Recommended

CGD NOTES

Key takeaways

Converging around a common agenda

- The two years of global debate on MDB reform have borne fruit in forging common objectives: MDBs have largely converged around a shared reform agenda.

- This analysis tracks reform progress across seven MDBs on 28 reform agenda items, grouped under five categories of reform: making more efficient use of capital, adding to capital, expanding mandates to include global challenges, transforming engagement with countries, increasing mobilization of private finance.

- Most MDBs have indicated their intention to pursue most of the reform agenda items.

- But the picture on MDB reform progress is highly mixed across institutions and across different types of reform.

Highly variable performance across institutions

- No single MDB can claim a monopoly on reform progress or excels in all the reform categories.

- But individual institutions are leading the way for different reforms. That variation holds promise: what is possible for one institution should be possible for the others.

For most reform agenda items, a long way to go

- We see the most progress in incorporation of global challenges—including climate—into institutional mandates and country diagnostics and strategies.

- All seven MDBs assessed have either included global challenges in their mandates or are in the process of doing so.

- But for most of the items on the rest of the reform agenda, implementation evidence is weak or absent in the majority of MDBs.

- For 60 percent of the agenda items, less than half of the seven MDBs have demonstrable implementation progress.

- Implementation progress is most limited in the categories of making more efficient use of MDB capital, adding to capital, and transforming country engagement. Implementation is somewhat further along in the category for mobilization of private finance, but we lack data that shows major gains in actual mobilization performance.

Introduction

Urgent development and climate finance needs have rightly pushed multilateral development banks (MDBs) center stage as finance leaders grapple with how to transform the international financial architecture to meet the needs of the moment. MDBs have the financial and non-financial tools, the on-the-ground presence, the knowledge, and the policy credibility to help countries integrate and finance development and climate objectives. But there is broad agreement that their twentieth century model needs to be transformed to achieve twenty-first century priorities and finance scale.

We have seen an active debate over the last two years about the nature and extent of the reforms needed. To advance a common reform agenda, the G20 commissioned work that has been instrumental in defining what is needed to use MDB capital more efficiently (here) and, more broadly, to make MDBs bigger, better, and bolder (here and here). These reports are broadly aligned with other efforts and proposals (e.g., the Bridgetown Agenda and the Paris Summit).

While views are certainly not uniform, it can be fairly claimed at this point that there is convergence around the broad outlines of reforms needed. This year, the focus needs to shift to implementation. Without real progress and actions by all the major MDBs, inertia could set in and we could permanently lose momentum.

The reform agenda is long and complicated. MDB shareholders, managers, and other stakeholders need a systematic way to assess progress as objectively and independently as possible. CGD has built this MDB reform tracker for this purpose. The aim is a comprehensive tool, but also a focus on reform progress that can be factually and consistently assessed across different institutions. This paper summarizes the MDB reform tracker methodology and findings. The findings are discussed under the following headings: the most advanced reforms, the least advanced reforms, and MDB reform leaders.

Methodology

The MDB reform tracker updates and greatly expands the previous tracker published in October 2023. For this tracker, we review reform progress in seven of the major MDBs: the African Development Bank (AfDB), the Asian Development Bank (ADB), the Asian Infrastructure Investment Bank (AIIB), the European Bank for Reconstruction and Development (EBRD), EIB Global, the Inter-American Development Bank Group (IDBG), and the World Bank Group (WBG). We judge their progress across five categories of reform:

- making more efficient use of MDB capital;

- adding new capital to meet needs and manage risks;

- expanding MDB mandates to include global challenges;

- transforming country engagement for efficiency and impact;

- achieving a major expansion in MDB mobilization of private finance.

(Another major piece of the reform agenda concerns how MDBs function collectively as a system. We plan to publish a separate review of progress in that area.)

Within the five categories, we identify individual reforms necessary to achieve the overall reform objective. Those individual reforms total 28 items, comprising a comprehensive reform agenda. We define reform items as objectively as possible to limit subjective judgments in assessing progress. The resulting MDB reform tracker is a matrix with seven columns and 28 rows that can be accessed here.

Each cell shows our assessment of reform progress. Progress is assessed using four criteria:

- Reform is not being pursued;

- The institution has announced an intention to pursue the reform;

- Implementation of the reform is in progress but further actions need to be taken;

- Needed reform actions have been implemented.

To assess progress we used information publicly available on MDB websites or in public documents. We also asked the MDBs themselves to add information to the matrix to supplement the information we found in order to generate as accurate an assessment of progress as possible. We are grateful that all of the MDBs responded to our request and provided helpful information. The online reform tracker is constructed to allow users to scroll over individual cells to reveal links to the documents and website information used to assess progress for that cell.

Findings

One central finding is that the picture on MDB reform progress is mixed across institutions and across different types of reform. But for most reform categories, there is a long way to go.

Progress in different categories of reform varies significantly. And no individual institution has yet managed to pull far ahead of the pack by advancing and implementing reform across the board. That is not surprising. The agenda is long and often requires major decisions and actions across different parts of institutions and by both MDB shareholders and management.

But we do observe some noteworthy patterns which reveal areas where progress has clearly been embraced and other areas where more attention will have to be focused going forward.

The good news is that most institutions are pursuing most of the reforms. We can conclude that the reform discussions and debates over the last two years, though sometimes difficult and contentious, have at this point helped MDBs coalesce around a widely shared reform agenda.

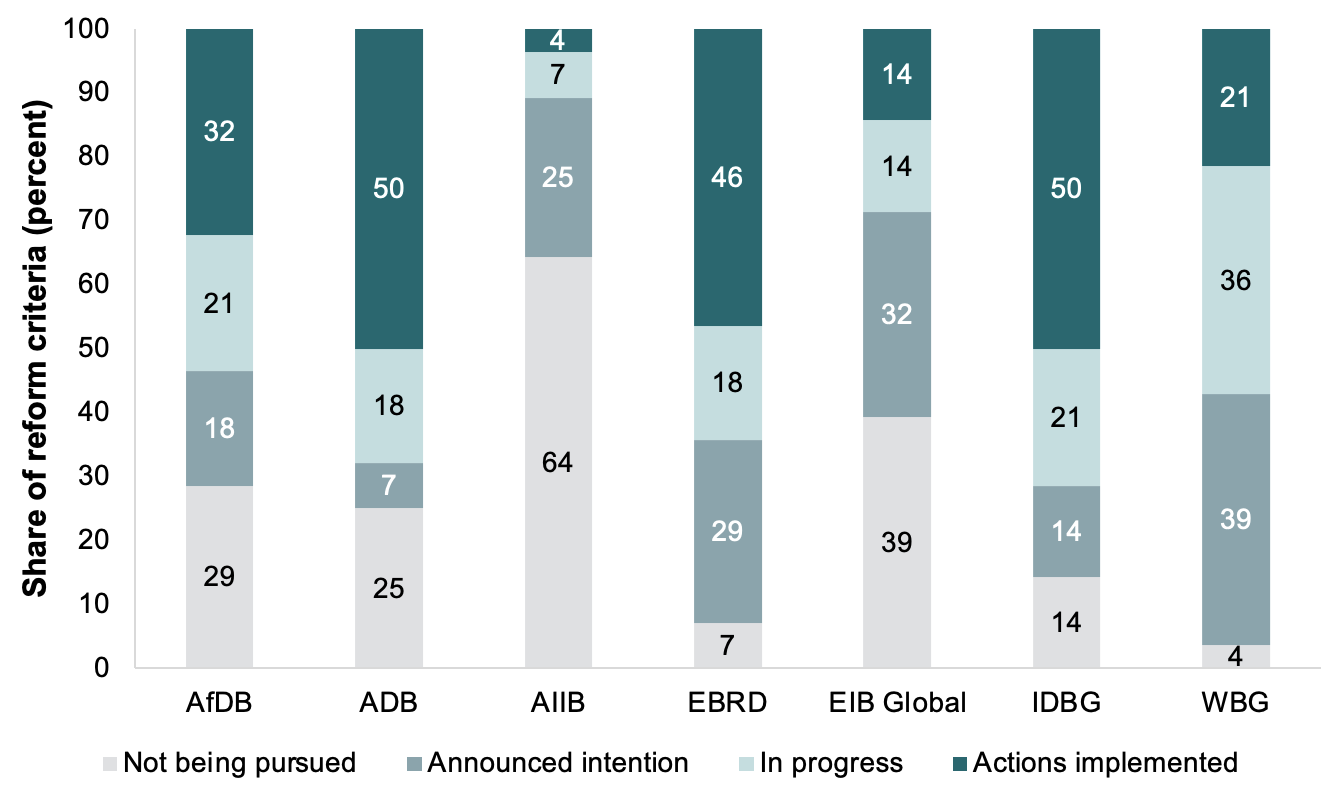

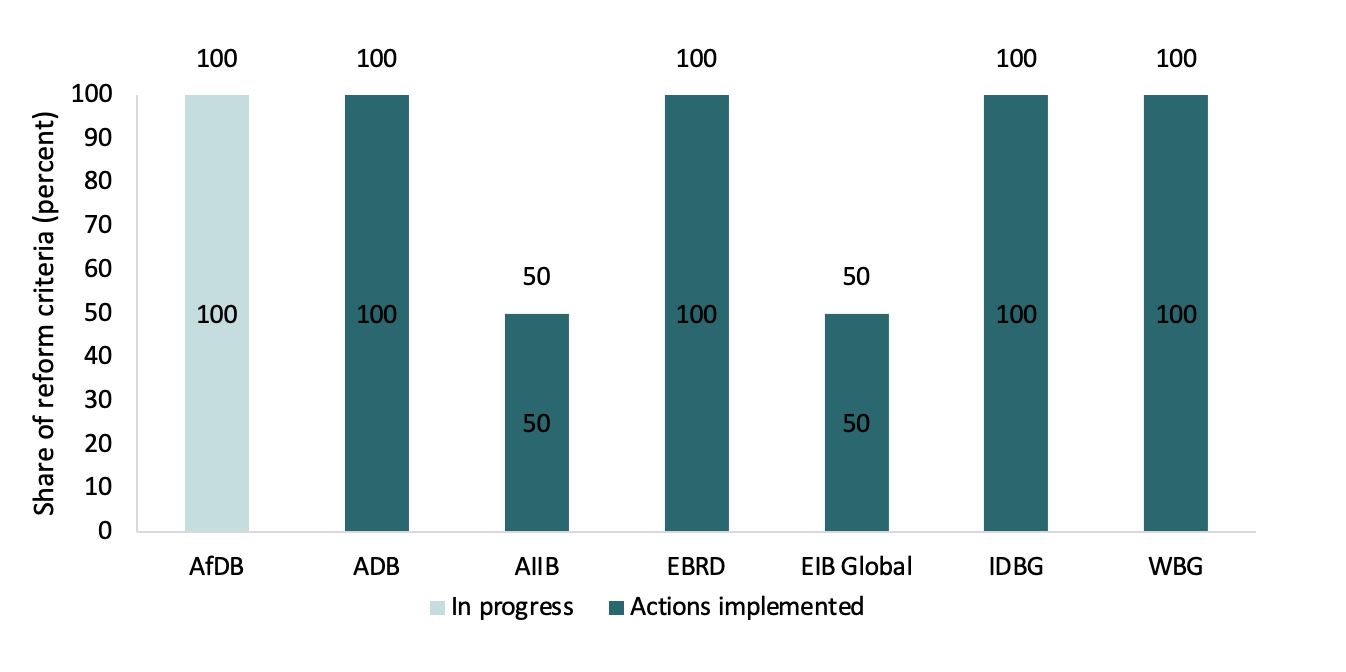

Figure 1. Reform progress across institutions

The World Bank Group, for example, is at some stage of pursuing 96 percent of items on the comprehensive reform agenda (Figure 1). The EBRD is close behind at 93 percent. And the ADB and IDB Group stand out as having actually implemented actions on half the agenda.

Looking across the agenda

Figure 2 presents the complete agenda and shows the share of institutions for each agenda item that are in two later stages of reform: they are either pursuing reforms (“in progress”) or have taken the actions needed to implement reform (“actions implemented”), rather than simply announcing their intention to pursue reforms.

Figure 2. Progress across the full reform agenda

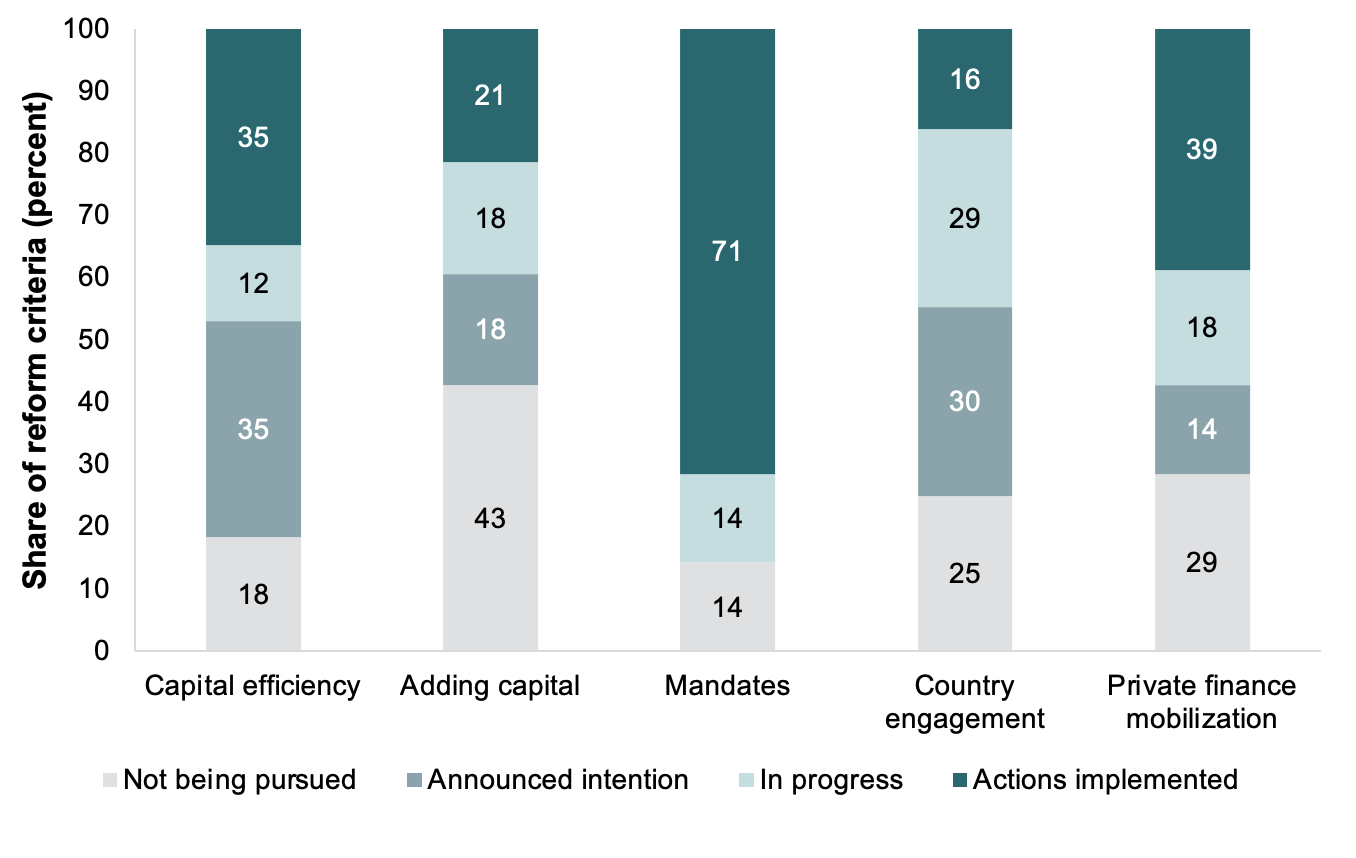

For the five broad reform categories, we computed an unweighted average share of institutions that are pursuing or implementing reforms within that category (Figure 2). Less than half of institutions are actively pursuing or have implemented needed actions on capital efficiency, adding to capital, and transforming country engagement. An average of 57 percent of institutions are pursuing reforms to expand private finance mobilization. And 86 percent of MDBs have integrating global challenges into their mandates and country strategies or are in the process of doing so.

Most advanced reforms

At more detailed level, across all 28 agenda items, we can identify those for which more than 50 percent of the MDBs are at the stage of implementing reforms. It is a minority of reforms, about 40 percent of the agenda: 11 out of 28 items (Figure 2).

We see the most progress in the reform category for incorporating global challenges into institutional mandates and country diagnostics and strategies (Figure 3). All seven MDBs surveyed have either included global challenges in their mandates or are in the process of doing so. And most also integrate global challenges into country strategies. This confirms that the recent focus of the G20 and other shareholders on climate and other global challenges is bearing fruit.

Figure 3. Progress across reform categories

For other reform categories, progress is much more uneven and dispersed in individual items across the agenda. Under maximizing capital efficiency, for example, one item stands out: 86 percent of MDBs are freeing up capital for more lending through donor guarantees at the portfolio level that take risk off their balance sheets. Donor shareholders appear to be finding it easier to contribute to guarantee funds that leverage multiples in lending capacity rather than to launch complicate negotiations for general capital increases.

Progress on adding to capital through general capital increases (GCIs) is limited. But for GCIs, the role of shareholder is key. They mostly drive the pace of progress. More institutions are working on issuing hybrid capital, although only one—AfDB—has actually gone to market. But a welcome finding concerns a critical building block for timely decisions on capital needs: regular capital reviews. These are now undertaken by more than half the MDBs surveyed, though not necessarily based on metrics standardized across institutions.

Evidence of change in MDB approaches to country engagement is not necessarily emerging in areas that borrowing countries prioritize, like streamlining operational efficiency. But we are seeing steps toward engaging with countries through country platforms, like Just Energy Transition Platforms, that bring governments, MDBs and other partners, and the private sector together around common goals in a critical sector. Eighty-six percent of MDBs are working through at least one country platform. That bar is relatively low, however, and it will be important for MDBs to help drive more intensive and widespread application of these channels for collective action. We are also seeing an uptick in MDB partnerships with the Multilateral Investment Guarantee Agency (MIGA) as a source of powerful insurance products, although actual transactions, especially at the country portfolio level, are still limited in volume.

Another key focus in the reform agenda is MDB engagement with the private sector to support major increases in private finance mobilized for SDG and climate investment. So far, the area where progress is most advanced is the use of catalytic risk-sharing projects like first loss guarantees. All of the MDB surveyed use these instruments for a significant share of commitments, although loans are generally still well over 50 percent of commitments. More than half of the MDBs also deploy the analytic and policy building blocks of effective private finance mobilization: assessments of additionality (MDB involvement makes private investment possible that would not otherwise have happened) in project documents and inclusion of private sector diagnostics and investment climate reforms in country strategies.

Least advanced reforms

For 17 reform agenda items, less than half of institutions have reforms in progress or implemented. Five of these are in the capital efficiency group: shareholder-defined risk appetites, appropriate valuation of callable capital and preferred credit treatment, adjustments in leverage ratios to incorporate such valuation and shareholder risk appetite, and relocating leverage targets to capital adequacy frameworks. This evidence shows that, while CAF reforms are clearly a priority for shareholders and a stated priority for MDB heads, it is still way too early to declare victory.

In the adding to capital category, shareholders have approved general capital increases in only two of the institutions, EBRD and IDB Invest. Several other MDBs have indicated that they do not see a need to expand sustainable lending capacity through capital increases. Less than half the institutions have issued or are working on issuing hybrid capital, either to private investors or shareholders, despite the strong demand for these assets demonstrated by the AfDB’s very successful sale in January. We see a disconnect between calls for tripling MDB lending capacity across the system by 2030 as one essential contribution to addressing huge SDG/financing gaps, on the one hand, and perceived demand for lending by some MDBs, on the other. This disconnect points up the importance of pursuing the bigger and the better/bolder bank agendas at the same time.

For country engagement, progress is limited in two of the categories that client countries care about most: transaction times and operational efficiency generally. Only one bank, the World Bank Group, has publicly set targets for significantly reducing project development and approval times. And, interestingly, we do not see the same progress as in non-sovereign operations in shifting to more catalytic products like guarantees (on their own balance sheets) for sovereign operations. While a number of banks are using guarantees in innovative individual sovereign transactions, such as guarantees for blue or green sovereign bonds, the share of those instruments in overall sovereign commitments remains low.

Under the private finance mobilization reform group, a few other agenda items where reform progress is limited are worth noting. Only three institutions have set and published targets for private finance mobilization relative to their own account commitments. Less than half have actions implemented (based on shares of overall commitments) in two areas of finance where capital market gaps are most binding: local currency finance and early-stage finance for firms and infrastructure. And less than half are actively pursuing the shift from the “originate to hold” to the “originate to distribute” model through transfers of risk for portfolios of mature, performing assets to the private sector.

MDB reform leaders

Figures 4-8 demonstrate that MDB reform leadership differs across different reform categories. No one bank dominates or consistently leads. Differences are instructive, however. For the most part, what is possible for one bank should be possible for others. (Note that caution should be exercised in comparing the performance of AIIB, a much younger institution, with that of others. AIIB is currently undertaking the mid-term review of its corporate strategy, to be completed by the first quarter of 2025, which will, among other things, chart its reform course going forward.)

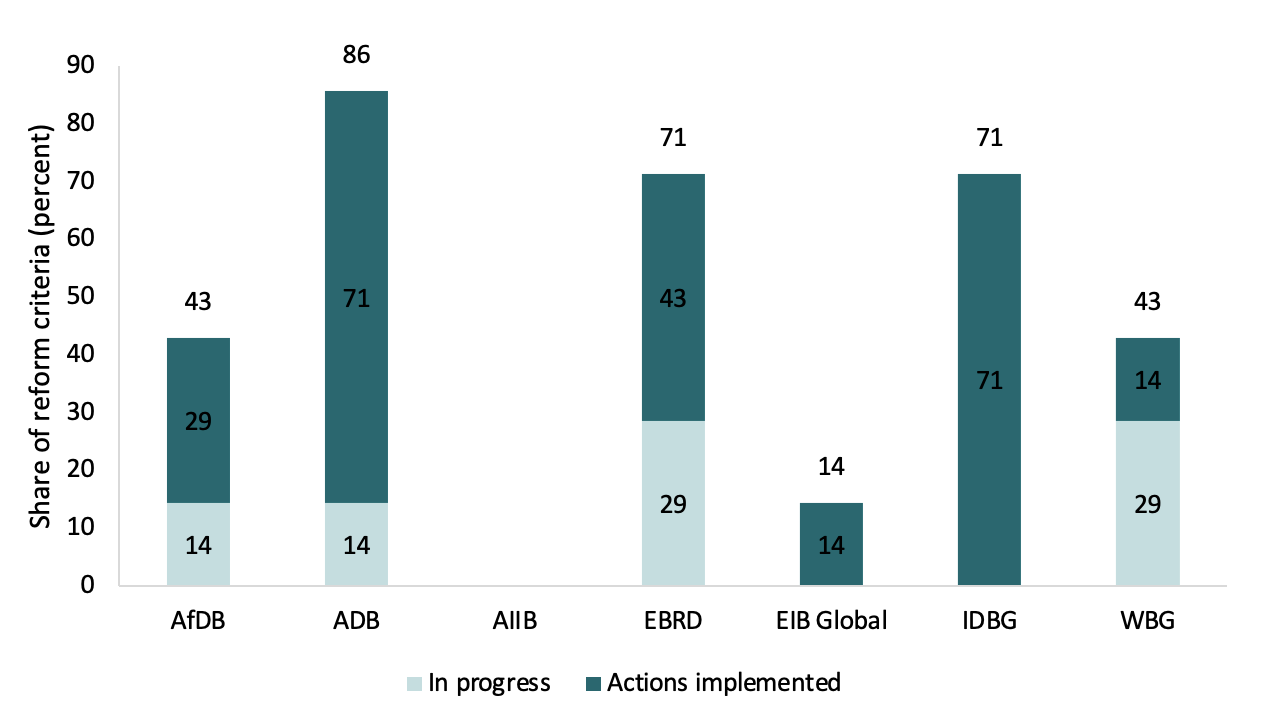

Figure 4. Maximizing capital efficiency: Reform progress across institutions

Figure 4 shows that ADB and IDBG are the farthest advanced on the capital efficiency agenda. Both are taking forward reforms involving valuation of callable capital and preferred creditor treatment that should open significant lending headroom. This progress should be reinforced by the current G20-mandated analysis to clarify procedures in the event of capital calls and to assess the probability of calls, which should provide the basis for more adjustments in risk tolerance and leverage ratios across the MDB system.

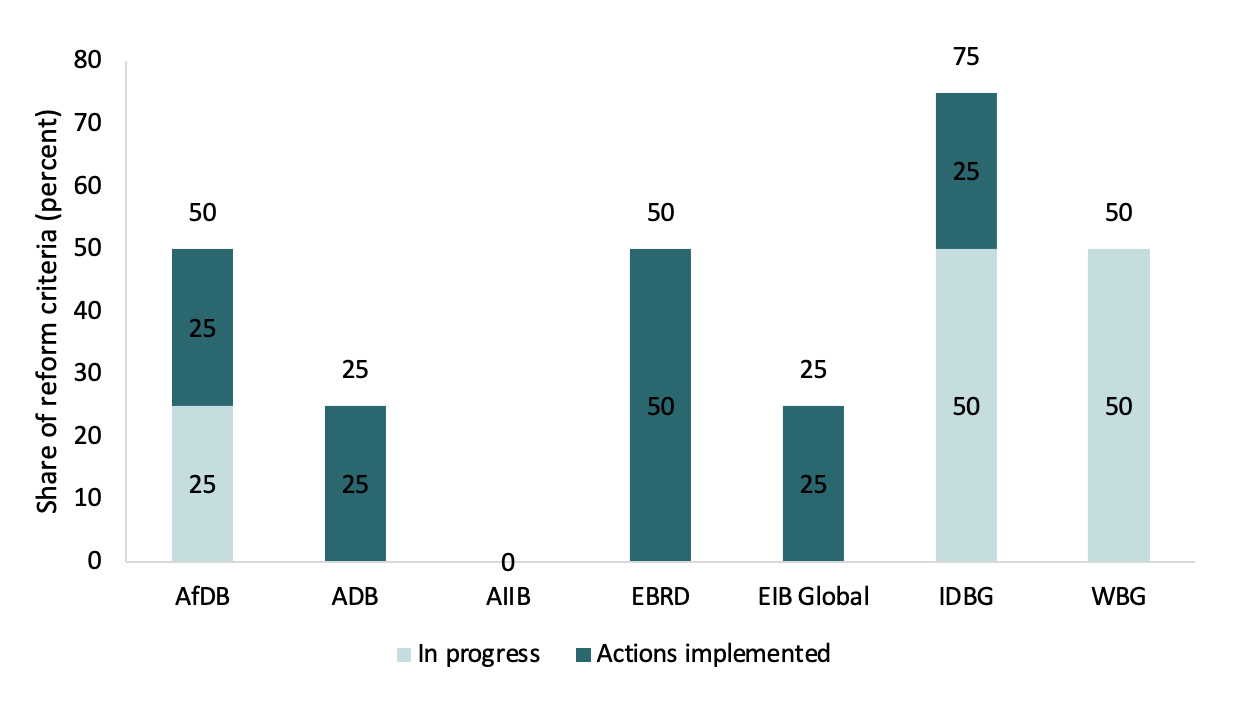

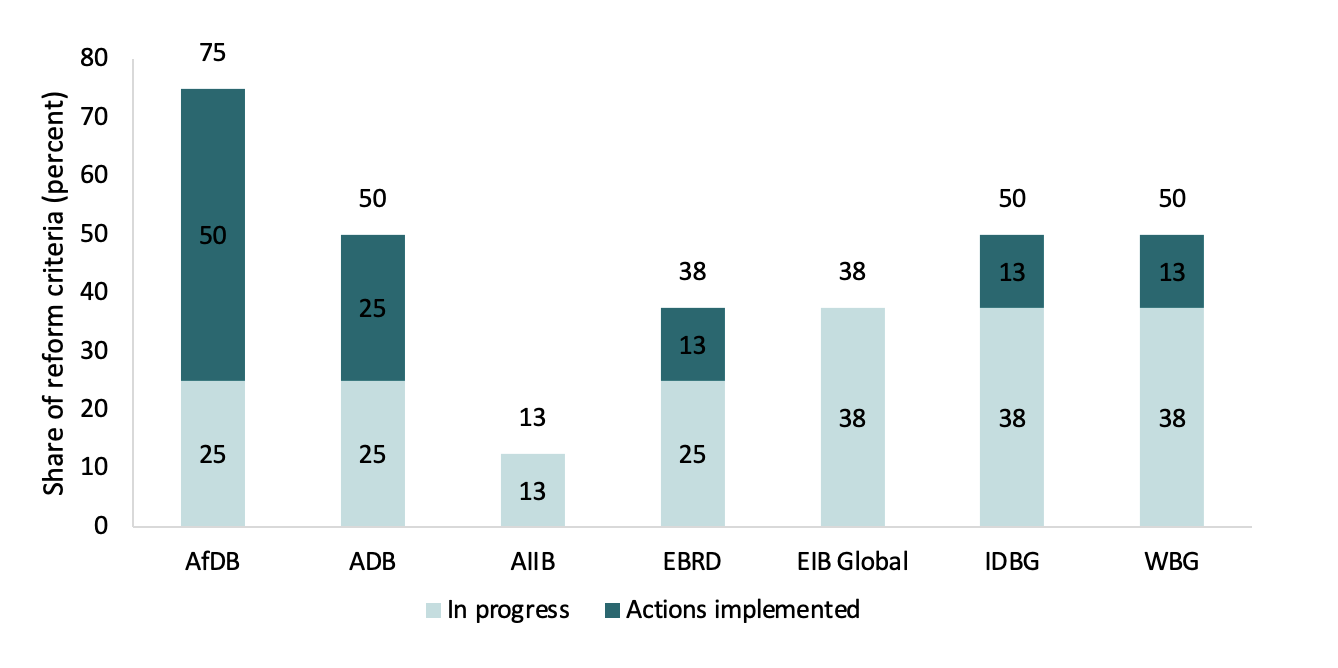

Figure 5. Adding capital: Reform progress across institutions

The EBRD is the leader in this category for adding capital (Figure 5), especially given recent shareholder approval of a general capital increase. The capital increase for IDB Invest along with IDB efforts in other avenues like hybrid capital make it a leader as well, with the AfDB and the World Bank Group close behind.

Figure 6. Expanding mandates: Reform progress across institutions

We see strong progress on expanding mandates across the board (Figure 6). AfDB is in the process of integrating global challenges into its mandate, and the lower scores for AIIB and EIB Global are the result of their different country approach, which does not involve individual country strategies. Therefore the concept of integrating global challenges into country strategies is not relevant.

Figure 7. Transforming country engagement: Reform progress across institutions

For transforming country engagement (Figure 7), AfDB is the leader. It is making progress across most of the agenda items: setting targets for improving transaction times and operational efficiency, reporting and setting output targets in its corporate scorecard, engaging through country platforms, prioritizing regional programs and investments, and partnering with MIGA.

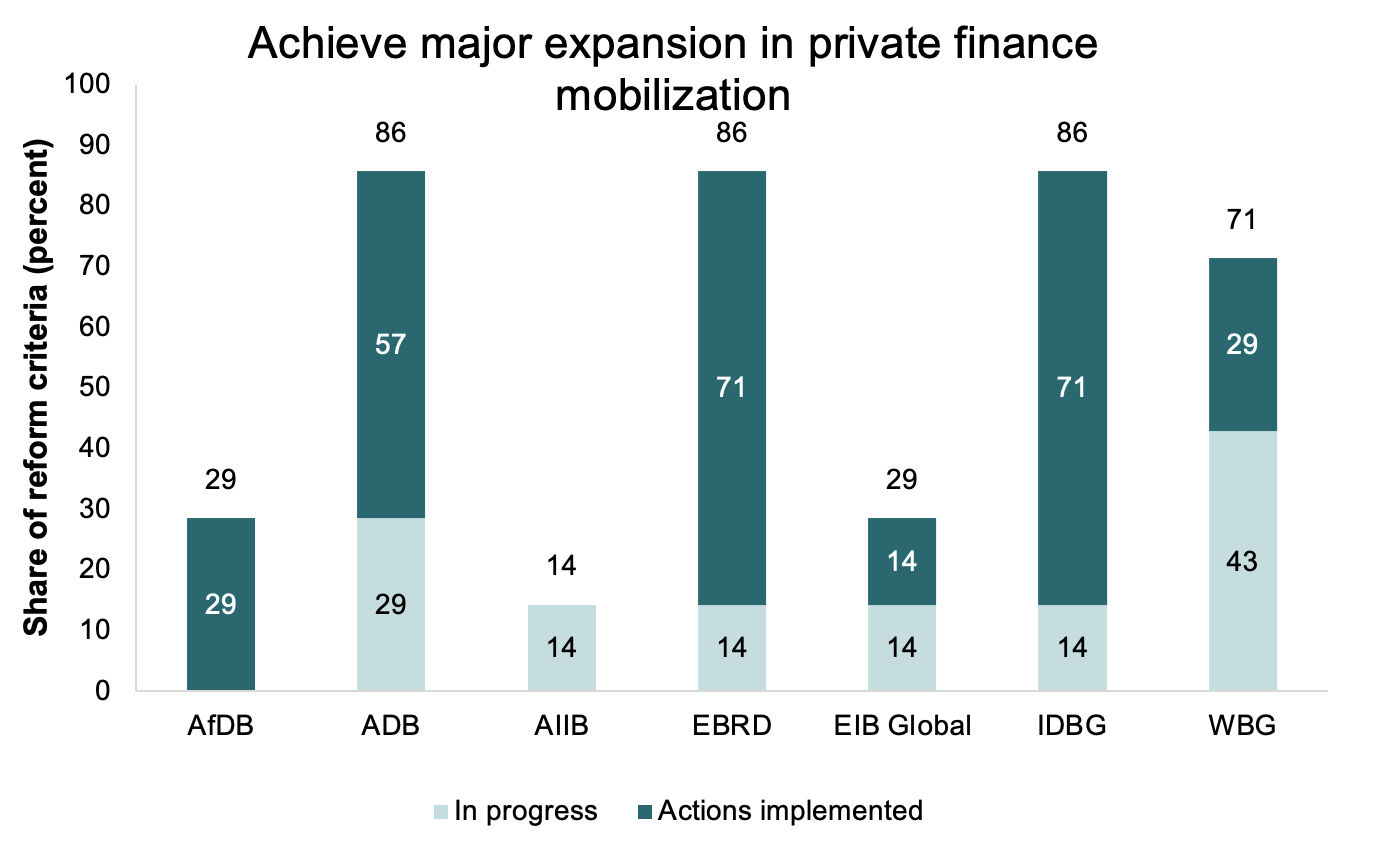

Figure 8. Expanding private finance mobilization: Reform progress across institutions

ADB, IDBG, and EBRD show good progress in expanding private finance mobilization (Figure 8): they are the only MDBs that set and publish targets for mobilizing private finance. The WBG’s private finance arm, IFC, should be recognized for nearly doubling its share of catalytic instruments (guarantees, equity, and risk-sharing products) to nearly 30 percent of long-term finance commitments in FY23, up from 16 percent in FY18. Note, however, that while we are seeing supportive steps for increasing private finance mobilization, we do not yet have data that show large changes in MDB private finance mobilization volumes or in the ratios of mobilization per dollar of MDB own-account commitments.

Conclusion

This analysis helps us understand a complicated picture. It breaks down progress by reform and by institution, and identifies where the attention of management, shareholders, and other stakeholders needs to be focused going forward. The central finding is that, while all MDBs are at some stage of pursuing most of these reforms, there is a long way to go before declaring victory on the majority of agenda items. And no MDB has a monopoly on reform progress. We should take encouragement from the significant variation in progress across the institutions: for the most part, what is possible for one should be possible for the others.

Thanks to Victoria Dimond, Nico Martinez, and Nayke Montgomery for their assistance with gathering the data and information used in this analysis.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.