Recommended

The IMF’s Resilience and Sustainability Trust (RST) has been operational for over a year, with the first seventeen countries receiving commitments of financial support. But if lending from the RST is to achieve its objectives, the IMF should make it fitter for purpose by taking a radically different approach in applying conditions to the loans. This paper first gives the background and summarizes the argument; sets out the unique challenges involved in designing best practice conditionality to deal with climate change – the focus of the RST so far; and makes three specific suggestions to address shortcomings in the emerging conditionality to make the most of the IMF’s new initiative to help member countries build resilience and sustainability. The IMF has adapted its approach based on initial experience. A forthcoming Executive Board review will allow for further course correction and much-needed greater traction for the RST.

From the paper:

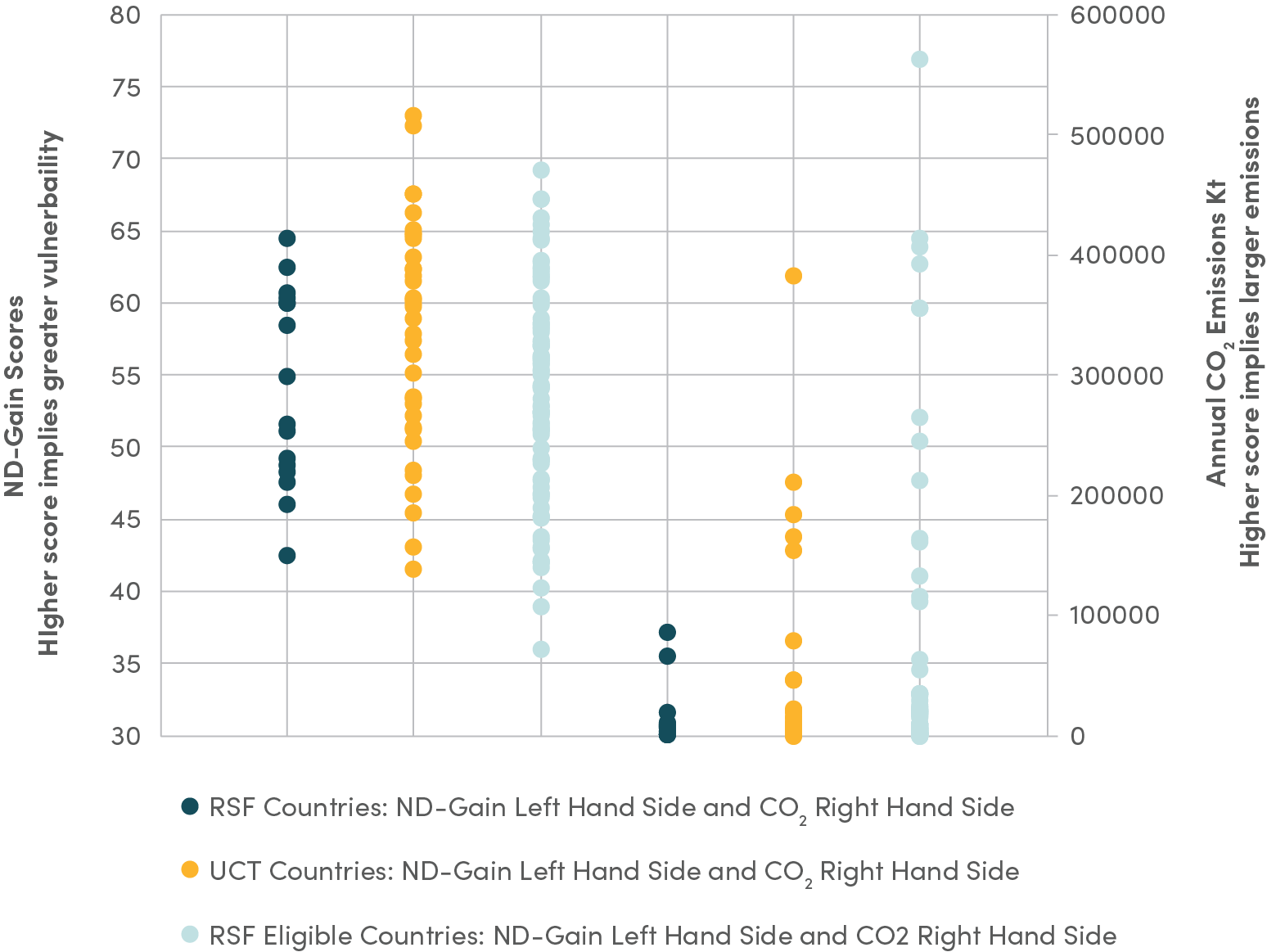

The IMF formally established its new Resilience and Sustainability Trust (RST) in April 2022 with its declared purpose “to help countries build resilience to external shocks and ensure sustainable growth, contributing to their long-term balance of payments stability.” The focus has so far been exclusively to address the challenge of climate change though pandemic preparedness was identified as another area to be covered, with the possibility of adding other topics at a later stage. In all, 143 countries were deemed eligible in principle. The immediate impetus for the IMF’s initiative came in the midst of the global pandemic. The unprecedented allocation in August 2021 of some $650 billion worth of Special Drawing Rights (SDRs) to IMF member countries was accompanied by a pledge from the largest economies—who had no need of the lion’s share they received of the additional SDRs—to “recycle” or “re-channel” $100 billion worth of SDRs to countries in greater need of them. Part was envisaged to bolster the IMF’s Poverty Reduction and Growth Facility (PRGT) with some scope also to channel through other multilateral institutions. Some $44 billion was targeted for the new RST, of which some $36 billion could be lent out with the remainder set aside to provide against liquidity and credit risk. So far, almost $30 billion is available to lend. The Resilience and Sustainability Facility (RSF) was created as the lending instrument funded by the RST.

Lending operations began in late 2022. By October 2022 the IMF had firmed up sufficient financial contributions from creditors and declared the new Trust operational. Subsequently it negotiated policy programs with the first recipients, setting the conditions that countries must meet to secure loans with unusually long-term (20-year) maturity. By end-February 2024, the IMF Executive Board had approved commitments totaling $7.0 billion to Costa Rica, Barbados, Rwanda, Bangladesh, Jamaica, Kosovo, Seychelles, Senegal, Niger, Kenya, Morocco, Moldova, Cabo Verde, Benin, Mauritania, Paraguay, and Cameroon. The first disbursements were not scheduled to be made for several months after initial approval and depended on subsequent IMF Executive Board review. By end-February 2024, only $1.4 billion had been disbursed to nine countries, with a further $3.4 billion to the seventeen countries so far scheduled for 2024. Nonetheless, getting even this far is an accomplishment and reflects the IMF’s ability to adapt its financing instruments to meet new needs of its member countries. The IMF has had to overcome major technical, legal, and financial hurdles as well as find policy consensus amongst shareholders. However, what comes next—including the approach to conditionality—will be crucial to determining whether this initiative is ultimately a success.

A central issue is that the metrics for success are not well specified, making it difficult for the RST to be fully effective until they are made clear and conditions appropriately geared to what the IMF can help deliver. The IMF’s approach so far seems to be to hope for the best by providing additional liquidity support and by specifying as conditions various useful country-led policy reforms – some already under consideration -- that plausibly contribute to tackling long-term structural problems and prospective balance-of-payments problems. This approach blurs three competing though not explicit objectives. The most important is to support substantive policy reform in countries facing climate change. Two others are implicit: to disburse quickly to alleviate liquidity concerns; and to contribute -- de facto --to debt reprofiling for developing countries in the years to come, objectives that are easier to pursue at the margin through the RSF than relying solely on regular IMF facilities. However, specifying more clearly the IMF’s role in the difficult task of meeting the first objective is the key to the ultimate success of the RST, and the focus of this paper.

Read the full paper here.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.

Image credit for social media/web: Tada Images / Adobe Stock