This blog is the fifth in a series on the effects of Basel III on Emerging Markets and Developing Economies (EMDEs) based on the analysis of a CGD Task Force exploring these issues. The first blog on cross-border spillovers can be accessed here, the second on trade finance can be found here, the third on regulatory asymmetries between domestic and foreign banks is here. The fourth blog on infrastructure finance and SME lending is here.

While the immediate and direct effects of implementing Basel III regulatory reforms in emerging markets and development economies (EMDEs) are in these countries’ banking systems, there might also be effects beyond them on other segments of the financial system. In this blog post, I will focus on two specific areas of concern—risk management and capital market development, and spill-overs from banking structural reforms in advanced countries.

Risk management and capital market development

One of the critical functions of the financial system is to provide risk management tools and services to the economy. Banks offer such services (through, e.g., derivatives for third parties but also hedging their own positions), booking them as off-balance sheet items (as they are contingent exposures). In less developed capital markets, banks also have an important role to play in developing derivative markets. Capital requirements for such off-balance sheet positions can thus have an important effect on banks’ offering of such risk management and their role in capital markets. At the same time, the move toward centralized clearing of derivatives to improve their monitoring and risk management has implications for banks operating in small emerging markets that are not able to support a domestic Central Counterparty Clearing (CCP) and have to thus rely on over-the- counter (OTC) transactions.

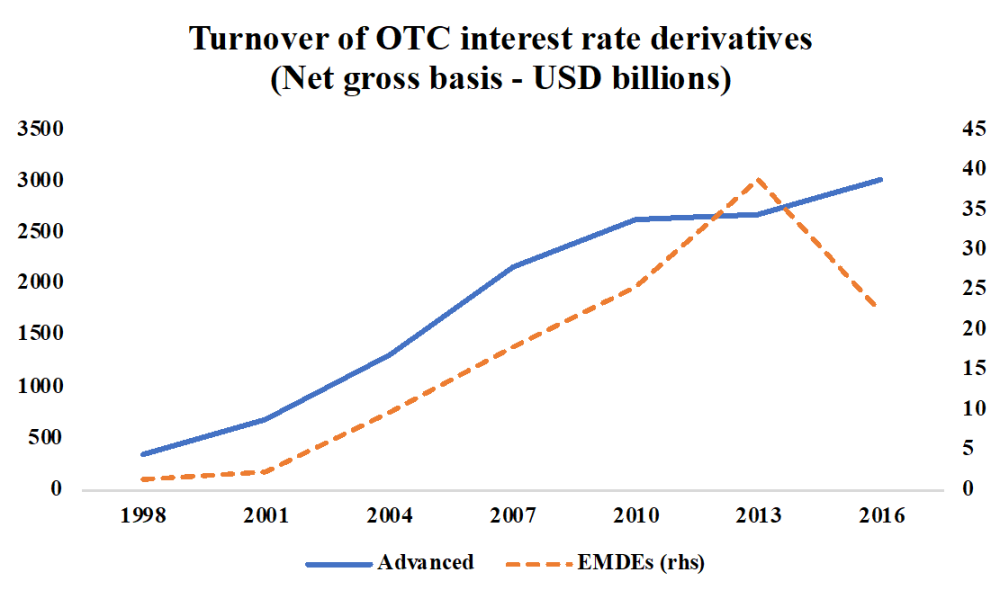

This discussion is against a backdrop of relatively underdeveloped hedging markets as show in Chart 1 for the case of OTC interest rate derivatives, which historically have been much smaller in market depth than in advanced countries, but have even experienced a reduction in recent years.

Chart 1: Turnover of OTC interest rate derivatives in advanced and emerging markets

Under Basel II, capital requirements were already imposed on off-balance sheet items including derivative positions, but these requirements became more expensive under Basel III and are now also subject to liquidity requirements. In addition, requirements for higher capital on non-centrally cleared derivatives, posting additional margins for over-the-counter (OTC) derivatives, and additional clearing fees to process transactions have made derivative transactions significantly more expensive for banks. This might also apply to derivative transactions between local banks in EMDEs and large cross-border banks, where the latter might have to apply higher capital requirements on their positions in comparison to EMDEs’ banks, which in turn, makes them more expensive for local banks in EMDEs.

These higher costs, both in terms of margins and capital requirements, might make banks more reluctant to engage in derivative markets, which ultimately might not only reduce the provision of hedging and risk management services for their clients, but also impede the development of local capital markets in EMDEs.

Spill-over from advanced economies’ structural banking reforms

A second effect of regulatory reforms—in this case in advanced economies—might be from structural reforms. Specifically, there might be a spill-over effect of structural banking reforms in advanced economies on capital risk management possibilities and capital market development in EMDEs. While strictly speaking not part of the Basel III process, several advanced economies have introduced steps toward the separation of core commercial bank activities and investment and capital market-related activities. In the UK, for example, this is known as ring-fencing, following recommendations by the Vickers Commission. In the US, the Volckers rule has imposed limitations on banks for trading on their own books in certain asset and derivative classes. The higher costs of capital market-related activities following from these reforms might make large multinational banks more reluctant to engage in cross-border transactions with banks in EMDEs, ultimately having a negative effect on capital market development in EMDEs through similar channels as discussed above.

In summary, regulatory reforms in the banking system, such as those under Basel III can have effects on other segments of the financial system, which in turn affect the real economy. Given that such regulatory reforms aim at higher financial stability, they might be well justified. However, given that non-bank segments of the economy are still in development in most EMDEs, adverse effects must be carefully monitored and options should be explored to mitigate them.

Together with Senior Fellow, Liliana Rojas-Suarez, Thorsten Beck co-chairs the CGD Task Force, Making Basel III Work in Emerging Markets and Developing Economies.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.