We first collaborated in 2010 at the inaugural meeting of Vital Voices’ La Pietra Coalition to call attention to the need for banks to sex-disaggregate their clients’ portfolio as a first step towards better serving the women’s market—an estimated 1 billion potential customers. Back then we had little knowledge that technology might be the magical wand to get financial services in the hands of women.

Eight years and millions of mobile financial transactions later, we came together again at a private CGD roundtable in London to discuss the potential of mobile banking and savings for women’s economic empowerment. We were pleased to hear the richness of research evidence and interventions on women’s financial inclusion that have emerged over the past decade. What follows are some takeaways from our deliberations, informed by this research and practice:

Technology can widen financial access and be transformative, but with some caveats…

-

Mobile money has increased women’s access to financial services, especially in poor countries that have been underserved by banks. But the explosion in mobile technologies and mobile banking has yet to narrow the nine percentage point gap between the number of male and female bank account holders—a gap unchanged between 2011 and 2017 over three editions of the Findex survey.

There is some good news: subsidizing women’s mobile phone ownership and designing customized financial products for the women’s market may help narrow this gap. In 2010, the Cherie Blair Foundation documented a 21 percent gender gap favoring men in mobile phone ownership in low and middle-income countries, with cost being the main barrier for women. Unfortunately, their efforts to provide mobile technologies to women have often been confronted by poor mobile infrastructure and mobile providers’ lack of awareness of the need to include women in segmentation strategies and marketing services.

Women for Women International seeks to improve incomes of and empower marginalized women in conflict-affected countries. It channels monthly stipends to women attending their 12-month long group training through formal bank accounts, where these exist. Women in Nigeria, however, often close them at the end of the program because of the accounts’ fees and administrative challenges. (Women for Women International is currently conducting a randomized control trial in Nigeria to assess if follow-up mentoring and membership in village savings and loans associations affect women’s economic outcomes—results are due in 2020.)

-

Mobile savings are preferred by women and have unexpected “‘empowerment”’ outcomes. The privacy of individual savings accounts and the mental allocation of funds in commitment savings plus helpful design features such as reminders to save all contribute to empowering women, especially those who are less empowered than others. Empowerment is most often measured by women’s increased decision-making over household expenditures. But savings are comparably low profitable products for financial sector providers and hard to commercialize. If savings are the entry point for women’s financial inclusion, the cost-effectiveness case has to be made and communicated to banks and other financial service providers. Both women’s preferences and constraints need to be better understood so a wider range of more profitable financial products (including insurance) can be designed using savings as the entry point.

Financial training can increase use of financial products and may itself be empowering but these effects may not last, especially in adverse environments.

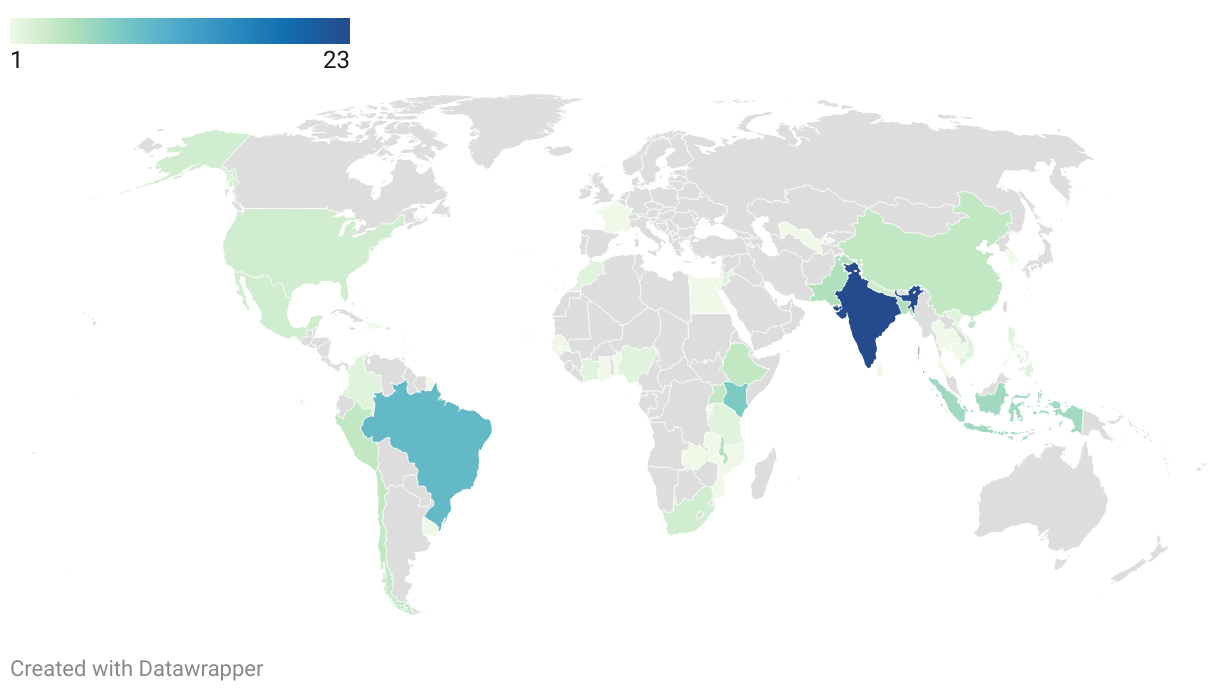

Two randomized control trials led by CGD and partners in Tanzania and Indonesia document that financial and business management training, bolstered by access to mobile savings, increases women’s use of mobile savings, improves business practices (as measured in Tanzania), and empowers them. But these are short-term results and we can only hypothesize about the mechanisms that have triggered this greater empowerment.

The trainings had broadly similar contents (financial literacy and basic business concepts) but were of very different durations. The training in Tanzania, conducted by Technoserve, was a six week-long course, while Mercy Corps’ training in Indonesia was a single three-hour session, plus three follow-up mentoring sessions. Both trainings and the mentoring were done in groups. They were of high quality and effective in increasing knowledge on the product and usage of mobile savings. But they have yet to increase incomes, so we believe the empowerment effects are directly related to both the financial knowledge gained and the confidence building resulting from the training and the group’s social support.

Other evidence backs the importance of social validation and self-affirmation, especially (but not only) for women. The World Bank Africa Gender Innovation Lab research has shown positive income effects when enhancing psychological messages are combined with business training for women entrepreneurs (here and here). Cognitive therapy to depressed new mothers in Pakistan resulted in increased empowerment seven years later. Positive thinking, more generally, can help boost students’ test scores, women’s savings, the work effort of microentrepreneurs, and other behaviors that help poor people increase their incomes and improve their lives.

Interventions can empower women in the short-term but what about entrenched traditional mindsets in financial and business environments?

Financial products need to be smartly designed to respond to women clients’ preferences. For instance, CARE’s GRAD program in Ethiopia broadened communication channels that financial service providers used to include radio and more informal channels that reached women better. And it used informal savings groups as a stepping stone to formal ones.

But financial products (and training) also need to be free of gender biases. Women (especially poor women) are widely and wrongly perceived as less productive and more economically dependent than they really are. For interventions that seek to empower women economically to truly succeed, these mindsets need to change. One way to de-bias the provision of financial services may be to have female bank agents. The Girl Effect Accelerator project supports Zoona, the largest mobile money operator in Zambia, where 60 percent of the 400 mobile agents are young women from poor communities. The Girl Effect observes, however, that managing agent networks (male and female) requires significant oversight and personnel. The Indonesia study, which also has experienced challenges managing mobile bank agents, is testing to see if financial incentives to mobile bank agents improves performance and de-biases financial service provision, increasing the numbers of women clients reached with mobile savings (more to come!). Sex-disaggregated data on customers’ needs and performance and rigorous evidence on the benefits of full financial access for women should provide the basic rationale for and further help changing mindsets.

With all this shared and more, the roundtable still ended with lingering questions, such as:

-

How can financial training be delivered to customers sustainably on a larger scale?

-

How do we take social change up to scale in the digital world?

… and with a call for partnerships to move the needle on financial inclusion for women and for open data sharing partnerships.

Baroness Goudie is a global advocate for the rights of women. She advises philanthropic, political, and commercial organisations on ways to achieve better gender balance and encourage diversity in leadership. She has been a member of the British House of Lords since 1998. You can follow her on Twitter: @BaronessGoudie

Baroness Goudie is a global advocate for the rights of women. She advises philanthropic, political, and commercial organisations on ways to achieve better gender balance and encourage diversity in leadership. She has been a member of the British House of Lords since 1998. You can follow her on Twitter: @BaronessGoudie

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: Photo by Jonathan Torgovnik/Getty Images, courtesy of www.imagesofempowerment.org