A sense of urgency was present at a recent World Bank Spring meeting on financial inclusion. This is not surprising, given the Bank’s ambitious goal of Universal Financial Access by 2020. Two years to go and globally about 1.7 billion adults remain unbanked—close to 1 billion of them are women. It’s clear that to meet this goal, we all must focus our efforts on women.

How big is the gender gap in financial services?

Women continue to lag well behind men in having a bank or mobile money account. Globally, 65 percent of women had an account in 2017 compared to 72 percent of men. This 7 percentage point gap is unchanged since 2011. In developing economies, this gap, at a wider 9 percentage points, is also unchanged since 2011. Bank lending is also unequal: eighty percent of women-owned micro, small, and medium enterprises do not get the finance they need, a need which is estimated at $1.7 trillion globally (IFC).

At the Spring Meetings, H.M. Queen Maxima of the Netherlands called out the gender gap and made the important point that the development impact of full financial access will be only realized when people have an account and use it (Findex data shows that of the adults that do own accounts, 20 percent of them don’t use them).

When thinking of solutions, we need to think big and strategically

To spur action that can reach millions of women quickly and effectively, solutions must be big and impactful (just the opposite of the mostly small scale, pilot programs for women which have prevailed to date).

For example, an increasingly popular solution with large scale impact is to digitize payments to women with either government payments (including cash transfers to poor mothers) or private sector wages. India has shined in quickly lowering the gender gap in account holdings because of its Aadhaar initiative, which provides unique biometric IDs and enables enrollees to easily receive benefits. Between 2014-2017, account ownership in India rose more than 30 percentage points among women, and the gender gap shrunk from 20 percent to 6 percent (although a quarter of these accounts are inactive, and more so for women than for men).

Two other potentially game changing solutions are promoting savings—especially mobile savings—and collecting sex-disaggregated supply-side financial services data and then acting on that data to provide products and services that work for women.

(1) The promise of savings

Women will want and use their bank accounts if they are linked with secure savings products.

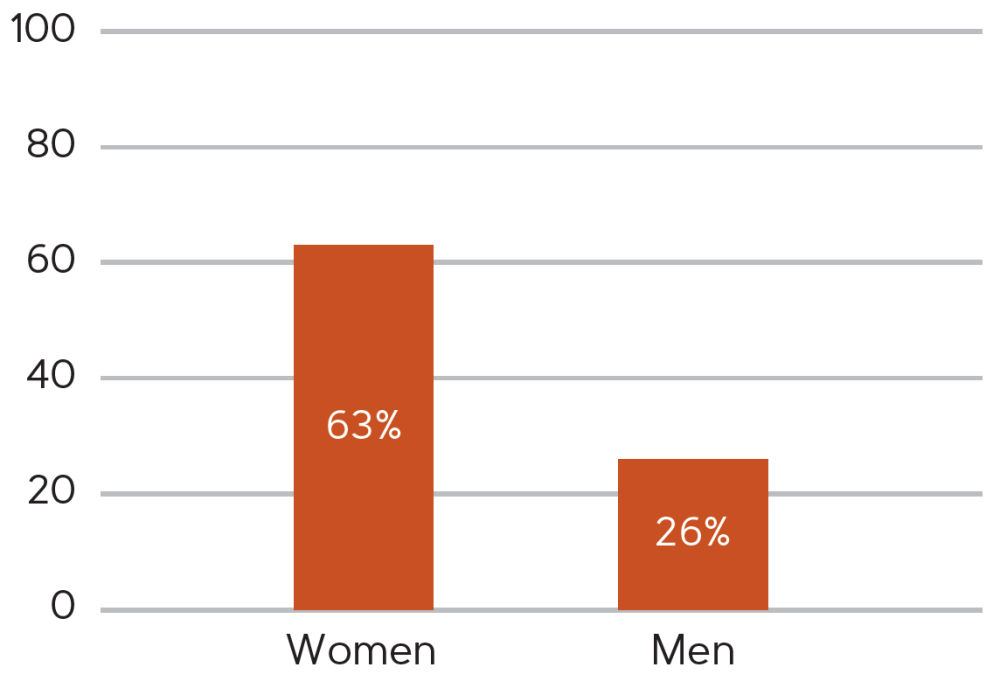

We had mentioned in an earlier blog that women have a preference for savings, citing supply-side trend data from all banks in Chile. But generalizing findings from one country, however impressive the data is, is tough. That’s why we conducted a meta-analysis of the rigorous evidence (2004-2018) and measured the impact of providing access to savings accounts across different countries and populations. We found that women are much more interested in saving than men.

Meta-analysis of 13 basic savings RCTs from pool of 49 savings RCTs (2004-18)—share of adults who would open basic savings accounts

Savings is especially important for women entrepreneurs

For most women, especially in developing countries, self-employment is the norm. They are subsistence farmers and micro entrepreneurs, and while their work is critical for family well-being, they earn significantly less than men and their opportunities for growth are hampered by social and economic constraints. Digitized wage payments will not reach them and government cash transfers will reach them only if they are very poor.

Data on a random sample of men and women entrepreneurs in East Java, Indonesia, showcase the disadvantages women business owners in East Java face and underscore the critical importance of leveling the playing field for them by providing full and unbiased access to financial services, using savings as a strategic entry point:

- Women lead more than half of all micro, small, and medium-sized enterprises in the country, but in East Java, men business owners earn more than twice more, from business and other sources of income, than women business owners

-

Men’s business assets are twice as large

-

Women business owners are younger and less educated, and reside in smaller families (and thus have fewer labor assets in the form of unpaid family workers)

-

When men and women entrepreneurs are matched in terms of age, marital status, number of children, education, cognitive ability, risk taking attitudes, household size, and household and business assets, the disparity in earnings is reduced by only 32 percent. Legal and institutional discriminatory business environments probably play a big role in accounting for the unexplained difference in earnings.

-

Women save almost twice as much as men do, as proportion of their earnings, but have significantly less access than men to bank savings (more than 3:1)

The multiple benefits of mobile savings for women

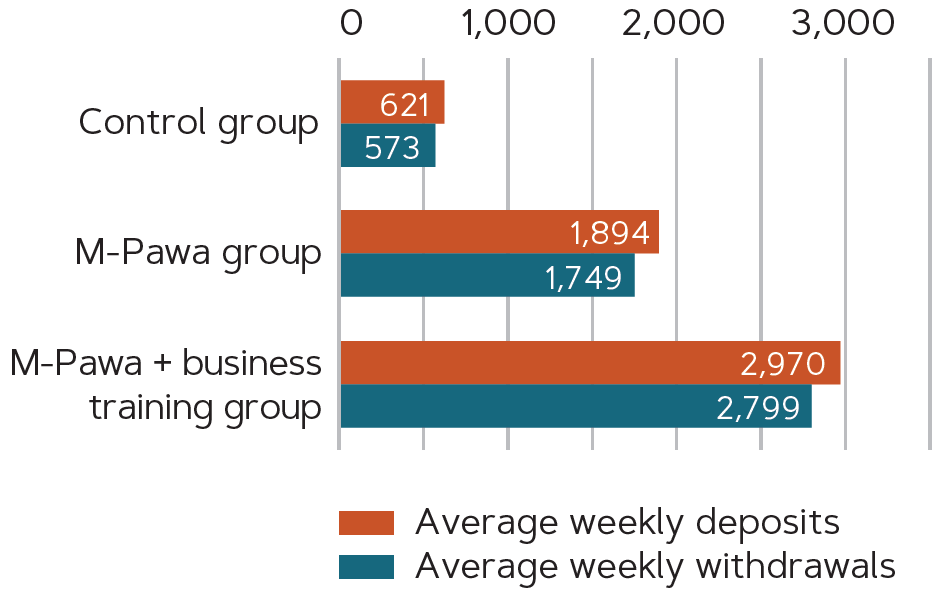

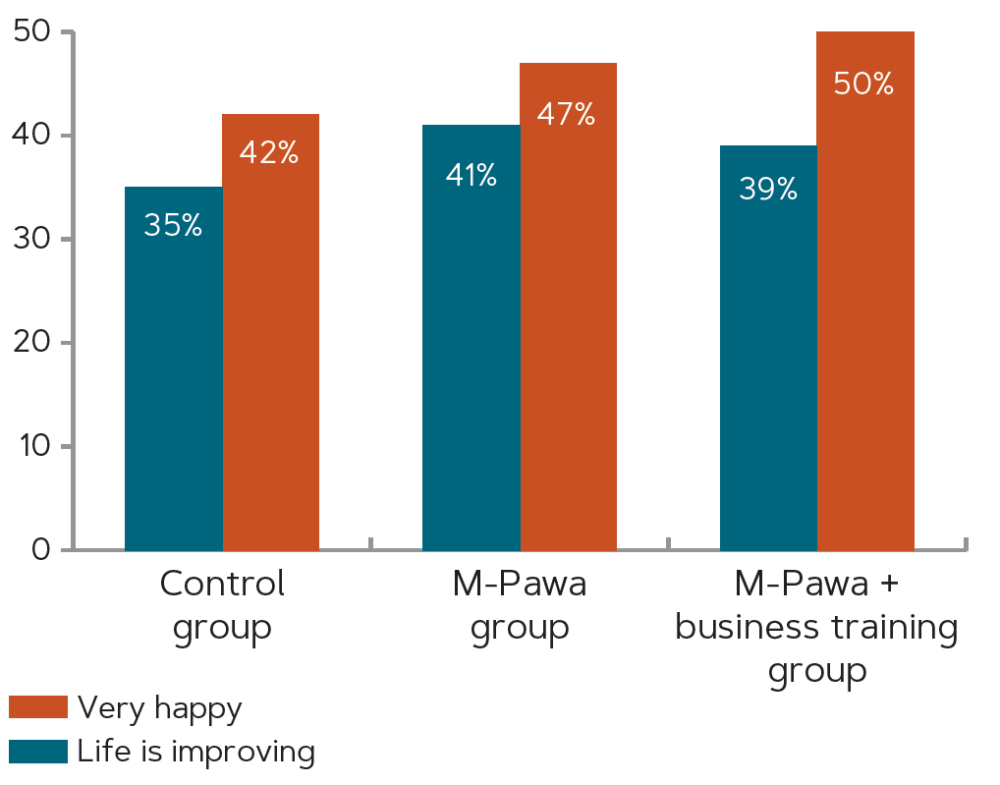

Individual, secure mobile savings accounts reduce transaction costs and increase women’s economic self-reliance by providing privacy and mental discipline. A study in Kenya shows the benefits of mobile savings in reducing poverty, especially among women-headed households. Short-term results of a mobile savings experiment in Tanzania also provide evidence that is consistent with this empowerment effect of mobile savings: business women who had access to a mobile savings app (M-Pawa) reported being more “empowered” in contrast with women who did not have access to the app. Additional business training also boosted savings and improved business practices but did not add to the sense of empowerment obtained by saving through a mobile platform.

Savings were higher after access to mobile savings—and even higher after added business training (in Tanzanian shillings)

M-Pawa increased women’s happiness and optimism, business training had no additional significant effect (% of study participants answering ‘yes’)

(2) The need to seize the women’s market—and first, to find out how with sex-disaggregated bank data

The Findex data is demand-side data, based on individual interviews with nationally representative samples of the adult population. While valuable, it lacks the complement of hard data from banks and mobile providers themselves on their client portfolios. Currently, most banks do not sex-disaggregate their client data and roughly two-thirds of banks do not treat women as a separate group. Little wonder that women access formal financial services much less frequently than men if their distinct preferences are ignored or assumed to be equal to those of men by the financial institutions that could be serving them.

H.M. Queen Maxima also addressed a side event at the Spring meetings organized by Data2X’s Women’s Financial Inclusion Data (WFID) partnership, which works to improve gender data, and supply-side sex-disaggregated data in particular, in the financial sector. Her Majesty called for the need for supply-side as well as demand-side data and for more granular data to provide deeper insight and to identify problems with access and use.

When banks collect sex-disaggregated data, products become more women-friendly

At the Data2X event, policy-makers and financial regulators shared examples across countries on how sex-disaggregated data revealed problems they were previously unaware of:

-

Chile: the rich supply-side data prompted banks to run separate demand-side focus groups for men and women and correct the higher interest rates they found were being charged to women clients

-

Brazil: Julie Katzman, Inter-American Development Bank, mentioned how data revealed that women bank clients were downloading and deleting a data-intensive digital banking app due to data costs. This led the bank to launch a “light” app instead

-

Rwanda: Peace Masozera Uwase, National Bank of Rwanda, cited how data that showed that only 12 percent of women had access to formal credit led to the creation of a government backed guarantee fund to support women business owners

-

Mexico: A national demand-side survey revealed that a program pushing for wages to be deposited in bank accounts supported financial inclusion for men but not for women, because women are less likely to be formally employed, recounted Maria Fernanda Trigo, National Banking and Securities Commission (CNBV). As part of expanding financial access to women, CNBV is designing a mobile product for domestic workers, most of them women, to include insurance and retirement savings accounts.

Policy makers and financial regulators can spur banks to collect sex-disaggregated client data

Tukiya Kankasa-Mabula, Bank of Zambia, mentioned the important role of central banks in encouraging commercial banks to sex-disaggregate their data and grow the women’s market sector. For instance, Stanbic Bank was confident that it was serving women clients well but the data showed that women were only 26 percent of clients (although their loan performance was better than that of men clients). As a result, they developed a women’s banking program that includes mentoring, training, and networking for women clients.

Policy makers and financial regulators have an important role to play in spurring financial inclusion by urging the private sector to act, and also by helping create common definitions and international standards so that cross-country comparable, high quality demand- and supply-side data is collected and used.

The IMF and the World Bank have an especially critical role to play in financial inclusion for women

The IMF’s Financial Access Survey (FAS) has begun asking countries for sex-disaggregated supply-side data (27 countries reported this data in the 2017 FAS) and is stepping up its outreach to accelerate progress. The World Bank Group is expanding the International Financial Corporation’s work on financing women-led firms and collecting supply-side sex-disaggregated bank data through the Women’s Entrepreneurs Finance Initiative (We-Fi).

But there’s more work to do. The IMF and the World Bank have critical roles to play. They are respected international leaders in the financial sector, and have a unique opportunity, through their regular policy dialogue with client countries and their lending and technical assistance work, to lead and champion financial inclusion for women in their core economic sector lending, building on the above cited worthwhile but still emerging and discrete (extra-budgetary) initiatives.

Closing the financial inclusion gender gap will only happen when banks and mobile money providers treat women fairly and as a distinct market segment, collect sex-disaggregated data on their portfolios, and use that data to design products for women clients. The clock is ticking.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.