Recommended

Interest in mobilizing private finance for SDG investments is surging in a world of stagnating aid, limited fiscal space, and rising LIC debt. But is more reliance on private finance realistic for LICs? This paper explores the performance since the global financial crisis of one source of private finance for LICs: cross-border private capital inflows.

Much of the evidence is encouraging, and some of it flies in the face of conventional wisdom. For LICs, private capital inflows are an important and growing source of finance. For the median LIC, private capital inflows are now as large as ODA as a share of GDP. And the FDI component—most of LIC inflows—has been stable and resilient throughout the post-crisis period.

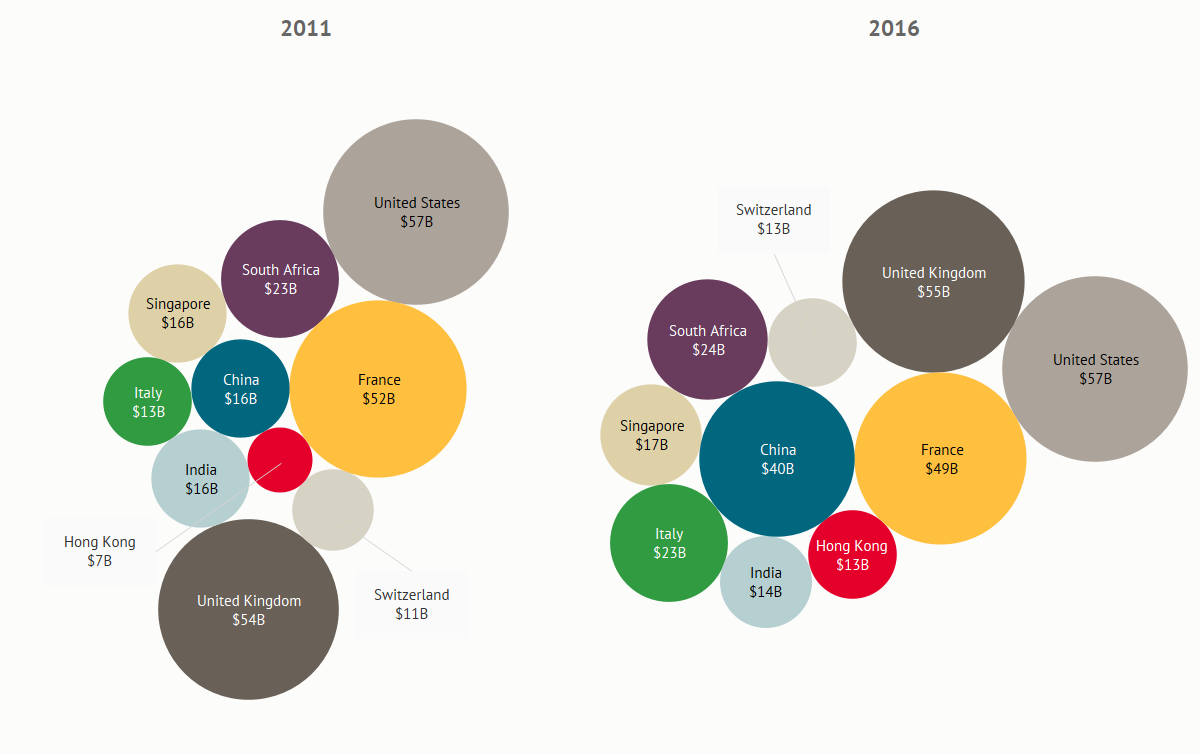

Importantly, inflows are not all captured by resource-rich LICs. In 2017, more than half of capital inflows to LICs went to non-resource-rich LICs. Increasingly, policies, not just resource endowments, shape LIC destinations for foreign capital. The relation between median capital inflows/GDP and median regulatory quality is significantly positive for non-resource-rich LICs. And sources of FDI are diversifying. In 2016, China’s stock of FDI in Africa was almost as large as that of the traditional investors: the US, UK, and France.

But there is also not-so-good news. Median private capital inflow/GDP ratios are not positively correlated with median private domestic investment/GDP in LICs. Nor is there a significant relationship with median public investment/GDP. The apparent lack of complementarity between foreign and domestic investment may point to problems related to investment enclaves and/or the role of the state in LIC economies. As in other countries, non-FDI inflows to LICs are volatile and sensitive to global commodity prices and interest rates. We find no relation between median country per capita income levels and private inflows/GDP, highlighting the need for caution in IDA graduation policies.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.