Summary

When shareholders meet in spring 2013 for preliminary negotiations for a new replenishment of the World Bank’s International Development Association (IDA), they are likely to ask that the International Finance Corporation (IFC) continue to transfer a portion of its “profits” to IDA. This practice—a subsidy from the bank’s private-sector lending arm to its concessional sovereign lending window—served its purpose, but it is not the best way for the IFC to contribute to economic growth in IDA-eligible countries. Instead, IDA’s shareholders should insist that the IFC provide financing and its expertise in a way that fits what it does best—investing in the private sector—while giving the IFC incentives to accelerate what it should do even better—taking greater risks in poorer countries.

The International Finance Corporation (IFC) is the window of the World Bank that invests in the developing world—but strictly to private entities—through debt and equity investments, credit guarantees, and advisory work. The IFC is not as well known as the World Bank’s lending windows for governments—the International Bank of Reconstruction and Development (IBRD) and the International Development Association (IDA)—but the IFC provided $15.5 billion in FY2012, [1] a bit less than IBRD’s $20.6 billion and slightly more than IDA’s $14.8 billion. [2]

IFC Transfers to IDA

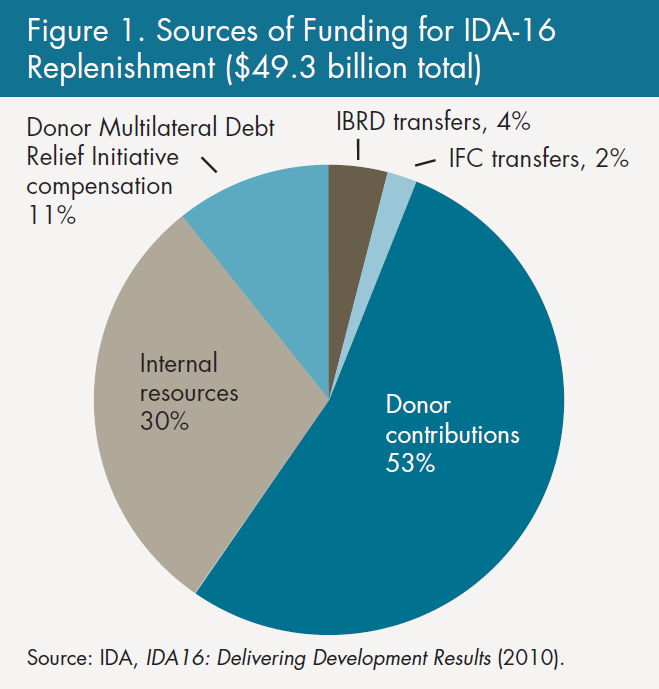

In recent years, the IFC has transferred a significant portion of its net income to the International Development Association (IDA), [3] the window of the World Bank that provides grants or concessional interest-rate financing to the world’s poorest countries. IDA is funded every three years, primarily by donor countries (that is, wealthier shareholder countries—see figure 1). In the IDA-15 negotiation in 2007, however, the World Bank proposed the IFC transfer some of its income to increase the IDA replenishment. [4] The World Bank and IDA shareholders believed that an IFC transfer to IDA would increase the total replenishment to record amounts, demonstrate that the whole World Bank Group can use its “profits” to provide more finance to the poorest countries, and take financial pressure off the donors to pledge greater amounts when many of these countries are managing their own financial crises. The IDA-16 negotiation that ended in 2010 repeated this practice; to date, the IFC has provided well over $2 billion in transfers to IDA.

Despite good intentions, this practice has outlived its usefulness and should be changed during the IDA-17 negotiation that will begin in 2013. [5]

What’s Wrong with IFC Transfers to IDA?

The current approach has several flaws:

- It loses leverage. Arguably, one of the most effective aspects of IFC finance is that it mobilizes other finance. In FY2012, the $15 billion invested by the IFC resulted in another $5 billion provided to IFC investments. Not only is this leverage lost when it is provided as a transfer to IDA, but the transfer reduces the amount of investable capital that the IFC has available.

- It acts as taxation. The IFC finances private-sector projects and programs in developing countries. The transfer policy therefore launders the hard work and entrepreneurship of individuals and private companies in developing countries to finance grants and loans to the public sector. In short, it acts as a form of taxation on private investment instead of boosting the capital of the IFC so that it can do what it is designed to do—investing in the private sector.

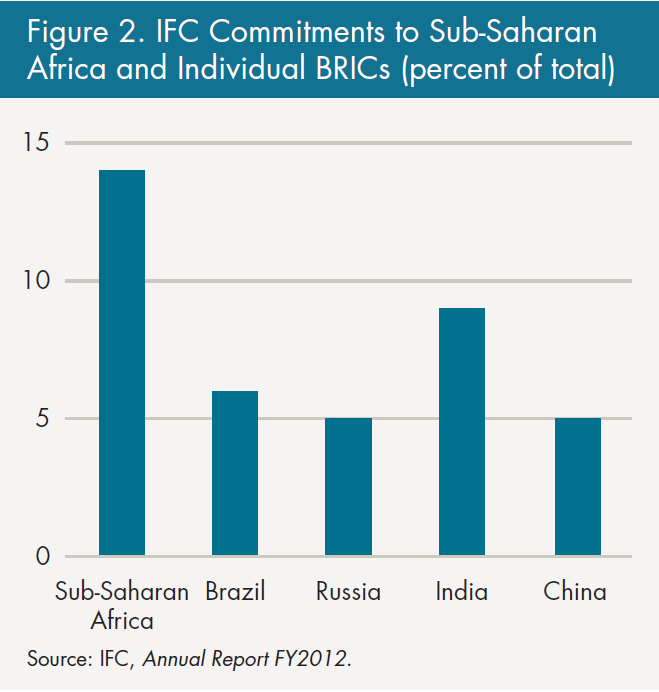

- It emphasizes profits over development results. The IFC maintains a delicate balance between achieving profitable financial returns while producing strong development outcomes. The IFC’s model already appears to favor (some would say “heavily”) profitability over development results. The transfer of IFC net income to IDA appears to push the incentive even further in that direction rather than encouraging the IFC to take risks to assist firms or projects that other private investors are simply not prepared to finance. For instance, in FY2012, less than 20 percent of IFC resources went to Africa, which is arguably the riskiest region for private-sector investment in the world. This is a significant increase from a few years ago, and IFC management should be commended. However, it is still revealing that total IFC outstanding commitments to all of sub-Saharan Africa are comparable to commitments to the individual BRICs, which private investors already considered some of the most attractive options (see figure 2).

- It facilitates donors’ financing tricks. The IFC transfer, in essence, is a way to take pressure off shareholder governments. Donor governments should not be in the practice of finding clever ways to avoid their respective appropriations processes, which is where legal authority and democratic values rest.

- It ignores the changing demand for capital. IDA is on the precipice of graduating its largest clients, such as India, Vietnam, and Ghana. By 2025, more than half of today’s IDA-eligible countries will likely be too rich to qualify for IDA resources. The remaining countries will be significantly smaller in size and overwhelmingly African. [6] IDA will therefore need less total capital, while demand for IFC private-sector and infrastructure investments is likely to grow. In other words, the time is ripe for the IFC to become more deeply engaged in these countries.

A Better Approach for IDA-17

The most redeeming quality of the IFC transfer to IDA is that it forces IFC resources into the poorest countries. A better approach than merely transferring capital to IDA governments, however, would be to use the IFC’s skills and experiences to build capacity, create more sustainable projects, leverage other sources of finance, promote more competitive markets, and allocate risk capital in a more efficient manner.

In its November 2012 midterm review, IDA asked its member nations to come up with ideas to improve IDA as input to the IDA-17 negotiations. The United States and other countries should call on the IFC, working with IDA, to put a list of options on the table for alternatives to the transfer that would still benefit IDA-eligible countries.

A number of ideas could be explored: establishing a ring-fenced private equity fund only for IDA countries, financing postconflict technical assistance, creating an small and medium enterprise (SME) finance fund, or setting ambitious targets for infrastructure finance. Perhaps the clearest and most promising option would be a dedicated infrastructure fund for projects in IDA-eligible countries. No matter what approach is taken, a sound governance framework will be necessary so that the IFC’s resources are truly additional.

A Dedicated IFC Infrastructure Fund for Low Income-Countries

The World Bank estimates that the funding gap for infrastructure in Africa alone exceeds $30 billion annually. Shortfalls mean that 500 million Africans live without access to electricity and allow transportation costs to be a leading constraint on competitiveness. It is unsurprising that 20 percent of African households cite the lack of infrastructure as their most pressing concern. In order to close these gaps in the poorest countries throughout the world, the G-20 and others have recognized the importance of finding ways to leverage the resources of the public sector to bring in the private sector. That need and consensus provides an opportunity for both IDA and the IFC to form a unique version of a public-private partnership.

IDA staff, for instance, could consult with IFC counterparts earlier in the process of producing with borrowing countries the Country Assistance Strategies (CASs) that identify investment opportunities and policy deficiencies. Working with the IFC, the IDA staff could then design technical assistance projects to help governments improve their investment climate.

The IFC could then take some actions in exchange:

- Ring-fence an amount of net income—say $500m per year for the next three years—into a fund to be deployed only in IDA-eligible countries for infrastructure projects (with flexibilities built-in to deal with potential bad financial years).

- Set specific targets for expanding the IFC’s role in facilitating the preparation of projects. Often, the preparation costs of project finance are not financed because the early risks are unattractive to private sector investors. Setting targets could be done at the country level or even the regional level; it is a theme highlighted in IDA’s midterm review.

- Finance a guarantee facility to make weak government contracts bankable. (A variation could scale up existing vehicles, such as Infraventures and ensure that it is working in IDA countries.) [7]

- Require the IFC to report to shareholders where and how they invest in IDA countries. In addition, the World Bank should hire an outside auditing firm with specific private-sector investment expertise to report to the IDA negotiators on whether IFC’s investments are truly additional.

Conclusion

The timing for a new approach couldn’t be better. First, the G-20 leaders reiterated last year that donors need to find more ways to finance infrastructure in low-income countries, complemented by private sector investment. Second, the Obama administration is purportedly working toward an energy initiative for Africa and will likely tap the resources and expertise of institutions such as the IFC. Finally, for the first time in its history, the IFC’s CEO is from a former IDA country. From China, Jin-Yong Cai wrote in his first op-ed as CEO that “the IFC is willing to take greater risks, demonstrating the benefits of investing in tough places.” That sounds more like direct IFC investments in IDA countries than sending a check from one side of Pennsylvania Avenue (IFC headquarters) to the other (World Bank headquarters).

A new World Bank president, a new IFC CEO, and a second term for President Obama—combined with the IDA replenishment process—provide a timely opportunity to find better ways to help IDA countries build the infrastructure they will need to thrive. This proposal is a concrete idea that negotiators should consider when they next meet.

This brief draws on the Future of IDA Working Group, Soft Lending without Poor Countries: Recommendations for a New IDA(Center for Global Development, 2012), and Todd Moss and Ben Leo, “IDA at 65: Heading Toward Retirement or a Fragile Lease on Life?” CGD Working Paper 246 (Center for Global Development, 2011).

The Center for Global Development is grateful for contributions from the Norwegian Ministry of Foreign Affairs, the Bill and Melinda Gates Foundation, and the UK Department for International Development in support of this work.

These investments were spread across over 550 projects in over 100 countries.

IBRD and IDA: The World Bank, Annual Report 2012, available at http://go.worldbank.org/ZJCK7BDUY0; IFC: International Finance Corporation, Annual Report 2012, available at www1.ifc.org/wps/wcm/connect/CORP_EXT_Content/IFC_External_Corporate_Site/Annual+Report/2011+Printed+Report/AR_PrintedReport/. Further explanations of each of the specific “windows” can be found in the Center for Global Development’s “The ABCs of the IFIs” briefs, available at www.cgdev.org/section/topics/ifi/abcsofifis.

The IFC earns net income from a combination of fees, lending spreads over its cost of capital, and capital gains and dividends from its equity investments. Over the past five years, it has earned about $1.6 billion per year in net income, including an average transfer of about $0.4 billion per year to IDA.

The number (IDA-15) reflects the replenishments that have happened since IDA’s formation in 1960.

See the Future of IDA Working Group, Soft Lending without Poor Countries: Recommendations for a New IDA(Center for Global Development, 2012), available at www.cgdev.org/content/publications/detail/1426547/, for a comprehensive report on issues that IDA should address in its upcoming negotiation.

Todd Moss and Ben Leo, “IDA at 65: Heading Toward Retirement or a Fragile Lease on Life?” CGD Working Paper 246 (Center for Global Development, 2011), www.cgdev.org/content/publications/detail/1424903.

InfraVentures is a project development fund created by IFC in 2008 that has the mandate of taking an equity stake in IDA infrastructure projects. It is managed by experienced fund managers.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.