of nirmatrelvir/ritonavir FPP licensees included in this analysis have no licensing experience. Furthermore, only around half of molnupiravir and nirmatrelvir/ritonavir FPP licensees included in this study (10 of 18 and 15 of 28, or 56 percent and 54 percent, respectively) have previously achieved WHO PQ. The deficit of experience is even larger with respect to other key regulatory processes, such as the FDA tentative approval—a mechanism leveraged by PEPFAR during the HIV/AIDS epidemic to fast-track approval for antiretrovirals. Only three (of 18; 17 percent) and eight (of 28; 29 percent) molnupiravir and nirmatrelvir/ritonavir FPP licensees, respectively, have previously achieved FDA tentative approval.

Figure 1. Licensing experience

Note: Licensing experience is defined in this study as previously receiving voluntary licenses either from MPP or Gilead, which issued voluntary licenses for hepatitis C medicines

Figure 2. Regulatory experience

Although many companies have experience with voluntary licensing and/or regulatory processes, many do not. As a result, the generics market for nirmatrelvir/ritonavir and molnupiravir may face delays as newcomers get up to speed. Licensees without WHO PQ experience may take longer to successfully submit dossiers. And since the generic products must achieve WHO PQ before purchases can be made, delays may cause demand to remain low, which can discourage manufacturers from entering the market. As well as potentially slowing down the production and regulation of generic oral antivirals for COVID-19, companies’ lack of experience makes it difficult to predict their probability of successfully scaling up production. Thus, the generics market remains highly uncertain.

In addition, the FDA tentative approval pathway could expedite regulatory approval for generic versions of nirmatrelvir/ritonavir and molnupiravir, but licensees might require additional support to utilize this alternate process since most companies have not previously achieved FDA tentative approval. Similar to companies that will navigate WHO PQ for the first time, gaining familiarity with the FDA tentative approval process will take time and could delay access to these treatments

Recommendations

Voluntary licensing can accelerate access to life-saving treatments, such as COVID-19 oral antivirals, in less lucrative markets where innovators are not incentivized to sell. However, the success of these agreements and the generics market hinges on the particular features included in the agreements. Three key policy actions would improve the probability of success for voluntary licensing arrangements during this pandemic and the next one.

-

Innovators and the MPP should implement and scale up key features likely to decrease the lag between innovator and generic versions by:

-

Developing global access plans. Innovators should develop global access plans for all medical countermeasures developed and/or deployed during health emergencies like pandemics to facilitate a rapid global rollout for emergency health products. These plans would outline an approach to voluntary licensing, enabling quick execution once promising clinical evidence is available for innovator products.

-

Issuing API-specific licenses. Innovators should continue to issue API-specific licenses, in line with these agreements, to help speed up generic production by helping to create a market for APIs and allowing manufacturers to specialize in either API or FPP production, without having to face investment costs or delays to produce the other component.

-

-

Innovators and the MPP should address features of licensing arrangements that do not support or that work against access goals by:

-

Including all UMICs. Licensing agreements must include all UMICs to ensure that all countries where innovators are not likely to sell their product have access to generic versions of the treatments. Tiered royalty structures may be needed to account for income differences among purchasing countries and protect the profit potential for manufacturers.

-

Decentralizing regulation. The regulatory process must be decentralized to improve efficiency and avoid bottlenecks, especially given that oral antivirals are considered low-risk products. The FDA tentative approval process should be activated to accelerate regulation of COVID-19 treatments. In parallel, voluntary licensing agreements should leverage other strong regulatory mechanisms, such as those deemed “functional authorities” by the WHO’s Global Benchmarking Tool and those included on the WHO’s listed authorities. Since many licensees do not have experience with WHO PQ or other regulatory processes like FDA tentative approval, additional support is needed from stakeholders like the WHO and US government to help licensees successfully submit dossiers and avoid delays. Any changes to the acceptable regulatory pathways must trickle down to conditions set by development banks and grantors to ensure these funds can be used to purchase generic COVID-19 treatments approved by nontraditional regulatory authorities.

-

Enabling R&D. Innovators should allow research and development of generic products to prevent regulatory delays and fill key research gaps on the effectiveness of the treatments. Innovators should also include provisions to adequately supply comparator product to facilitate bioequivalence studies.

-

Allowing co-formulation and co-packaging. Agreements must support co-formulating and co-packaging treatments to reduce health and supply chain risks.

-

-

Innovators, the MPP, researchers, and funders should continue to monitor and assess the features with less certain implications for access to medical countermeasures. Decisions to protect innovator supply rights, issue an unprecedentedly high volumes of licenses, and work with less experienced manufacturers could create strong market conditions for critical medicines like nirmatrelvir/ritonavir and molnupiravir, or they could delay or work against access in LMICs. Additional analysis is needed to evaluate the risk and/or benefit of each of these features to determine how future licensing agreements should address them.

Conclusion

The MPP agreements for generic versions of molnupiravir and nirmatrelvir/ritonavir have immediate implications for access to critical medical countermeasures to mitigate the COVID-19 pandemic. In addition, these agreements offer lessons for how voluntary licensing must evolve in order to support rapid access to critical treatments in LMICs during health emergencies going forward. Voluntary licensing agreements can be a powerful tool to facilitate global access to essential medicines—but without careful attention to their features, their impact on access in LMICs will be too little, too late.

[1] Analysis distinguishing API and FPP licenses is based on data included in the press releases that announced the MPP licensees for molnupiravir and nirmatrelvir/ritonavir in January and March 2022, respectively, as they are the only public data distinguishing the type of license (i.e., API vs FPP) that each licensee received. Given the outflux and influx of licenses since these initial announcements, only companies that are still included on the licensing deal at the time of writing were included in this analysis, for a total of 23 for molnupiravir (compared to an initial 27 and current total of 23) and 34 for nirmatrelvir/ritonavir (compared to an initial 35 and current total of 38).

[2] Given the significant differences between the production and regulatory processes for API and FPP, and since previous licensing agreements have mostly applied to FPP, we only analyze companies licensed to produce FPP.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.