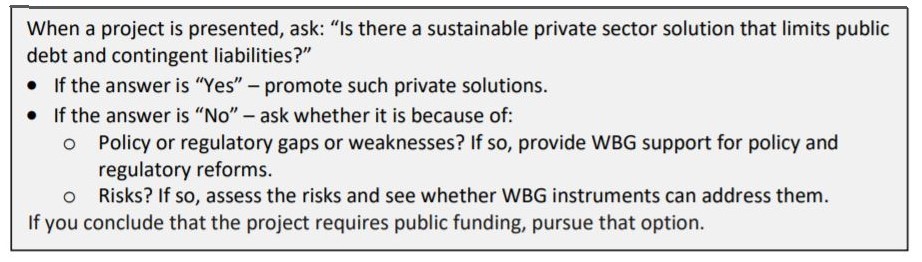

Last year the World Bank adopted a new “cascade” approach that intended to maximise finance for development by prioritising private solutions wherever possible:

Source: World Bank

Source: World Bank

In what world would this “cascade” algorithm make sense? Without a good answer to that question, the cascade risks looking like ideology rather than sound development finance advice.

An economist explores the question

World Bank economist Tito Cordella has published a fascinating theoretical exploration of this question “Optimizing Finance for Development”, focused on the optimal sequencing of the three possibilities: reform, subsidies (risk mitigation), or public funding.

But as economists are wont to do, Cordella strips his model down to the bare minimum needed to analyse the question in hand. Yet his model contains some ingredients that could help us think about the cascade more broadly. Moreover, it is not always obvious how to connect his stylized model back to reality. This blog post tries to do that. Before proceeding, it should be noted that World Bank research economists do not speak for the Bank and so this is not an attempt to hoist the Bank on its own petard: what matters are the arguments being made, not who is making them.

Efficiency first

As an economist, the first question Cordella asks is: which is more efficient, public or private? When Cordella writes that “to focus on the policy relevant trade-offs, most of the analysis features the case in which the private sector has an efficiency advantage”—that’s because for him when the public sector is more efficient the solution is trivial: the public sector should do it. That is a significant departure from, “if the private sector can do it, it should.”

But I suspect many people may feel that even basing the choice between public or private on efficiency is too reductive. Many North Americans fundamentally object to the idea of socialised medicine—for example—whilst many Europeans find the American health system equally objectionable. Societies have different ideas about fairness and equality. We could interpret “efficiency” more broadly, meaning that we want to satisfy social preferences in the most efficient manner possible. Or we could see the role of the Bank as setting out the costs of achieving various social outcomes and leaving it to the political process to decide what’s worth the price.

In Cordella’s model, public and private are assumed to have the same cost of capital but differing levels of efficiency across projects, which shows up in the form of different rates of financial return: greater efficiency means higher returns. Beneath the abstraction of a model, what do financial returns mean in the context of public provision? Some public projects charge user fees (e.g., utilities) but the government can also capture financial returns via incremental economic activity, which is taxed. Efficiency is a simple model parameter, but in reality the analysis of public versus private efficiency would (should) be complex: all else equal, perhaps public schooling is more efficient because it reaches the less well-off, and lower inequality is good for growth and tax revenues. Perhaps public roads are more efficient because they have a larger economic impact on overall economic activity than a toll road. The model also recognises that efficiency is not just about returns that can be internalised financially—projects create externalities. Cordella assumes externalities are the same under public and private provision, but that is merely because he is not interested in that aspect of the problem; the theoretical implications would be trivial: all else equal, if positive externalities are larger under public provision, the public should do it.

Cordella is focused on the set of projects where the private sector has an efficiency advantage, but the returns are not sufficient to induce investment. For these, there is an interesting problem of whether, and how, to bear the costs of overcoming that. His model introduces two helpful ideas: policy reforms that improve the commercial viability of projects can come at a social cost, and subsidies to induce private participation can be too expensive. This is a useful contribution to policy debates over “blended finance” which thus far have had little to say about when levering the private sector is not worth the trouble.

The analysis reveals that sequencing of the cascade algorithm only matters because governments are unable to perfectly fit instruments to projects. If subsidies and reforms are precise and project-specific, sequencing is irrelevant. But if the cascade approach is implemented in stages where, in effect, the “reforms department” does as much as it can with its instruments first before passing on the residual of projects to the “subsidies department,” then the sequencing is important. Cordella finds that contrary to the “cascade” it is best to apply subsidies first, and crowd-in the projects which are close to commercially viable at low cost, before turning to reforms when they come at a meaningful social cost. If reforms are cost free, the implications are trivial: do them. Cordella concludes:

The objective of maximizing private finance for development may conflict with the objective of optimizing finance for development.

A different motivation

However, the cascade is motivated by something that does not feature in Cordella’s model: the scarcity of public funds. There is no government budget constraint in the model. It could be introduced by assuming the cost of public finance is increasing in the quantity of public projects, so that “efficiency” becomes combination of costs and returns. The effect on Cordella’s model would be to expand the set of projects where the private sector has an efficiency advantage, and thus candidates for the cascade. Presumably the cost of financing subsidies would also reflect the increasing cost of public finance and the last-resort public option would become less often feasible, so the importance of reforms would rise. Behind the cascade model lies the idea that developing countries have reached the limit of fiscal space, so choosing private solutions where they are available is the only way of getting more done.

A counter argument is that if an economy can afford to pay for a new airport, for example, via users fees high enough for a private provider to make profits, then it should also be able to afford to pay those fees to a government-run airport or to pay via taxation. If the government has a profitable investment opportunity, it should be able to raise finance without seeing its cost of capital increase. Of course, if the government would be less efficient—perhaps it faces capacity constraints that aren’t about money but are about human resources—then that would settle it. But the cascade’s “private if possible” rule makes sense if the scarcity of public funds dominates efficiency considerations, otherwise relative efficiency should be the deciding factor. And if the public sector is equally efficient, in the sense of being equally able to capture financial returns, then it should also be able to find the money. The public budget should not be regarded as fixed, irrespective of what positive return investment opportunities that the government faces.

Maybe there are too many “shoulds” in the previous paragraph. Governments may not be able to finance all their positive-return projects. The cascade could be justified as a second-best solution for a second-best world. It may also be better seen as a signal that the Bank is now more receptive to collaborating with the private sector, rather than as a rule to be followed to the letter. But even on a more sympathetic reading, a stated policy of unconditional preference for private provision may be hard to sustain.

Unconditional support for private finance is untenable

Opinion in some of the Bank’s shareholder countries is turning against private finance. More importantly, citizens of partner countries are reading stories like this: the American contractor Bechtel is lobbying the Kenyan government to choose conventional public procurement for a new Nairobi-Mombasa expressway, because it claims the financing cost under a PPP will be five times higher ($15bn versus $3bn). There is no mention of World Bank involvement in this project, but it’s a useful example. Kenya is a country with public debt approaching unsustainable levels so perhaps choosing private financing for this expressway would preserve fiscal space for something else, such as an investment in public rural roads.

What’s more, straight comparisons of financing costs can be misleading, because they obscure who carries the can for cost overruns under the two models (we should not assume a construction firm has the client’s best interests at heart, especially if advocating a cost-plus over a fixed-cost contract). The right choice is not obvious, so advice from the World Bank could be useful here. A flow chart that points straight to the private sector is not.

Cordella’s model sets aside theoretical possibilities if the implications are trivial. It may seem trivial to conclude that the choice between public and private finance should juggle both public financing constraints and comparative efficiency, but the cascade doesn’t work that way. And it should.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.