Updated October 2016

Policy Recommendations

- Establish a full-service, self-sustaining US Development Finance Corporation (USDFC) that delivers development results, advances US foreign and commercial policy objectives, and reduces the federal deficit through modest operating profits.

- Implement reforms to ensure that the USDFC crowds in private capital and demonstrates clear development impact and market additionality.

Introduction

The future of development policy is in development finance. Developing countries need aid less and less as their incomes rise and economies grow. What they need now is private investment and finance. US development policy, however, has failed to bring its development finance tools in line with this reality. Related US efforts have not been deployed in an efficient or strategic manner because authorities are outdated, staff resources are insufficient, and tools are dispersed across multiple agencies.

Other players are doing more. Well-established European development finance institutions (DFIs) are providing integrated services for businesses, and these services cover debt and equity financing, risk mitigation, and technical assistance. Moreover, emerging-market actors — including China, India, Brazil, and Malaysia — have dramatically increased financing activities in developing regions such as Latin America and Sub-Saharan Africa.

As the needs of developing countries have changed, so has the political and economic environment in the United States. First, traditional development dynamics are shifting rapidly from a donor-recipient aid relationship to win-win partnerships involving public and private actors. Second, most US aid agencies typically are not positioned to address many pressing development priorities, such as expanding economic opportunities in frontier markets. Third, the US development assistance budget has become increasingly constrained, with growing pressure to cut programs.

Within this context, we assess the need for a modern, full-service US Development Finance Corporation (USDFC) and provide a series of options for how the next US president could structure such an institution consistent with bipartisan congressional support and budgetary realities. For such a USDFC, we propose below potential products, services, and tools; size, scale, and staffing requirements; governance structures and oversight functions; performance metrics; and capital structure models. We conclude with a notional implementation road map that includes the required US executive and legislative actions.

Responding to the New Development Finance Landscape

The strategic imperative for US development finance has increased tremendously. First, citizens in Latin America, Africa, and other regions are most concerned about employment and economic opportunities. According to representative surveys, more than two-thirds of African citizens cite employment, infrastructure (e.g., electricity, roads, water and sanitation), inequality, and economic and financial policies as the most pressing problems facing their nations (see figure 1).[1] In Latin America, roughly 60 percent of survey respondents cite employment, economic, and financial policy issues, as well as crime and security concerns. In contrast, only 20 percent of Africans and Latin Americans are most worried about health, education, food security, or environmental issues — the issues that existing US development policy targets the most.

Figure 1

Second, businesses in emerging and frontier markets are most constrained by inadequate access to capital, unreliable electricity, burdensome tax policies, and unstable political systems. Access to finance and reliable electricity are the most frequently cited issues in almost half of the 81 surveyed developing countries, and these issues negatively impact firms in all developing regions.[2] To illustrate, roughly two-thirds of surveyed Nigerian and Pakistani firms cite unreliable electricity as their biggest constraint, and nearly half of all firms surveyed in Côte d’Ivoire, Indonesia, and Zimbabwe cite access to finance as their biggest challenge.

Third, the relative and absolute importance of foreign aid has declined significantly over the past two decades. In 1990, aid exceeded 20 percent of gross national income in 13 developing countries (out of 120 examined countries).[3] That figure had fallen to only four developing countries in 2012 (Afghanistan, Burundi, Liberia, and Malawi), despite a doubling of total global aid during the same period from $59 billion to $133 billion. The exponential increase in government revenues, driven by both economic growth and improved tax administration, has been even more striking (see figure 2).[4]

Figure 2

Fourth, foreign government partners are increasingly focused on attracting private investment, especially in infrastructure and productive sectors. Nearly every national development strategy emphasizes attracting private investment for physical infrastructure (e.g., electricity and transport) and labor-intensive sectors (e.g., agriculture, services, and manufacturing), reflecting the political imperative of establishing more inclusive economic opportunities in the near and medium term for the rapidly expanding working-age populations in many regions.

At the same time, the development finance landscape has changed dramatically with the entry of several emerging-market actors. The China Development Bank and the Export-Import Bank of China were established in 1994. Both now have major financing portfolios throughout the world, particularly in Latin America and Sub-Saharan Africa. China is far from the only emerging-market actor in developing countries. India, Malaysia, Turkey, Brazil, and other countries now have public entities that provide project and trade finance, as well as guarantees.

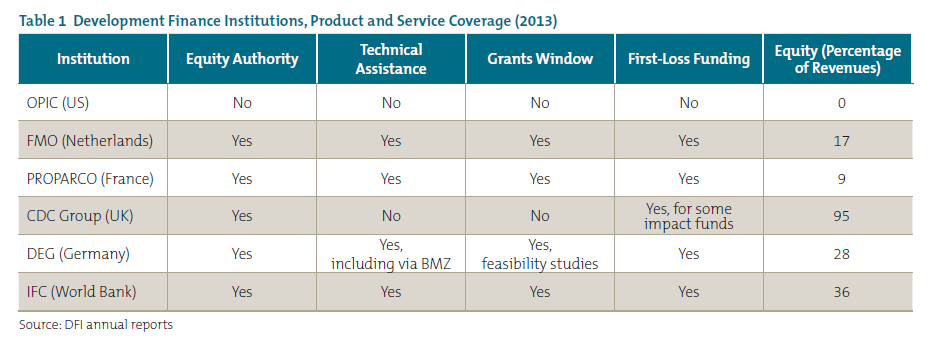

Finally, many well-established organizations in traditional donor capitals now provide integrated services for businesses that cover financing, risk mitigation, and technical assistance. These organizations include FMO (Netherlands), DEG (Germany), PROPARCO (France), and the International Finance Corporation (IFC, the private-sector arm of the World Bank Group). This model has streamlined available private sector–based development tools under one institutional structure, thereby enhancing efficiency and effectiveness.

Adjusting to US Political and Budgetary Realities

The political and economic environment within the United States has also changed dramatically, particularly over the past five years. First, development dynamics are shifting rapidly from a traditional donor-recipient aid relationship to mutually beneficial partnerships involving public and private actors. An illustration of this trend is the Obama administration’s Power Africa initiative, which uses a three-pronged approach involving (1) country government reforms; (2) private-sector investments; and (3) US government cofinancing, risk mitigation, and technical assistance.

Second, most US aid agencies typically are not positioned to address many pressing development priorities, such as expanding economic opportunities in frontier markets. In such places, the focus should be on promoting greater engagement by private investors and businesses, as noted earlier. This focus involves using non-aid agencies like the Overseas Private Investment Corporation (OPIC) and the private-sector windows of the multilateral development banks. The Millennium Challenge Corporation (MCC) is the noteworthy exception to this aid agency dynamic. However, MCC is not scalable because of its grant-based model and its need for congressional appropriations, as well as its ability to work in a limited number of countries.

Third, the US development assistance budget has become increasingly constrained, with growing pressure to cut programs. At the same time, domestic political constituencies have remained strong for many social-sector issues, such as combating infectious diseases (e.g., HIV/AIDS, malaria) and promoting access to education. This suggests that any future budgetary cuts will likely be focused on program areas that lack such vocal constituencies, such as economic development programs outside of frontline states. Collectively, this also means that the next US president will be highly constrained in promoting private sector–based development models through traditional development assistance budgets.

Existing US Private Sector–Based Development Programs

The US government’s primary development finance vehicle is OPIC, an independent government agency that mobilizes private capital in emerging and frontier economies to address development challenges and to advance US foreign policy objectives. OPIC provides US investors with debt financing, loan guarantees, political risk insurance, and support for private-equity investment funds. It operates on a self-sustaining basis and has provided positive net transfers to the US Treasury for nearly 40 consecutive years. Since its inception, OPIC has helped mobilize more than $200 billion of US investment through more than 4,000 development-related projects.

With few exceptions, OPIC has not evolved since it was first established in 1971. The most significant exception relates to debt seed capital for private-equity funds, which OPIC began providing in 1987. OPIC remains highly constrained by inadequate staff and outdated authorities. For instance, it must rely on congressional appropriations to cover annual administrative expenses (e.g., salaries, travel, and office space) despite generating significant profits on a consistent basis. This de facto constraint, driven by congressional unwillingness to expand the number of staff, has prevented OPIC from fully leveraging its existing capital base.

Other programs within US agencies that promote private sector–led development approaches are spread across multiple agencies, resulting in redundancies, inefficiencies, and, frequently, a lack of coherence.

- The US Agency for International Development’s Development Credit Authority (DCA): USAID’s DCA provides partial risk guarantees to unlock private financing in support of US development priorities. In 2013, DCA approved 26 new partial credit guarantees in 19 countries, which may mobilize nearly $500 million in private capital over time.[5]

- USAID Enterprise Funds: Since 1989, Congress has appropriated resources for a range of enterprise funds, which are capitalized either entirely or partially by USAID grants. This program, which has a mixed track record,[6] originally began with a focus on promoting private enterprise in former Eastern Bloc countries. Similar funds have been launched in other countries since then, such as in Egypt and Tunisia.

- US Trade and Development Agency (USTDA): This small, autonomous agency is primarily focused on connecting US businesses to export opportunities in developing countries. However, it also promotes private sector–based development through small-scale financing for feasibility studies and technical assistance programs.

- Economic Growth-Related Grant Operations: The US Government also supports large-scale grant operations through the State Department and USAID that help address a broad range of private sector-based development issues, such as infrastructure and business climate reforms. For example, USAID has a range of grant-based programs within its Bureau for Economic Growth, Education, and Environment that promote private enterprise in developing countries. These programs focus largely on four key areas: (1) building skills and management capacity, (2) deepening access to finance, (3) supporting business climate reforms, and (4) establishing linkages with US businesses and organizations.[7]

Proposal for a Modern Scaled-Up US Development Finance Corporation

A modern, scaled-up USDFC would promote US policy objectives by harnessing America’s three greatest strengths — innovation and technology, entrepreneurship, and a deep capital base — at no additional cost to US taxpayers. It also would make a serious contribution to US foreign policy goals by aligning strongly with developing countries’ most pressing priorities (e.g., employment and economic opportunities). Lastly, the proposed USDFC would promote America’s commercial policy objectives by facilitating investment and business opportunities in the next wave of emerging markets but is structured to prevent “corporate welfare” by requiring market additionality.

Products, Services, and Tools

Almost all major DFIs have become full-service institutions that promote private sector–based development (see table 1). As with other institutions, the USDFC would offer a full suite of products, services, and tools to promote such development approaches. Currently, OPIC can offer direct loans, loan guarantees, risk insurance, and seed financing for independently managed investment funds. A full suite would add advisory services, feasibility studies, direct investments including equity, and technical assistance for business-climate reforms, which other US agencies such as USAID, the State Department, and USTDA have the authority to support. The USDFC would include these authorities and programs within a single, efficient, market-based institution. This change would require congressional authorization.

The USDFC also should have the authority to support non-US investors in certain circumstances. OPIC currently can only support firms or investors with significant American ownership or operational control. No other major DFI ties their financial engagement to national firms. This flexibility enables other DFIs to promote economic growth and job creation through local businesses in developing countries. This restriction has prevented OPIC from supporting strategic objectives where US investors are not active or prospective participants in a given country’s market or sector. The expanded authority could allow any investor to complete for OPIC support, with the notable exception of state-owned enterprises. Alternatively, a more modest adjustment could be limited to low-income countries and local firms domiciled in the respective developing country. In this instance, firms from developed or middle-income countries, along with their respective subsidiaries, could remain ineligible for USDFC operations unless there were highly compelling benefits to US development or other foreign policy objectives.

Size, Scale, and Staffing

The USDFC’s size and scale should be determined by the combination of market demand, the ability to demonstrate clear “additionality” (see further details below), and the maintenance of rigorous credit-quality standards and oversight. In addition, it must demonstrate tangible development results throughout its portfolio. As a result, there should not be an ex ante target size. Instead, the USDFC should have the ability to access significant sources of capital to respond to market dynamics and US development objectives, with appropriate oversight by the US Congress and the Office of Management and Budget. Currently, OPIC has legislative authority to support a $29 billion portfolio of loans, guarantees, and insurance.[8] As of 2015, roughly $9 billion of this capacity was undeployed because of insufficient staff and constrained authorities.

Existing bilateral DFIs provide a rough benchmark when considering the USDFC’s potential scale. Their portfolios range from 0.15 percent of gross domestic product (GDP) in the United Kingdom to more than 1 percent in the Netherlands. If these same simplistic ratios were applied to the United States, the USDFC could have a total portfolio ranging between OPIC’s current statutory authority of $29 billion and $180 billion.

The USDFC’s staffing size and administrative expenses also should reflect its operational requirements and objectives. Currently, OPIC has nearly 230 employees and an operating budget of $67 million.[9] The average OPIC employee is responsible for approximately $8 million in portfolio exposure. If OPIC’s existing portfolio-to-employee ratio remained constant, then the USDFC could require between 370 and 2,200 employees, depending on its portfolio size. This increase would entail an annual operating budget of between $110 million and $665 million, which would be self-financed through the partial retention of USDFC profits (see figure 3).[10] By comparison, the current staffing size of peer DFIs is as follows: 4,000 in the World Bank’s IFC, 499 in Germany’s DEG, 336 in the Netherlands’ FMO, 177 in France’s PROPARCO, and 102 in the United Kingdom’s CDC.

Figure 3

Governance Structure

The USDFC would be an independent government agency led by a management team appointed by the White House and overseen by a board of directors that includes both government and private-sector representatives. In this manner, the board would reflect the Corporation’s development and foreign policy objectives, as well as serve as a model for promoting private sector–based development. The Corporation also should include an equal number of public-sector representatives from each major political party. This would promote greater strategic continuity and help minimize short-term political pressures. Moreover, the board’s composition should seek to ensure coverage of several core competencies, such as international development, risk management, human resources and legal matters, global financial institutions, and specific priority sectors (e.g., power and transportation).

Requiring Transparency and Stoplight Screens for Market and Development Additionality

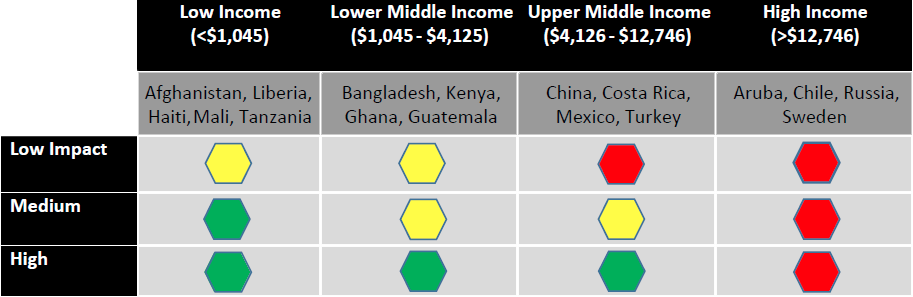

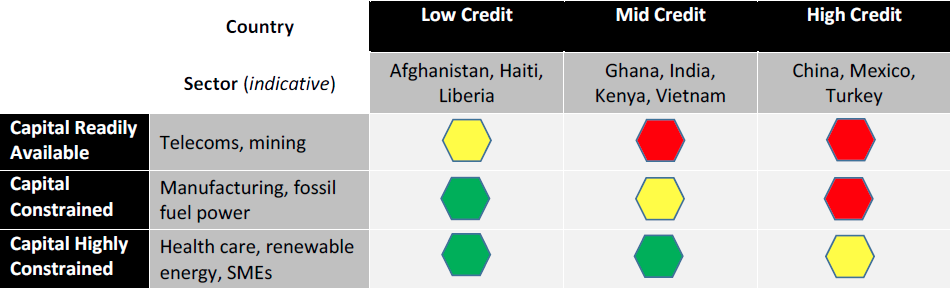

The USDFC should establish a performance measurement system that is modeled on global best practices, with a strong emphasis on transparency.[11] OPIC currently uses a Development Impact Matrix to evaluate and monitor both prospective and approved investment projects; however, the information is not reported publicly. The USDFC’s performance measurement system should expand upon OPIC’s existing approach by measuring, considering, and reporting on the “additionality” of its operations. This would require both ensuring that the institution is prioritizing development impact and does not compete with private sources of investment capital, while maintaining appropriate financial performance within its portfolio. We suggest a “Stoplight Screen” to monitor prospective projects’ (1) development impact and (2) market additionality, requiring increasing levels of board scrutiny from green to yellow to red.[12] Lastly, the USDFC would collect and publicly report on a series of institutional efficiency and performance metrics, such as financial performance, operating budget ratios, and average investment transaction review time.[13]

Across its operations, the USDFC should publicly disclose information by default and have a high bar for withholding information in deference to commercial confidentiality concerns. At a minimum, this would include all project description summaries and Development Impact Matrix scores (at the time of project approval). Moreover, the Corporation should publish project-level development performance data on an annual basis.

Capital Structure

The USDFC’s capital structure should reflect its desired scale, comparative advantage, and role within the US government’s development and foreign policy toolkit. In particular, its structure should only represent its potential maximum portfolio size. The actual size, as measured by total contingent liabilities, must reflect the institution’s ability to support individual transactions with strong development impact, prudently manage financial risks, and consistently demonstrate strong “additionality” vis-à-vis private-sector alternatives.

- Status Quo Structure: Under this option, the USDFC would rely upon OPIC’s existing maximum contingent liability limit of $29 billion.[14] This limit has not been changed since 1998, when it was increased from $23 billion. Future adjustments to the USDFC’s contingent liability limit would be considered on an ad hoc basis. Advisory services and technical assistance activities would be financed out of retained earnings at no additional cost to taxpayers.

- Revised OPIC Contingent Liability Limit: Under this option, the USDFC would rely upon an updated version of OPIC’s existing contingent liability. This limit would be adjusted upward to roughly $42 billion, thereby converting the current exposure limit from 1998 dollars to 2014 dollars.[15] Going forward, the maximum contingent liability limit would be inflation adjusted, which would prevent the erosion of the USDFC’s potential portfolio size in real terms. It would likely be many years, if ever, before that limit is approached. However, setting this limit would provide the USDFC with adequate flexibility to execute scaled private sector–based development approaches, while simultaneously ensuring proper portfolio risk management and oversight.

Policy Recommendations and Implementation Road Map

The implementation road map for the proposed USDFC will require actions by the US executive and legislative branches. These actions include the following:

1 The next US president should put forward a proposal to establish a consolidated US Development Finance Corporation, along with template legislation.

This should take place within the first 100 days in office. Such action would instill an appropriate level of political commitment and help build momentum within Congress. This proposal would be further fleshed out and amended as appropriate in close partnership with Congress.

2 The US Congress should pass legislation that will establish a USDFC to function as the premier development agency focused on private sector–based approaches.

At a minimum, the legislation should address the following components: products, services, and tools; size, scale, and staffing requirements; governance structures and oversight functions; performance metrics (which include stringent additionality and development impact requirements); and capital structure models.

Further Reading

Homi Kharas, George Ingram, Ben Leo, and Dan Runde. “Strengthening US Government Development Finance Institutions.” Washington: Center for Global Development, 2013, www.cgdev.org/sites/default/files/strengthening-us-government-development-finance-institutions.pdf.

Ben Leo, Todd Moss, and Beth Schwanke. OPIC Unleashed: Strengthening US Tools to Promote Private Sector Development Overseas. Washington: Center for Global Development, 2013.

Ted Moran and Fred Bergsten. “Reforming OPIC for the 21st Century.” International Economic Policy Brief Number 03-5, Institute for International Economics, Washington, 2003.

Dan Runde, et al. Sharing Risk in a World of Danger and Opportunities: Strengthening US Development Finance Capabilities. Washington: Center for Strategic and International Studies, 2011.

US National Advisory Board on Impact Investing. Private Capital, Public Good: How Smart Federal Policy Can Galvanize Impact Investing — and Why It’s Urgent. Washington: US National Advisory Board on Impact Investing, 2014.

Ben Leo and Todd Moss. How Does OPIC Balance Risks, Additionality, and Development? Proposals for Greater Transparency and Stoplight Filters. Washington: Center for Global Development, 2016.

Notes

[1] Benjamin Leo, “Is Anyone Listening? Does US Foreign Assistance Target People’s Most Pressing Priorities?” CGD Working Paper 348, Center for Global Development, Washington, 2013.

[2] These figures cover 81 low- and lower middle-income countries with recent completed World Bank enterprise surveys. For details, see the enterprise surveys at www.enterprisesurveys.org/data.

[3] World Bank, World Development Indicators data set, 2014, http://data.worldbank.org/data-catalog/world-development-indicators.

[4] Excluding the BRICS (Brazil, Russia, India, China, and South Africa), government revenues quadrupled from roughly $600 billion in 2000 to $2.6 trillion in 2012. This trend has been equally as striking in low-income countries, which experienced a fourfold increase in government revenues between 2002 and 2012. Source: World Bank, World Development Indicators, 2014.

[5] For additional details, see USAID, “USAID Development Credit Authority Activity in 2013,” www.usaid.gov/sites/default/files/documents/2155/2013_Deals_Public_SummaryFinal.pdf.

[6] Government Accountability Office, Enterprise Funds’ Contributions to Private Sector Development Vary, GAO/NSIAD-99-221 (Washington: GAO, 1997).

[7] For additional details, see USAID, “Supporting Private Enterprise,” www.usaid.gov/what-we-do/economic-growth-and-trade/supporting-private-enterprise.

[8] This authority is detailed in Section 235(1)(a) of the Foreign Assistance Act.

[9] This figure includes salaries, benefits, travel, contractual services, and other general administrative expenses. Source: OPIC, Annual Report 2013 (Washington: OPIC, 2013).

[10] These administrative budget estimates assume that OPIC’s current cost structure would remain unchanged. This is likely a conservative assumption given the potential for greater efficiencies due to economies of scale.

[11] Reporting practices include performance metrics and requirements that are regularly and prominently included in organizations’ annual reports or development impact reports.

[12] This would include the time required for each stage of transaction process. This information would be reported at the project and portfolio level.

[13] For additional details, see Ben Leo and Todd Moss. How Does OPIC Balance Risks, Additionality, and Development? Proposals for Greater Transparency and Stoplight Filters. CGD Policy Paper. Washington: Center for Global Development, 2016. /publication/how-does-opic-balance-risks-additionality-and-development-proposals-greater-transparency

[14] This limit is outlined in Section 235(a)(1) of the Foreign Assistance Act of 1961. The relevant language was last revised through Section 581(a) of the Foreign Operations, Export Financing, and Related Programs Appropriations Act, 1998 (Public Law 105–118).

[15] This figure is calculated using the US Bureau of Labor Statistics CPI Calculator tool, which is available at http://data.bls.gov/cgi-bin/cpicalc.pl. The adjustment could be based off of alternative methodologies as well, such as the cost of capital.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.