Recommended

Blog Post

Blog Post

Executive Summary

Background

Innovation—delivering new drugs, diagnostics, and devices—is a critical tool in the global fight against disease and premature death. Yet despite the potential for innovation to improve health around the world, the pharmaceutical industry’s investments in research and development (R&D) generally neglect diseases of the poor in favour of more lucrative high-income markets. Responding to this R&D gap, donor “push” investments have helped advance an innovation agenda to serve low- and middle-income countries. Though these investments have helped accelerate market entry of several important innovations, other donor-push products have fizzled upon market entry due to unaffordable or non-cost-effective pricing, disappointing efficacy, lack of political will, or lower-than-anticipated country demand. And with many large middle-income countries (MICs) poised to soon transition from donor aid, the sustainability of the current donor-led model is in question.

Tuberculosis (TB), an infectious disease primarily affecting the poor and vulnerable, ranks among the top 10 global causes of death. Current TB treatment cycles are long and toxic, causing some patients to discontinue treatment, develop acquired drug resistance, and risk spreading a drug-resistant pathogen to others. Drug-resistant strains are more difficult to treat, traditionally requiring long-duration toxic regimens and high-cost hospitalization (though recent innovations offer a shorter, more tolerable, and more affordable treatment). Despite years of global investment in TB control, modelling suggests that global goals for TB cannot be achieved without major technological breakthroughs. One particularly desirable innovation would be a short-course universal drug regimen (UDR)—equally capable of treating drug-sensitive and drug-resistant strains, with a two-month or shorter treatment duration. Donors, particularly the Bill & Melinda Gates Foundation (BMGF), have funded substantial early-stage R&D to source new treatment compounds that could contribute to a UDR, but substantial additional investments in late-stage trials would be required to bring such a UDR to market.

The global market for TB therapies reached roughly $1 billion in 2018 and is projected to grow by more than one-third by 2025—suggesting a potentially large and profitable market for better TB treatment. Yet despite the clear health need and potential return, private-sector actors have mostly shied away from the TB market. Industry perceives MICs—which make up the vast majority of the TB treatment market—as risky markets for an innovative product. Historically, many MICs have either aggressively negotiated down innovative drug prices, declined to purchase innovative therapies until they go off patent, imposed price controls, or exploited flexibilities in the World Trade Organization’s Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) for compulsory licensing of on-patent drugs.

For MIC markets alone to generate private-sector R&D investment, innovator companies will need assurance that MIC purchasers are willing to pay a value premium for innovation—potentially far higher than the cost of older, less effective genericized competitors, but low enough to ensure local value and affordability. Notably, recent policy announcements by MIC governments signal their increasing willingness to engage with and contribute to global health initiatives, including the TB R&D agenda. This suggests that a window of opportunity is opening to engage MICs in the development of a path-breaking health technology to address the TB scourge.

Introducing the Market-Driven, Value-Based Advance Commitment

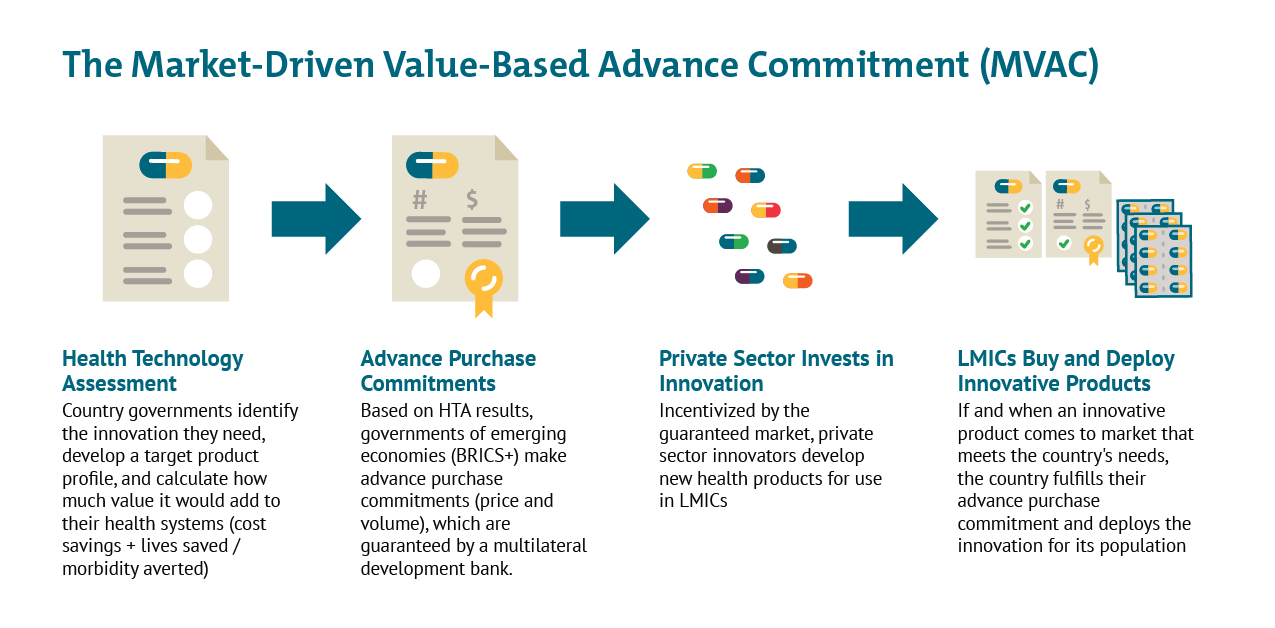

The market-driven, value-based advance commitment (MVAC) builds on the advance market commitment (AMC) mechanism previously used in global health with several important innovations and improvements. Most crucially, the MVAC is driven by MIC demand rather than donor contributions; is informed by countries’ ability to pay (see Box ES-1) rather than a single, “cost-plus” price; and allows pharmaceutical companies to reap higher revenues from a more effective product. In this report, we apply our new model—the MVAC—to a target product profile (TPP), published by the World Health Organization (WHO) in 2016 and endorsed by BMGF, for a pan-TB regimen. The TPP describes a UDR to tackle both drug-sensitive and drug-resistant strains, with a treatment cycle of less than two months.

Text Box: Box ES-1. Ability to Pay

In this report we use the term ability to pay to reflect healthcare systems’ (not individual patients’) ability to pay for lifesaving products based on the budgets those countries have allocated or plan to allocate to healthcare (and/or TB in particular) and given countries’ historical decisions to pay for health outcomes. Our methodology calibrates prices against available resources while accounting for the savings that a healthcare system could directly realise from introducing a TB cure, hence ensuring that the price proposed is affordable to the healthcare system given local circumstances. Importantly, we do not assume that these prices would be affordable to individual patients; rather, our calculations assume that governments will fulfill their responsibility and commitments to provide equitable, cost-effective TB care without user fees at the point of use. Differential pricing reflects the fact that affordability varies from country to country depending on each country’s wealth level, healthcare budget, and population’s ability to benefit from the technology. The specifics of our approach are detailed in Chapter 3)

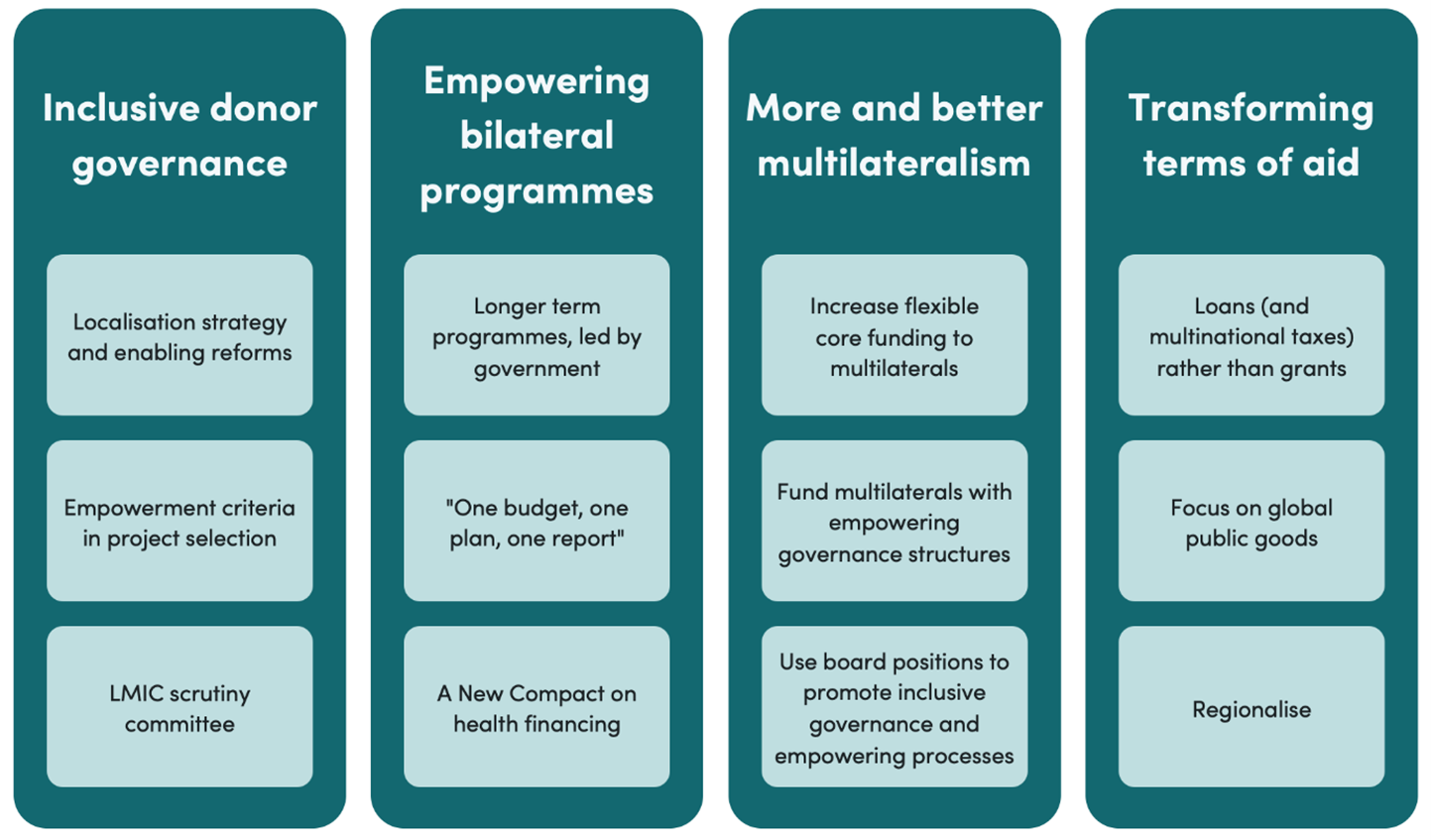

The MVAC rests on four essential design pillars:

- Health technology assessment. Health technology assessment (HTA), already a well-established process in MICs including Brazil, China, India, and South Africa, is a mechanism by which payers evaluate the value of a new product through the application of globally accepted methods. The MVAC will use HTA—based on country-specific evidence and ability to pay—to inform countries’ purchase commitments.

- Commitment guarantees. To drive engagement and investment in R&D by the pharmaceutical industry, it is critical that industry perceive MIC commitments as highly credible. Commitment guarantees—underwritten by a financial intermediary—will help ensure that MICs credibly signal their demand and ability to pay.

- Industrial policy alignment. Based on an initial landscaping analysis, we know that developing local industry (including home-grown research capacity and pharmaceutical industries) is a priority for many MICs.

- Governance structure. An MVAC governance structure credible to both MIC payers and industry is required to drive and operationalise the MVAC. This requires it to be authoritative, open, and sufficiently flexible to place MIC governments in the driving seat.

The MVAC model is intended to serve as a bridge between the dysfunctional status quo and a more sustainable and effective R&D ecosystem—one which more closely emulates the positive characteristics of high-income country (HIC) markets for healthcare products. Many of its core elements (including the need to underwrite commitments and the development of a joint TPP) will become less relevant as markets mature and trust is built between payers and industry. The governance structure—a secretariat to pool HTA resources, set and signal joint priorities, and conduct country-specific value assessments—may endure but evolve as national payers build up their own institutional, human resource, and data collection and analysis capacities.

Health Technology Assessment: Estimating the Value-Based Market for a New TB Treatment Regimen

HTA is defined as a “a multidisciplinary process that reviews the medical, economic, organisational, social and ethical issues related to the use of a health technology in a systematic manner,” whose “main purpose is to provide policymakers with evidence-based information, so they can formulate health policies that are safe, effective, patient-focused and cost-effective.” It is also “used by national authorities to help [them make] decisions on which technology should be reimbursed at national level” (emphasis added). HTA is well established in many HICs; a wide range of MICs—including India (see Box ES-2), China, Indonesia, Thailand, South Africa, the Philippines, and most of Latin America and the Caribbean (including Mexico, Brazil, Chile, and Colombia)—have also established HTA bodies linked to their national health insurance and pharmaceutical procurement agencies. In the context of the MVAC, early (or ex ante) HTA, conducted before the launch of the new treatment (based on the TPP characteristics), can then be applied to estimate the maximum justifiable size of a guaranteed purchase commitment given treatment alternatives, expected patient numbers, and local ability to pay.

Text Box: Box ES-2. India’s HTA Launch

India recently launched an HTA agency at the Ministry of Health and Family Welfare—HTAIn—to inform ceiling rates for reimbursement via a clearly defined process and set of methods. One of its earliest assessments evaluated lenses for cataract operations based on “clinical efficacy, cost-effectiveness, accessibility, availability, and feasibility.” The assessment concluded that “[small-incision cataract surgery (SICS)] with rigid lenses is the most appropriate intervention to treat cataract patients in India in [the] current scenario,” and recommended that the benefits package cover both phacoemulsification surgery and SICS at a cost of 9,606 Indian rupees (INR) and 7,405 INR, respectively.

We engaged a team of world-class epidemiological and economic modellers to undertake HTA and estimate the value-based market for a new TB drug treatment in line with the TPP in three countries—India, Russia, and South Africa.[1] The modelling approach is rooted in value-based pricing—the idea that payers should be willing to pay a price that represents the value produced by a new TB drug regimen to their respective healthcare systems (see Box ES-3). The model evaluates the UDR from a healthcare perspective, considering two sources of value: (1) additional health gains of the UDR compared with alternative therapies, valued at country ability to pay per quality-adjusted or disability-adjusted life year (QALY or DALY) based on supply-side constraints or opportunity costs, and (2) health system savings (e.g., averted hospitalizations and a reduced need for drug-sensitivity testing).

The full report includes extensive sensitivity testing, but we report our main (baseline) results based on a set of highly conservative assumptions, including launch of new and superior TB technologies before the TPP-based new drug treatment comes to market (Table ES-1). Based on these assumptions, the model estimates a total market in India, Russia, and South Africa of around $6.3 billion for the first 10 years after launch (Table ES-2).

Text Box: Box ES-3. Value-Based Pricing

Throughout this report we use the term value-based pricing from the perspective of the payer/buyer—that is, a healthcare system or insurance provider. We always assume zero out-of-pocket costs for individual patients and their families. We adopt the recommended approach set out in a UK Office for Fair Trading report in 2007, whereby pricing is informed by an assessment of comparative clinical and cost effectiveness through HTA and is meant to “ensure the price of drugs reflect[s] their clinical and therapeutic value to patients and the broader [National Health Service].” Similar approaches have been operational for several years in the UK National Health Service and several other universal and equitable healthcare systems, including those of Australia, Canada, and more recently, Brazil and Thailand. This HTA-informed approach has also been endorsed by the WHO Regional Office for South East-Asia (e.g., see paragraph 11 here) and the Pan American Health Organization. For further discussion of the term value-based pricing from the payer’s perspective, see here.

Table ES-1. PICO Statement for TPP-Based Drug Treatment and National Strategic Plans

| PICO element | India | Russia | South Africa |

|---|---|---|---|

| Population (in terms of current burden and resistance) |

High rate of TB, TB/HIV, and multi-drug-resistant (MDR) TB

Mainly resistance to first-line drugs |

High rate of TB and MDR TB

High levels of resistance to second-line drugs |

High rate of TB, TB/HIV, and MDR TB[2]

Mainly resistance to first-line drugs |

| Intervention | UDR as defined by the TPP | ||

| Comparator | Standard of care at the time of UDR introduction: ● New shortened regimen introduced in 2025 for drug-sensitive and MDR TB[3] ● New vaccine |

||

| Outcomes | ● Additional DALYs averted ● Net monetary benefit ● Health sector cost savings |

||

| Context (national strategic plan) |

Private-sector engagement Patient support (nutritional supplement) |

Scale-up of GeneXpert MTB/RIF in 2018 Standardisation of WHO MDR revised regimen | WHO symptom screening for all Standardisation of WHO MDR revised regimen |

Table ES-2. Key Results from Early-Stage (ex ante) HTA

| Maximum price per regimen (USD 2017) | Number of countries with at least one observation 2011–2015 | Number of regimens 2030 to 2039 (millions) | |

|---|---|---|---|

| India | 3.24 | 501 | 6.467 |

| Russia | 0.6 | 2,498 | 240 |

| South Africa | 2.37 | 864 | 2.743 |

| Total | 6.30 | NA | 9.450 |

The estimated value-based market for India, Russia, and South Africa will generate margins significantly larger than the expected cost of late-stage R&D. It could be possible, therefore, to pull a product to market with volume and/or price commitments that represent only a portion of total market demand.

Calculating and Securing the Advance Purchase Commitment

Drawing from the ex ante HTA results, participating countries must set a reasonable and sufficient purchase commitment to incentivise industry investments. The HTA results provide an upper-bound estimate for the size of that commitment; the lower bound of the commitment size must be expected to provide a risk-adjusted return for the successful innovator company. Given the large overall value proposition, there are many different commitment models that could deliver shared value to all parties.

We suggest a relatively simple and powerful model—a predictable revenue commitment pool, tied to product performance against the TPP—that could serve as a starting point for negotiations. As a first step, one or more high-burden countries would need to take a leadership role as “first movers”—for example, India and South Africa. Ex ante HTA for those two countries would reveal the total value-based market, the relative value of the TPP-based new drug treatment by country, and the relative value of the new drug treatment for each country vis-à-vis specific attributes of the TPP. Using the ex ante HTA results as a starting point, the first mover countries would set and divide up a total “commitment pool”—essentially, an advance purchase commitment (price x volume) tied to product performance. A minimum commitment pool would be offered for a product meeting a minimal TPP; a maximum commitment pool would be offered for a product meeting the entirety of the TPP. There are proposals as to the minimum acceptable TPP, but the minimum acceptable TPP needs to be reviewed and endorsed by the technical committee and ultimately the countries. The two countries would assume “shares” of the total commitment pool based on the relative value propositions in their respective health systems (Figure ES-1). Potentially, additional countries could join the commitment pool at a later date—leaving the total revenue guarantee unchanged but reducing each country’s specific commitment.

Figure ES-1. Indicative Schematic for Defining and Dividing a Value-Based Commitment

At the time of product launch, a form of at-launch HTA would be undertaken. Countries would rerun the early-HTA model with up-to-date product performance data, based on the clinical trial results with appropriate modelling. The value-based price in each country would be adjusted for performance. Countries would be responsible for fulfilling their prior volume commitments by purchasing a sufficient quantity of the product at the performance-adjusted value-based price. After fulfilling their commitments, countries would receive access to the product for the remainder of their demand at a discounted price (30 percent of the value-based price in the illustrative example) for a specified period. Ex post HTA (say two to five years later) using post-launch evidence collection could be used to assess whether the product is meeting the at-launch performance expectations; performance either exceeding or failing to achieve anticipated levels could prompt pricing adjustments for future purchases from a pre-agreed time point.

A more complicated (but potentially advantageous) approach would involve conducting a full HTA at launch by inputting up-to-date data reflecting the current situation in 2030. This approach creates additional complexity but offers a better precedent for value-based pricing by incorporating accurate parameters at the time of launch. Country-guaranteed revenue commitments would still be calculated based on baseline assumptions, with volume adjustments to reflect any price change, to ensure that the agreed revenue commitments were unchanged. This would provide the necessary predictability to countries, industry, and the financial intermediary for overall guaranteed revenue. Whether such an alternative process is feasible will depend on whether there is a shared understanding between the parties that the HTA processes will have the necessary robustness and credibility.

To guarantee countries’ purchase commitments, countries would leverage their own sovereign creditworthiness—intermediated through a AAA-rated intermediary guarantor such as a multilateral development bank (MDB)—to underwrite the advance commitments (Figure ES-2). As a first step—well before the drug comes to market—each country government would sign a contractual agreement with such an MDB laying out the terms of the commitment and clearly defining the country’s obligations after the drug becomes available. After the drug comes to market, the country’s commitment would convert to a conditional liability on the MDB ledger; the country would have 10 years (illustratively) to fulfil the entirety of its purchase commitment by purchasing drugs directly from the originator company or a local licensee authorized by the originator. If a commitment balance remains at the end of the 10-year window—that is, if a country were to partially or fully renege on its purchase commitment—the remaining balance would convert to a loan by the MDB, subject to repayment by the commitment-making country under pre-agreed terms. The remaining drug purchase commitment would be honoured by the MDB on behalf of the country, and the drugs would be supplied for the country to use as it finds appropriate.

Figure ES-2. Simplified Straw Man of Model to Underwrite Country Commitments

Based on a needs assessment and preliminary conversations with relevant stakeholders, the World Bank and the Asian Development Bank emerge as promising candidates to serve as MDB partners.

The MVAC model mitigates and distributes risk, reducing total risk to a more acceptable level for all parties. Along several dimensions, the MVAC is fully de-risked:

- The commitment guarantees offer clarity on market demand for a product that meets TPP performance expectations.

- The commitment ensures that countries can access the new products at affordable prices.

- The TPP ensures that products will meet local demand.

- The entire structure is premised on respect for the originator’s intellectual property.

Along other dimensions, risk is reduced and redistributed efficiently across parties:

- Suppliers continue to face the scientific risk that products will fail in late-stage trials; however, their overall development risk is substantially reduced with financial subsidies from global donors from early-stage pipeline development through proof of concept.

- Market entry of competitor products remains possible but unlikely, given the stringent TPP requirements (e.g., the requirement for a three-product combination); a more likely scenario would involve market entry of a vaccine (reducing the pool of people to be treated).

- We have assumed that at-launch HTA leads only to price adjustments from the full TPP price based on product performance. However, an alternative approach would include a full at-launch HTA, using a full set of up-to-date parameters, to calculate the value-based price at the time of launch. Ex post HTA, conducted after the product is launched, could again lead to price adjustment and further redistribute some performance/impact risk between countries and suppliers. In either case, the revenue commitment would not change. Instead, price adjustments would be offset by changes to the volume commitment, ensuring that countries, industry, and the guarantee provider all continue to benefit from a predictable revenue commitment.

- The MDB would reduce and absorb payment risk by transforming a stated commitment into a sovereign debt obligation.

Industrial Policy

The proposed MVAC model raises several issues related to participating countries’ industrial policy objectives. Development of the biopharmaceutical industry is a priority for the governments of India, China, and Russia. Russia is particularly protectionist in its policies, which results in a high need for localisation by multinational companies (MNCs). In India, South Africa, and China, although localisation is not required, there may be an expectation that MNCs would generate productive clinical development partnerships and local manufacturing arrangements.

The MVAC will need to accommodate countries’ preferential purchasing policies for local manufacturers, plus any specific requirements for local research. The successful innovator company could be expected to meet country industrial policy requirements by, for example, licensing production to local manufacturers. Given the high overall expected volumes, technology transfer models and license agreements between MNC developers and local manufacturing companies could also be a useful route to secure long-term supply.

It will be important, however, to avoid pushing up costs through the duplication of facilities. Having production facilities or clinical research facilities in each country is unlikely to be efficient. Compromise will be needed. High costs will lead to the need for a larger revenue commitment for the MVAC drug developers meeting the TPP. This is not a sensible use of MICs’ scarce health budget resources.

Governance

The MVAC is a vehicle for multinational cooperation; ultimately, its structure and operations must be owned and governed by participating country governments in partnership with relevant trusted global experts and institutional stakeholders. Yet for the model to work in practice, country governments must delegate key authorities to a permanent technical body that can manage day-to-day governance functions (Figure ES-3).

Figure ES-3. Mapping of Essential and Supplementary Governance Functions

To serve its core functions—and successfully manage a complex and politically sensitive negotiation process—the MVAC governance model would benefit from the following characteristics:

- Openness and credibility to the BRICS countries (Brazil, Russia, India, China, and South Africa), the CIVETS countries (Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa), and other MICs

- Credibility to industry

- Relevance to and/or expertise in TB

- Flexibility

- Ability to minimise transaction costs

- Ability to attract (or offer) long-term operational resources

Based on a needs assessment, we identified a World Bank trust fund as the best fit for MVAC operational needs. The World Bank is a credible multilateral institution—both for potential industry partners and for MICs—which already participates in institutional governance and could oversee a dedicated trust fund. The trust fund model is widely used to steward development resources and is well trusted by the donors who might subsidise the secretariat’s operational costs. Trust funds offer predictable multiyear funding—potentially using a single up-front investment to finance the MVAC secretariat over the entirety of its long-term life cycle.

The trust fund would be governed by an MVAC board, primarily comprising participating country governments; it may also include representation from external technical and funding partners plus independent technical advisors. The board would be responsible for setting the secretariat mandate and broad policy direction, as well as overseeing secretariat operations. To ensure that decision points are insulated from conflicts of interest—and thus credible to market actors looking to invest in TB R&D—the board would be supported by an independent technical advisory group.

In the first year, there would be a need to establish, test, and gradually expand a transitional secretariat, with costs of about $2 million–$3 million over a period of 12–18 months. This would build on the thinking and analysis delivered so far and would include (1) further modelling through modelling consortia; (2) contract drafting; (3) socialization and outreach to countries, industry, and MDBs; and (4) recruiting the core team at the secretariat.

Once fully functional, the secretariat would migrate in full to a permanent home, ideally within a World Bank trust fund. During high-intensity periods, we expect that the secretariat would need approximately 15–20 full-time staff members, including technical, legal, and country-specific staff, and it would commission and administer research grants from third parties.

Gathering and Reflecting Community Feedback

The Center for Global Development and Office of Health Economics released a consultation draft of the MVAC blueprint in March 2019 for public review and comment. Through mid-2019, we invited constructive feedback and dialogue to further hone the proposal and ensure it is responsive to the interests and concerns of all stakeholders. During this period, we worked proactively to engage with stakeholders in target countries, in international institutions, and within the pharmaceutical industry. This final report amends the draft in response to the comments we received.

[1] Modelling work completed by Anna Vassall, Gabriela Gomez, Nim Pathy, and Lotte Steuten; report forthcoming.

[2] MDR TB (i.e., TB resistant to at least both isoniazid and rifampicin) leads to substantially longer treatments and costs to the health service and patients, as compared with drug-sensitive TB.

[3] The standard of care was defined as new shortened regimens for first-line treatment (four months) in 2030 and for MDR (nine months, new drugs with no pre-existent resistance) in 2025. These regimens are similar to the BPaMZ and BPaL currently being trialled by the TB Alliance. In addition, we assume there will be a new vaccine coming to the market in 2027. This vaccine has clinical characteristics similar to the recently trialled M72/AS01E.

Rights & Permissions

You may use and disseminate CGD’s publications under these conditions.