Recommended

Blog Post

Blog Post

Development leaders from official bilateral and multilateral organisations, and development finance institutions, met in Paris in earlier this month for CGD’s annual Development Leaders Conference against a backdrop of a world facing down geopolitical, economic, and existential insecurity. Today’s leaders are dealing with a once-in-a-century public health crisis; a major geopolitical crisis which has not happened in a generation; and a global climate crisis which has no precedent in human history at all. The questions on everyone’s mind: What does this perfect storm mean for development cooperation and how should official development agencies and development finance institutions weather the long and perfect storm?

A perfect long storm: COVID-19, conflict, and climate change

The COVID-19 pandemic delivered a dual health and economic shock of enormous magnitude, pushing many countries into steep recession. It has stalled what was a hyper-globalizing world economy; deepened inequality; disrupted supply chains; increased inflation and labour shortages; revived protectionism; and shocked the global financial system. Then in 2022, the landscape of geopolitical risk dramatically changed with Russia’s invasion of Ukraine. The war in Ukraine thrust the world into a fraught period of geopolitical realignment, causing further supply disruptions, food and energy insecurity, and even more volatile financial markets. Add to this the existential crisis the world faces: global climate change and the devastating impacts on humanity and biodiversity of decades of carbon emissions and global warming.

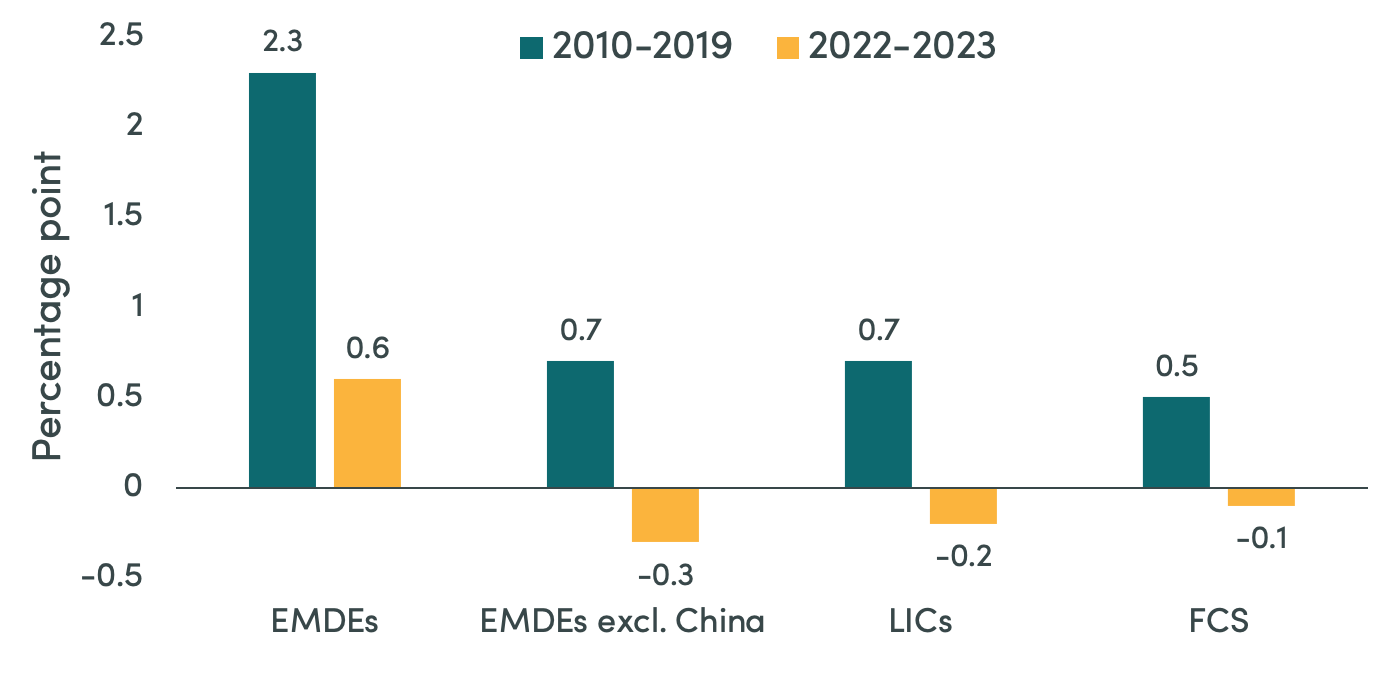

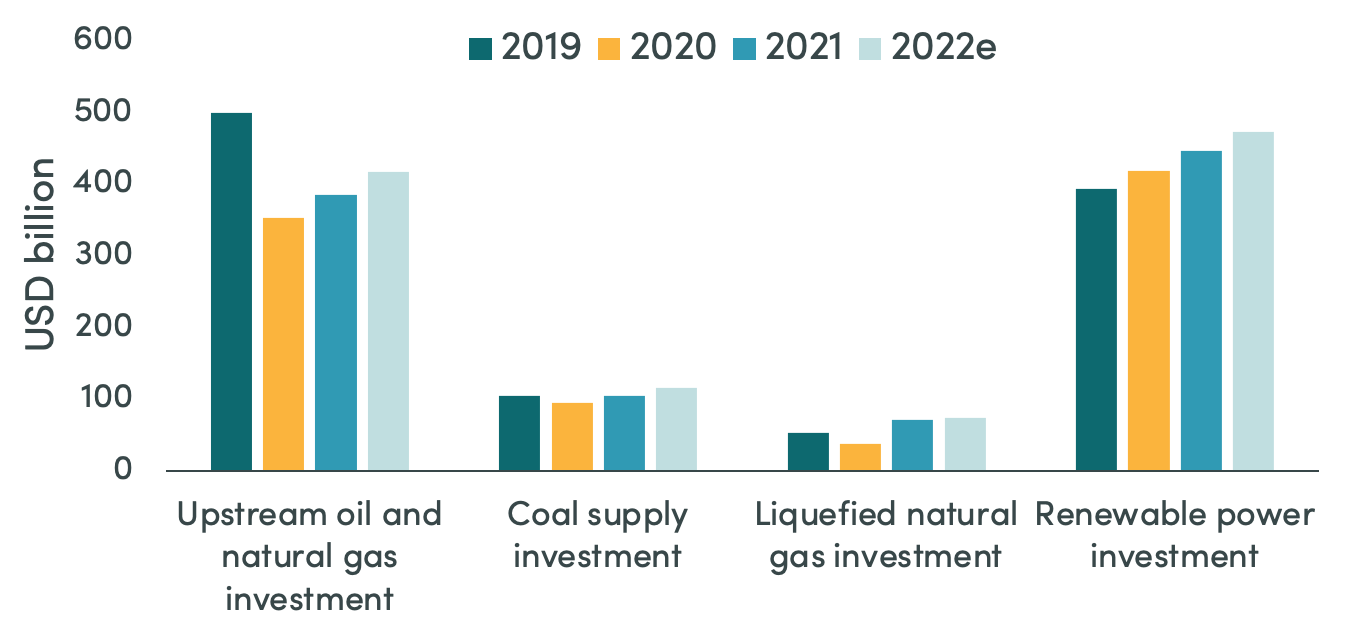

Figure 1 illustrates the significant acceleration of the economic divergence that opened in 2021 between advanced and developing economies. The combination of COVID-19, conflict in Ukraine and climate change has contributed to a grave outlook for global hunger, undoing two decades of progress. Progress on eliminating extreme poverty and inequality has decelerated while humanitarian needs have grown exponentially. Climate targets have stalled since last year’s United Nations Climate Change Conference, COP26, and energy security is moving climate down the list of government priorities. While annual greenhouse gas emissions experienced a strong decline in 2020 following economic shutdown around the globe, they resumed their historical increase in 2021 and outpaced 2019 levels. As European countries move away from Russian gas and oil, new investments in fossil fuels, including coal, gas, and liquified natural gas (LNG) are multiplying (see Figure 2).

Figure 1. Emerging market and developing economies (EMDEs) per capita income growth relative to advanced-economy average

Source: World Bank, Global Economic Prospects June 2022

Figure 2. Change in energy investments, 2019-2022

Source: IEA World Energy Investment 2022

The stark reality is that mid-way through Agenda 2030, we are further away than ever from achieving the Sustainable Development Goals (SDGs)–the COVID-19 crisis alone added a USD1.7 trillion shortfall in SGD investment to an existing annual gap of USD2.5 trillion. This growing financing divide is sharply diminishing the ability of many developing countries to respond to shocks, invest in recovery, and achieve the SDGs; many low-income countries are in no position to finance the necessary investment push.

Development cooperation providers are operating in a new reality

Development cooperation providers are operating in a world in which shocks and crises are growing ever more frequent and costly; where past gains in poverty reduction and human development are in reverse; where global challenges are growing in urgency, scale, and complexity; and where unmet financing needs for the SDGs are ballooning. Development cooperation providers must now consider how they respond to and straddle structural global challenges on the one hand, and poverty and vulnerability challenges at country level, on the other, alongside strengthening contingency finance and stabilization capacity to keep crises from worsening and spreading.

ODA is now under intense pressure to firefight shocks and crises

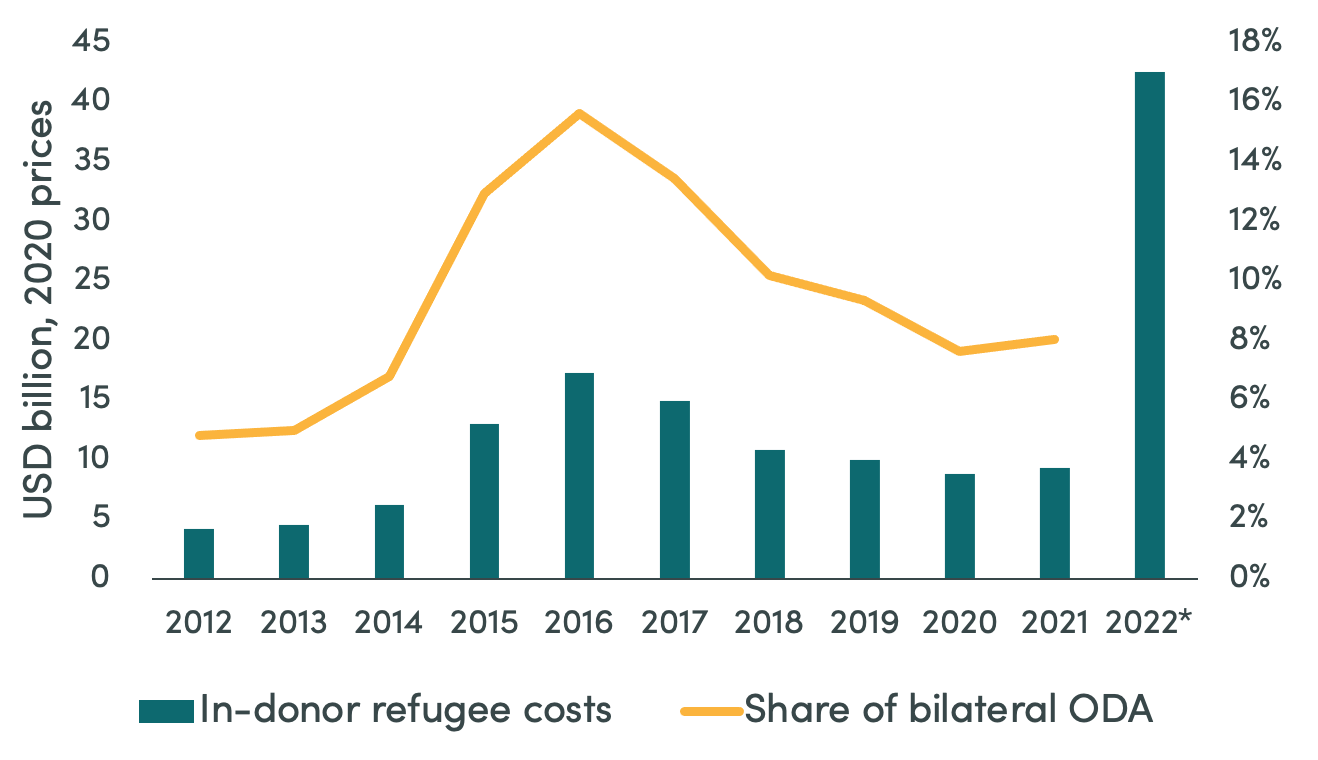

Within development agencies’ arsenal, it is official development assistance (ODA) that is being deployed to address these challenges, from firefighting shocks that spill over into developed countries, to tackling existential borderless threats, to dealing with poverty, inequality and vulnerability. In 2020, 20 percent of ODA was spent on global public goods (GPGs). In 2021, 10 percent of total ODA was spent on COVID-19 and vaccine donations. In 2022, approximately 25 percent of total ODA is projected to be spent on in-donor refugee costs largely driven by the influx of Ukrainian refugees in Europe (see Figure 3). Humanitarian budgets are being exhausted, leaving reserves at an all-time low to respond to crises and hotspots. ODA, which will undoubtedly remain flat in the years to come due to severe economic constraints and fiscal retrenchment in donor countries, risks being spread too thinly to achieve transformative results.

Figure 3. In-donor refugee costs and relative share of bilateral ODA, 2012-2022

Source: ONE’s ODA Ukraine tracker

Mobilizing the world’s financial power and aligning it to the SDGs needs to happen now

The problem, however, is not a shortage of investable capital in the global economy. The challenges are mobilizing the resources and getting the multilateral development banks (MDBs) to more aggressively leverage up to increase their firepower, aligning the world’s financial power with the SDGs and allocating the resources to the right places on the right terms. The development finance architecture has changed profoundly over the last few years, with a proliferation of actors and instruments, and there has been an infusion of sustainability in capital allocation processes. But the standards and measurement tools to track financial flows have not evolved with this architecture, blurring the overall picture of how much has actually been mobilized, what impact it is having, and how and where to incentivize further mobilization particularly of the private sector. Recent estimates show that reallocating a mere 1.1 percent of total assets held by banks, institutional investors, or asset managers, would be sufficient to fill the SDG financing gap. But a sense of urgency continues to remain elusive.

Global cooperation has never been more urgent

The current concatenation of global challenges means that global cooperation has never been more urgent. Yet there are few signs of the collective responses that will be needed to meet these challenges. The age-old saying “global challenges require global solutions” has never been more relevant, and yet the perception remains that rich countries are designing the answers without input from their partner countries, and then imposing them on multilaterals institutions to implement.

Despite the rollercoaster of crises that keeps derailing development progress, a crisis of confidence is engulfing the international development system. Trust in development cooperation and institutions is now at an all-time low after limited assistance for COVID-19 response, including for funding vaccination programmes, failure to act on the problem of unsustainable debt—despite increasingly articulate warnings of impending crisis—and broken promises on climate finance pledges.

How to restore and rebuild trust in the international dialogue and action remains the billion-dollar question.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.