Ideas to action: independent research for global prosperity

domestic resource mobilization

More from the Series

POLICY PAPERS

February 15, 2022

As the global financial community considers how to extend debt relief accompanied by IMF adjustment programs to vulnerable low-income countries, the issue of policy conditions for fiscal adjustment will inevitably arise. This paper considers the effectiveness of conditions related to domestic revenu...

Blog Post

March 30, 2021

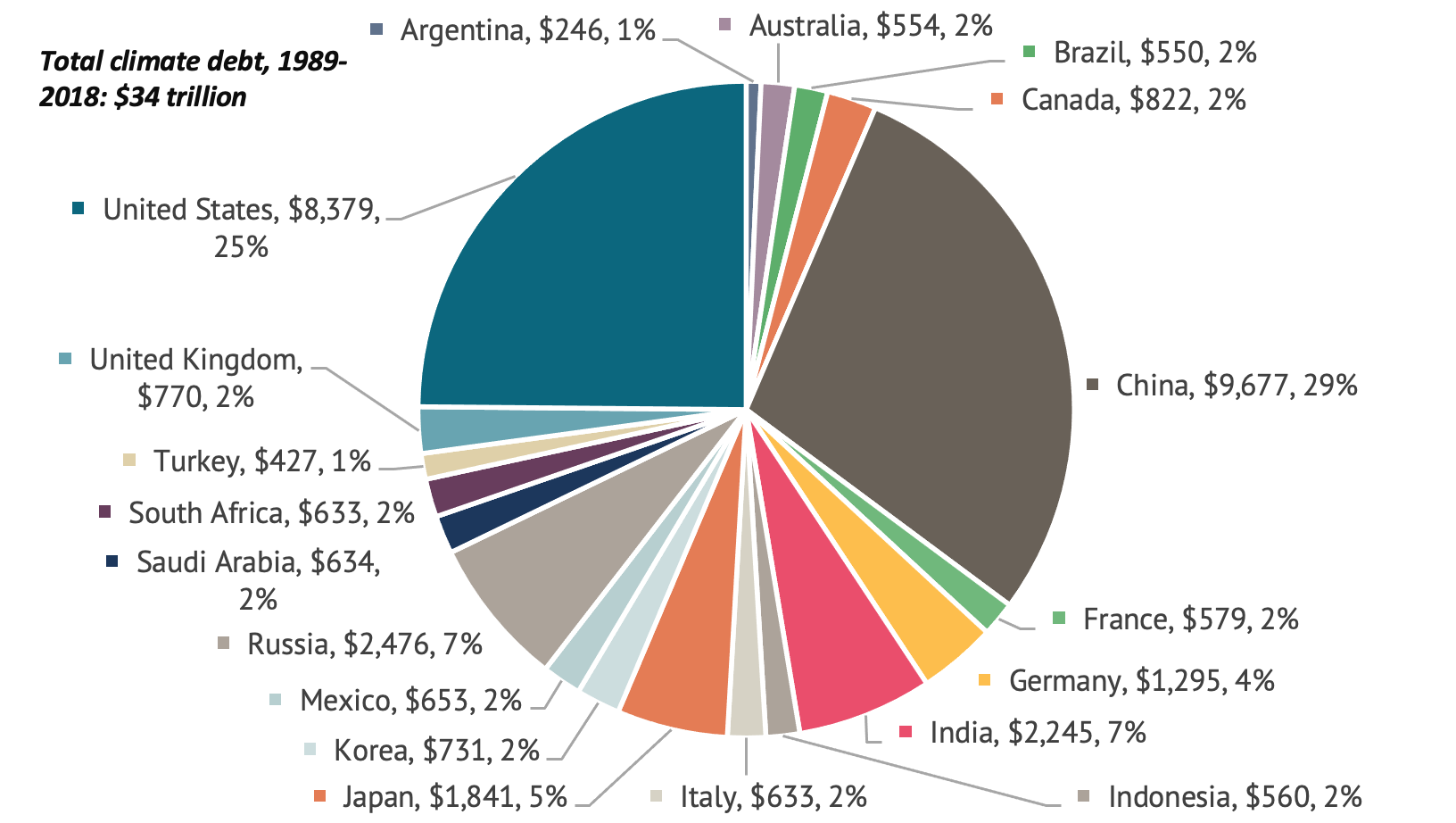

While a drastic reduction in carbon emissions is necessary to contain climate change, countries still have not reached a consensus on a fair division of responsibilities in reducing them. While advanced economies were the biggest emitters in the past, emerging economies, such as China and India, acc...

POLICY PAPERS

March 01, 2021

The Covid-19 pandemic has led to large budget gaps in low- and middle-income countries, with revenues projected to be reduced for years to come. This is the moment for policymakers to consider whether health taxes—levied on tobacco products, alcoholic and sugar-sweetened beverages, and polluting fue...

Blog Post

February 03, 2021

On January 25, the African Center for Economic Transformation (ACET) and CGD convened a panel of seven experts, including from government, the private sector, and financing partners, to discuss the potential for increasing DRM in the aftermath of the COVID-19 health and economic crises.