I am a recent convert to the case for taxing tobacco. While I was aware of the public health implications of the tobacco epidemic, I did not appreciate its magnitude or the importance of tobacco taxes as one of the most effective public policy tools for health. I did not appreciate, for example, that more people in developing countries die prematurely from tobacco than from HIV, TB, and Malaria combined. Nor that there is now compelling evidence that raising tobacco taxes, and hence tobacco prices, leads to a significant reduction in the incidence of smoking.

My foray into this issue was spurred by an invitation to give a keynote address at a high-level event on Tobacco Control and Taxation, organized by the World Bank. The event—held in the lead up to the Spring Meetings—brought together senior officials from Ministries of Finance and Health from some 40 countries.

From my own reading and discussions with colleagues, including Bill Savedoff and Janeen Madan (you can check out CGD’s tobacco-related work here), there was one question at the top of my mind: Why aren't tobacco taxes being addressed more forcefully and in more countries? Policymakers typically put forth a range of objections, but evidence suggests that tobacco taxes can be extremely effective—the cost is very low relative to the revenues and fully justified by the health gains. Drawing on my remarks at the event, here’s my take on three common objections to tobacco taxes and why they don’t hold up.

1. Tobacco taxes will not raise sufficient revenue? Experience suggests otherwise.

Tobacco taxes generate substantial revenue gains. In Mexico, a tax hike implemented in 2010 was followed by a 9 percent increase in revenues in 2011. Studies also show large potential revenue gains from tobacco tax hikes in countries like China and India. For example, raising the tax rate to 51 percent of the retail price in China, could increase revenues by an estimated US$10.4 billion. At some point, when people cut back enough on smoking, tax revenues could fall in the long-term. However, if that were to happen, we should celebrate it as a sign of public health success: it means people are smoking less and living longer, healthier lives.

2. Tobacco taxes are regressive and hurt the poor? To the contrary, evidence shows that the poor benefit more than the rich.

First, I’m not sure regressivity is the right criterion. Using regressivity as a criterion to judge a tax only makes sense if the tax is primarily aimed at raising revenues. But the primary purpose of a tobacco tax is to prevent unnecessary deaths by reducing smoking.

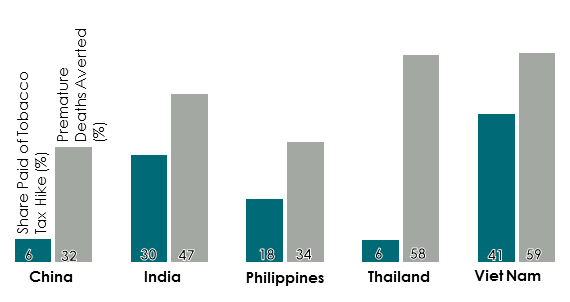

Research also highlights that the poor benefit more from tobacco taxes than the rich (see figure below). Smoking prevalence is higher among low-income individuals than affluent people, but poor smokers also respond more to price hikes by quitting or reducing consumption. As a result, poor smokers receive more health benefits than rich smokers, while wealthier smokers pay the bulk of the tobacco tax burden. But there are winners and losers. When people in poor households quit smoking they will gain better health and more disposable income. Those who do not quit, will continue to face health risks and lower disposable income. The appropriate compensatory policy is not to eliminate tobacco taxes but to finance smoking cessation programs targeted to poor households.

3. Tobacco taxes will lead to illicit trade? That’s possible but the evidence shows that many countries have successfully tackled this.

It is important to note that tobacco taxes and prices are not the primary determinants of illicit trade. Other factors like the effectiveness of tax administration, presence of organized crime networks, and complicity of the tobacco industry itself are more important. And tobacco companies are not allies. In 2008, two Canadian tobacco companies agreed to pay criminal fines and civil penalties totaling C$1.15 billion after admitting that they had aided cigarette smugglers between 1989 and 1994. In 2004, Philip Morris agreed to pay the European Union US$1.25 billion to settle charges that it had encouraged large-scale tobacco smuggling.

Experience in several low- and middle-income countries suggests it is possible to maintain high prices while lowering illicit trade using approaches like prominent tax stamps, local-language warnings on cigarette packs, as well as enforcing penalties. Countries like Brazil, Turkey, and Kenya have implemented advanced track and trace systems alongside supply chain control measures, which have led to large reductions in illicit trade, as well as increases in revenues.

Even in the presence of illicit trade, raising taxes can lower consumption and increase revenue. In the 1990s, South Africa raised excise taxes from 38 to 50 percent of the retail price and reported a relatively small rise in smuggling from 0 percent to 6 percent during the years when it raised excise taxes, but sales decreased 20 percent and revenue rose two-fold.

Tobacco taxes are often not part of the conversation in circles where tax policy is discussed and set. In many cases, Finance Ministries may not have exposure to the evidence from other country experiences. And this is precisely why the importance of the event hosted by the World Bank—which raised the issue so publicly—cannot be overstated.

Fortunately, momentum is building. It is very encouraging to see the World Bank take a more prominent role in supporting governments to design and implement effective tobacco taxes. It is also encouraging to see that the IMF recently published a technical note on raising tobacco taxes. But there’s a lot of work left to do. I'd like to see higher tobacco taxes as a central element in the IMF’s policy recommendations to close fiscal gaps in member countries. It will take getting recognition from those not directly involved in the health sector that tobacco taxes are an extremely cost effective policy tool to address one of the most pressing global challenges of our time.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.