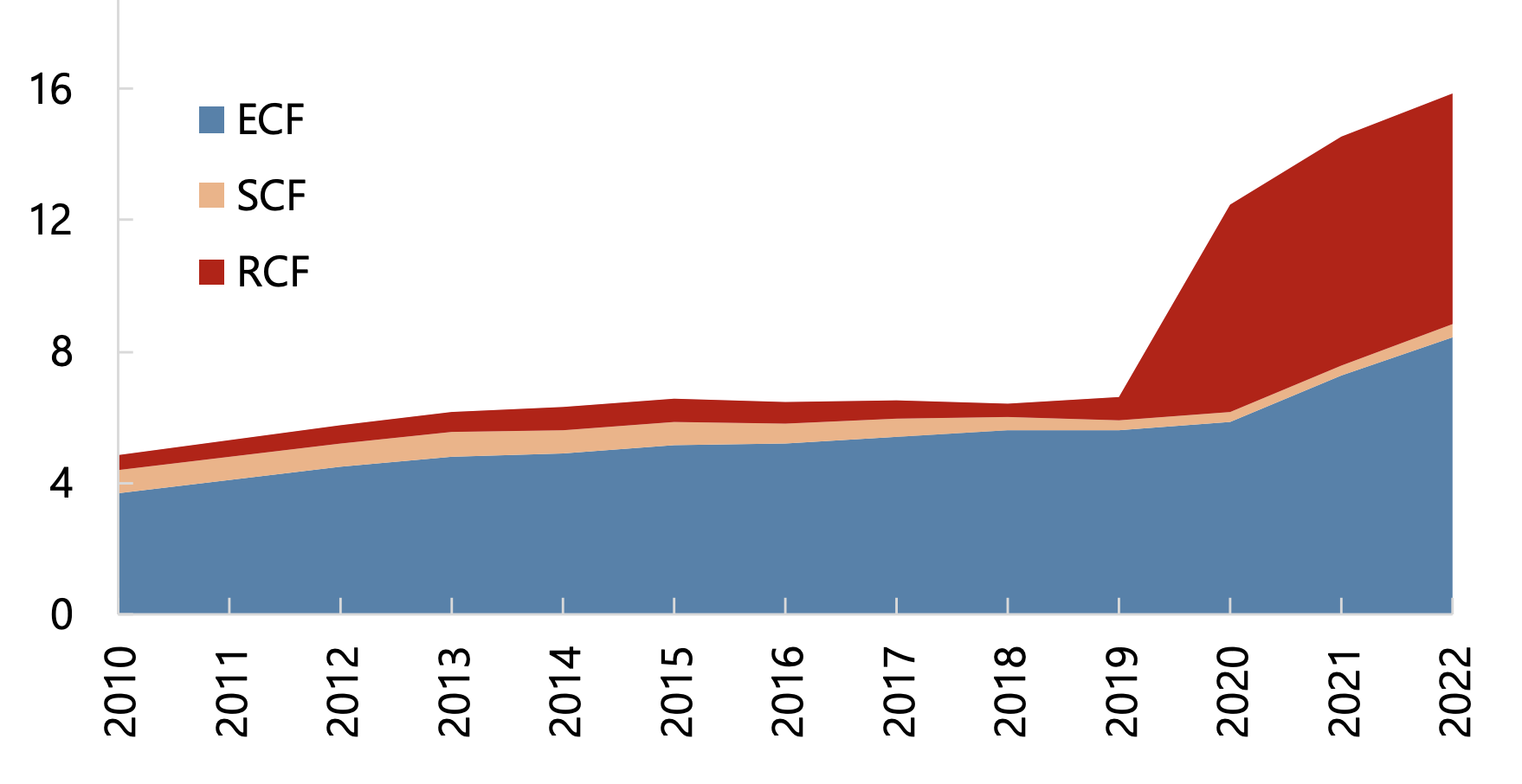

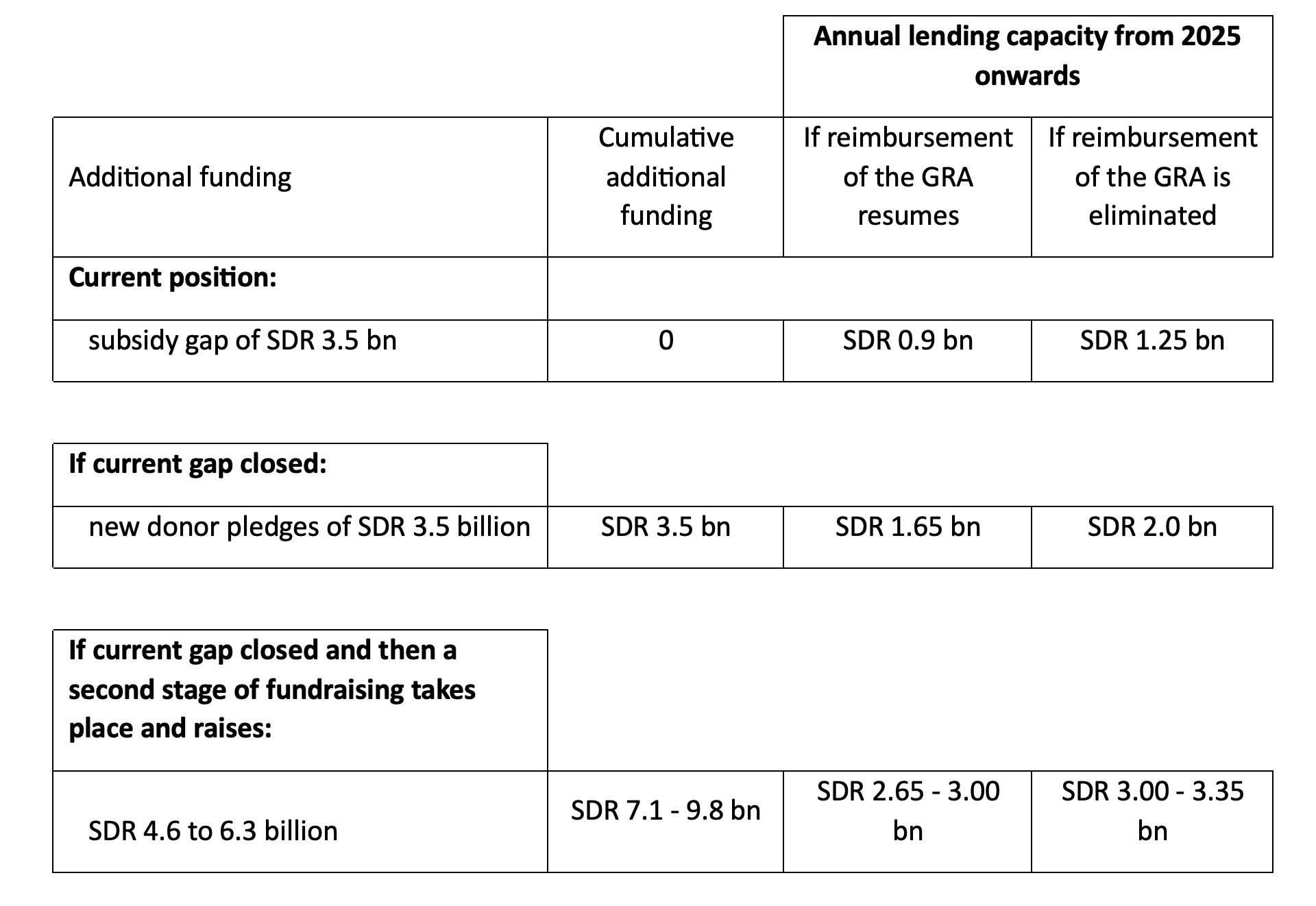

The International Monetary Fund (IMF) offers concessional assistance to low-income countries (LICs) through the Poverty Reduction and Growth Trust (PRGT). In response to the exceptional and urgent requirements of LICs during the pandemic, lending from the PRGT surged over the last 3 years (Figure 1). In fact, the total credit outstanding from the PRGT more than doubled in 2020 alone. Given the continued tenuous global economic environment, the strained budgets of major development donors including China, and the turmoil in international capital markets, we expect that the heightened demand for financing from the PRGT will persist in the coming years. Thus, it is imperative the PRGT possesses sufficient resources to meet these demands.

But, current resources for the PRGT are not sufficient to support continued high demand. The problem is the lack of subsidy resources, which has worsened markedly in the current environment. If donors don’t step up with new commitments of SDR (special drawing rights) 3.5 billion, PRGT lending will be a fraction of its current levels from 2025 onwards.

Figure 1. Credit outstanding in the PRGT, 2010-22 (SDR billion)

Source: IMF, 2023 review of Resource Adequacy of the PRGT, RST, and DRT

Note: Extended Credit Facility (ECF), Stand-By Credit Facility (SCF), and Rapid Credit Facility (RCF) are the facilities under the PRGT

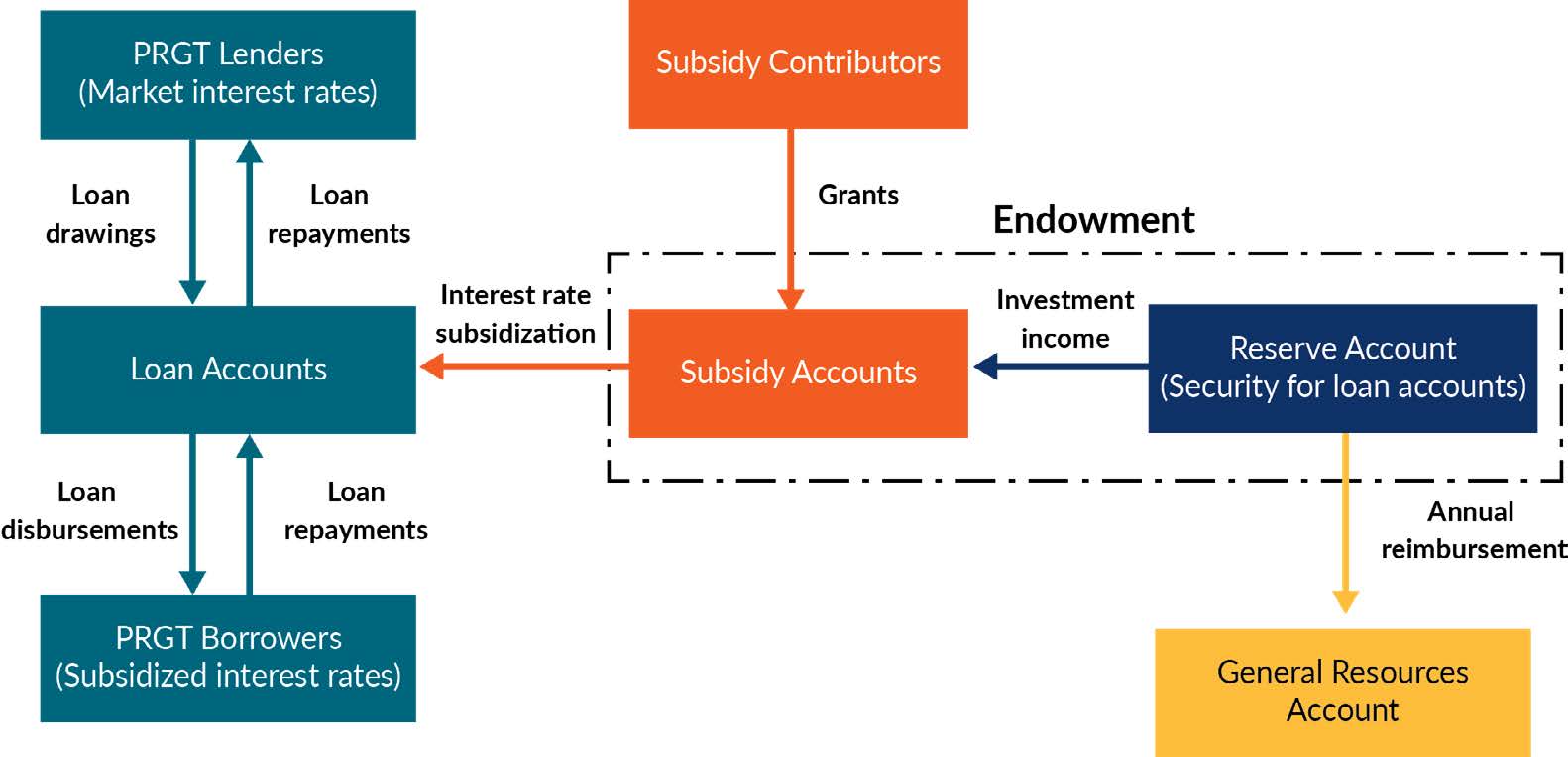

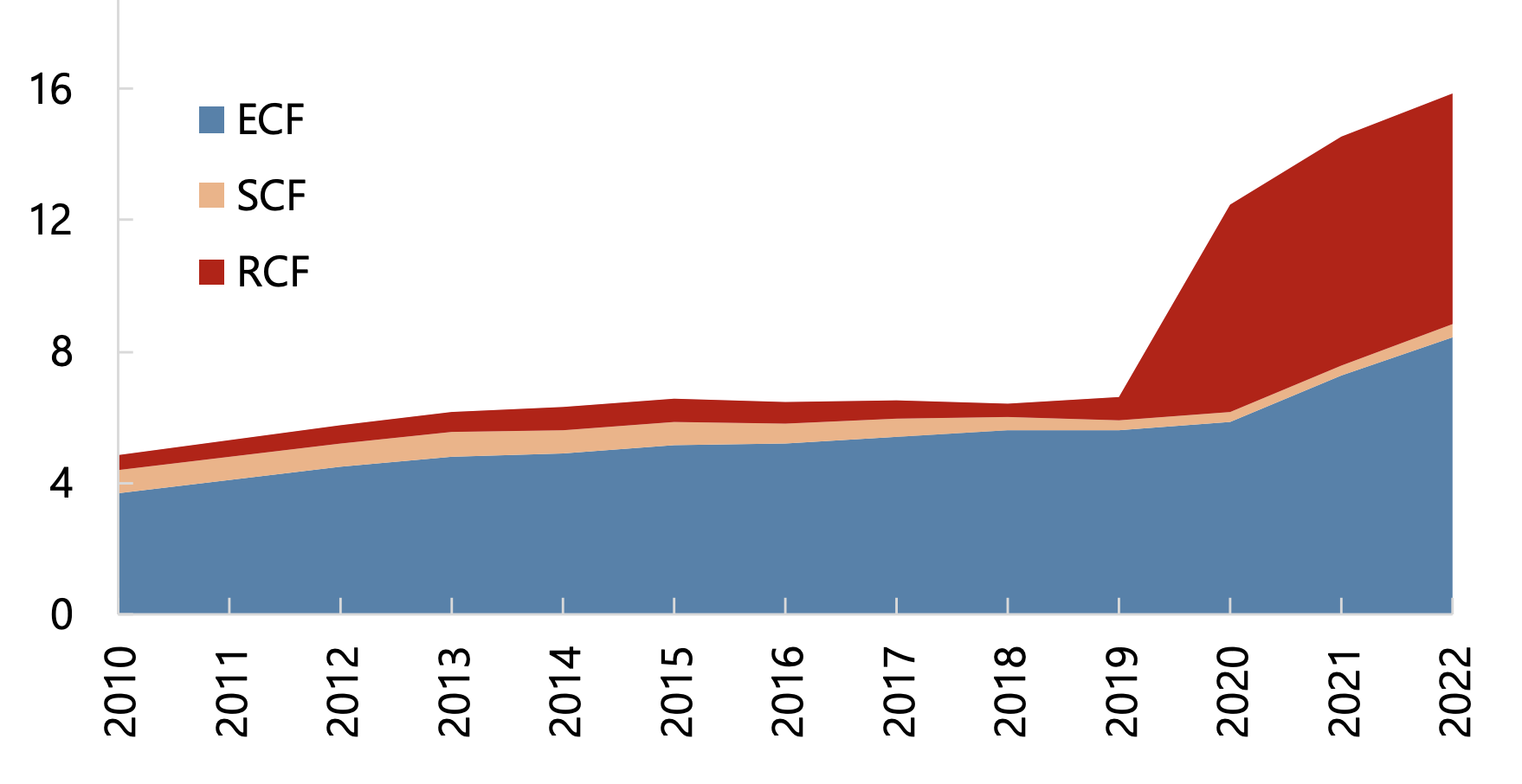

The Poverty Reduction and Growth Trust structure

Unlike lending from the IMF’s General Resources Account (GRA), lending under the PRGT is done on concessional terms—below market interest rates and 10-year maturities with a 5-year grace period. This concessionality is designed to make the loans more affordable for LICs and recognizes the medium-term challenges they face in achieving economic growth and reducing poverty.

To allow the IMF to lend on concessional terms, the PRGT relies on a special financial structure which consists of a Loan Account, Subsidy Account, and Reserve Account (Figure 2):

-

Loan Account: The Loan Account consists of the resources that are lent to LICs. These resources are loaned to the PRGT by donors and then on-lent to LICs through the PRGT. IMF member countries contributing loanable funds to the PRGT are paid the SDR interest rate for the duration of the loan.

-

Subsidy Account: The Subsidy Account holds the funds that are used to offset the difference between the interest rate that is paid to the donor (the SDR interest rate) and the below-market interest rate that is charged to LICs (currently zero percent). These resources are contributed by IMF member countries and by the IMF.

-

Reserve Account: The Reserve Account is a buffer that is used to cover any unexpected losses or delays in loan repayments. This account was originally funded through resources derived from gold sales and yields investment income that can be used to supplement the subsidy account. The reserve account is also used to reimburse the IMF for the expense of running the PRGT, including staff resources.

Figure 2. PRGT structure and the flow of funds

Source: David Andrews, Financing a Possible Expansion of the IMF’s support for LICs, February 2021

Note: Subsidy contributors can also contribute to the Deposit and Investment Account (DIA) instead of providing grants to the subsidy account. Contributions to the DIA will be invested in safe assets and net returns on contributors’ investments will be added to the Subsidy Reserve Account.

How is the Subsidy Account funded?

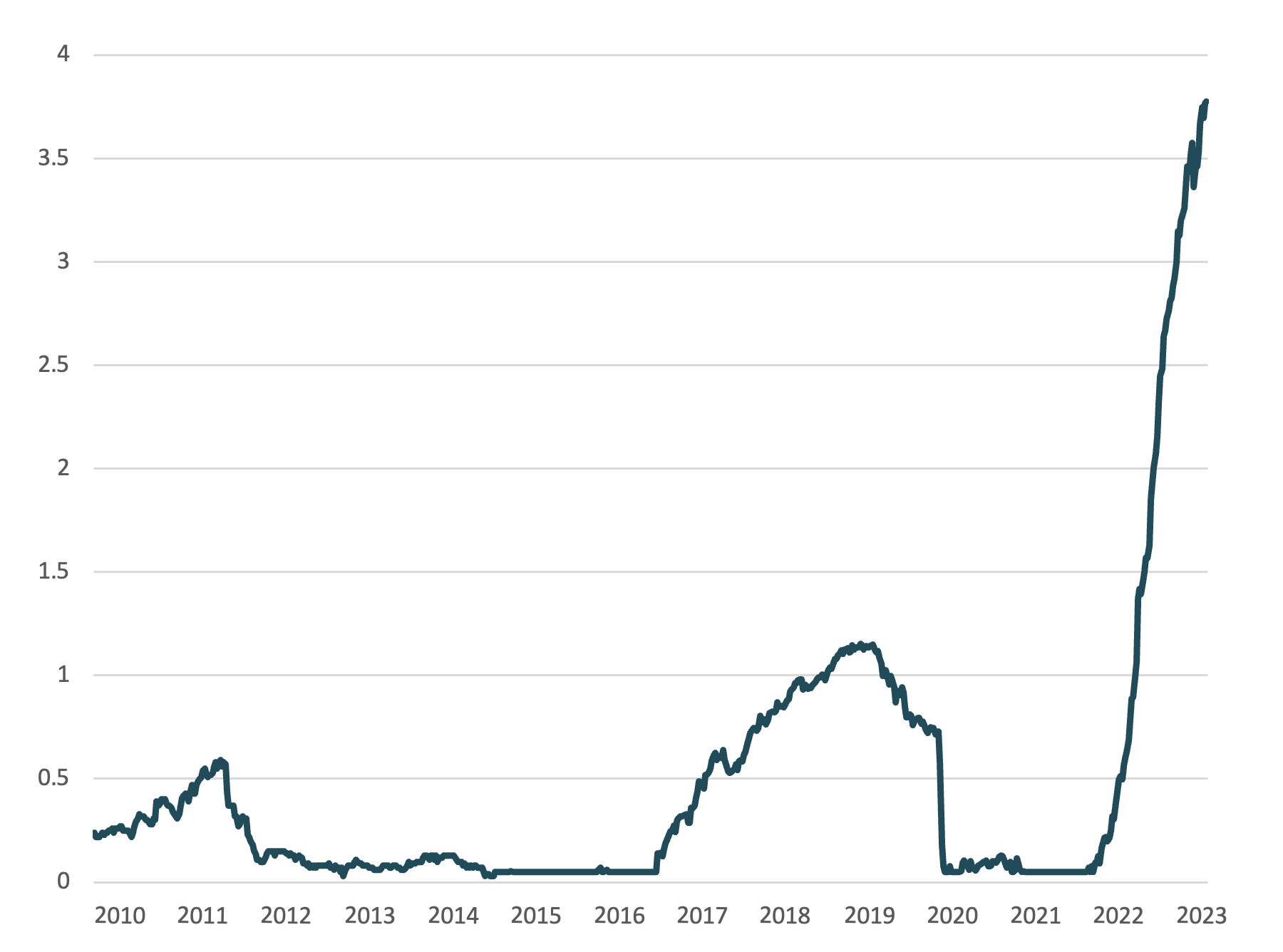

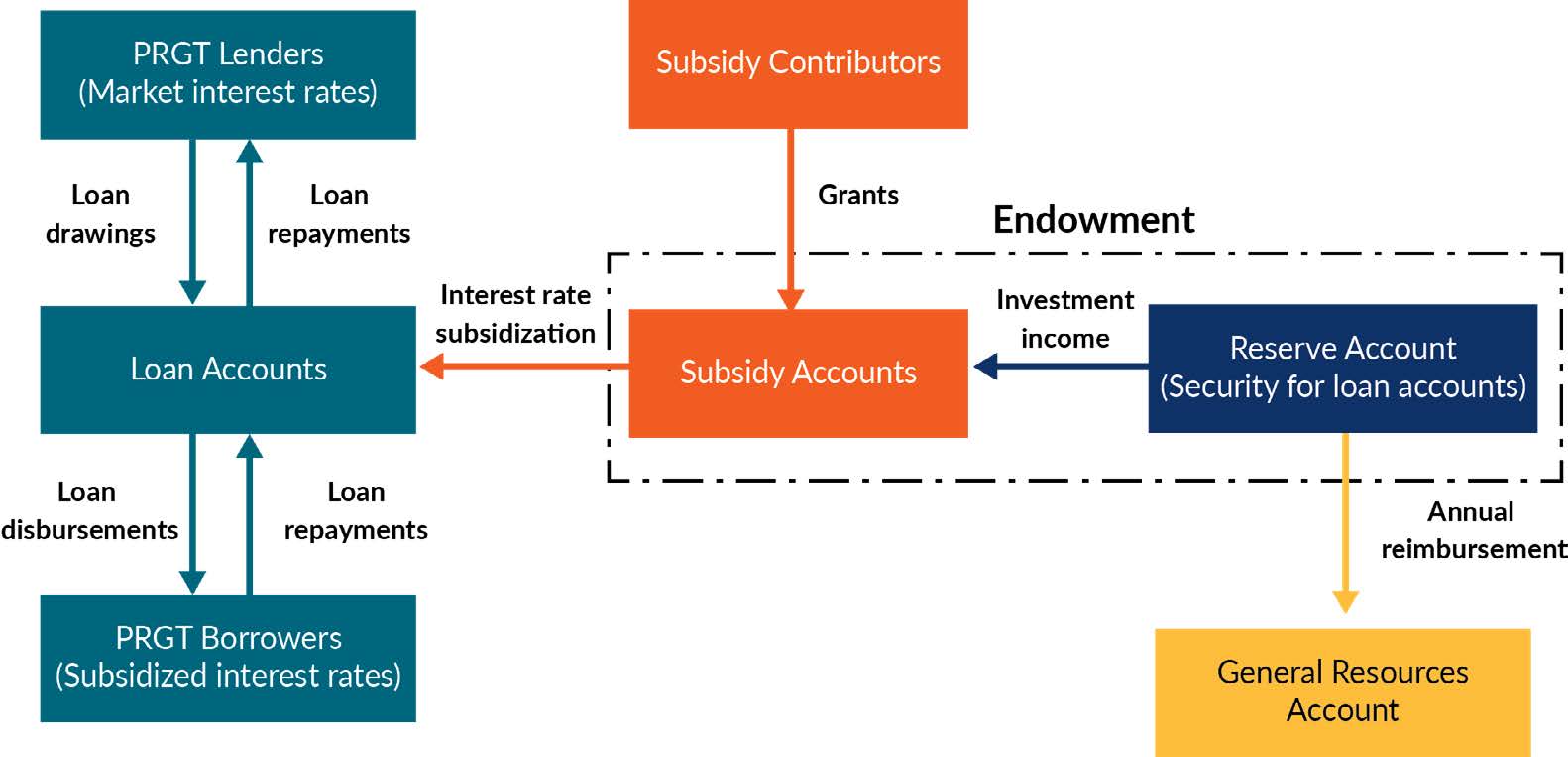

The Subsidy Account within the PRGT is essential for maintaining the concessionality of the PRGT by holding contributions from donor countries to cover the cost of providing concessional loans to low-income countries (LICs). However, this account now looks to be seriously underfunded, because of the combination of rising interest rates (figure 3 below), the heightened demand for lending and financial support from LICs (as we have seen in figure 1), and donors not meeting targeted contributions expected from the IMF.

The Subsidy Account is funded by two sources:

-

Bilateral contributions from member countries and the IMF: These are voluntary contributions that are made specifically to fund the subsidy account and generally in form of grants.

-

Investment income from the IMF: Funds in the reserve account are invested in safe assets. Return from these investments are used to supplement the Subsidy Account.

Figure 3. SDR interest rate

Source: IMF data

The Shortfall on Subsidy Resources

A recent paper published by the IMF lays out an in-depth analysis of the adequacy of resources in the PRGT, Resilience and Sustainability Trust (RST), and Debt Relief Trusts.

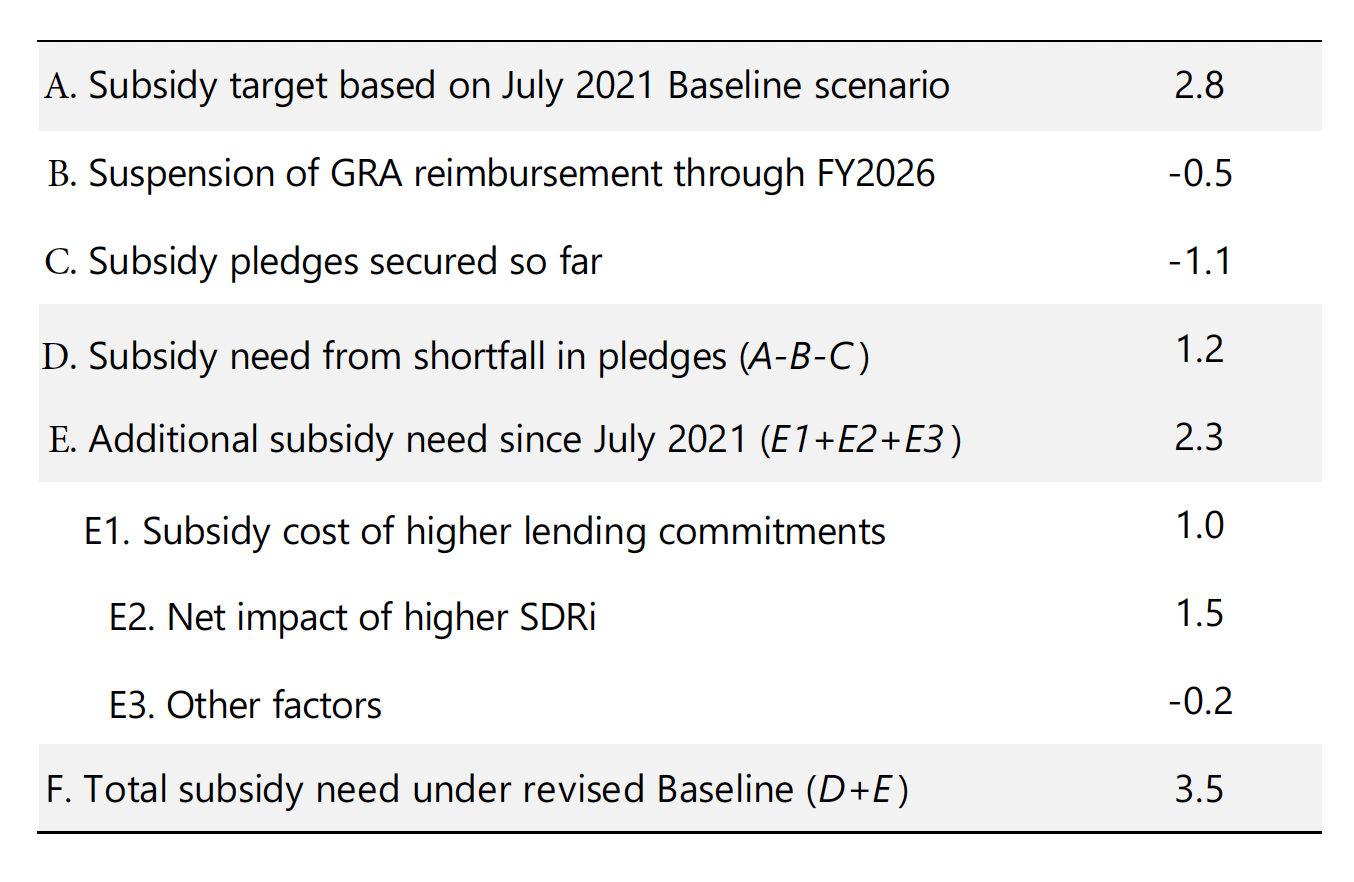

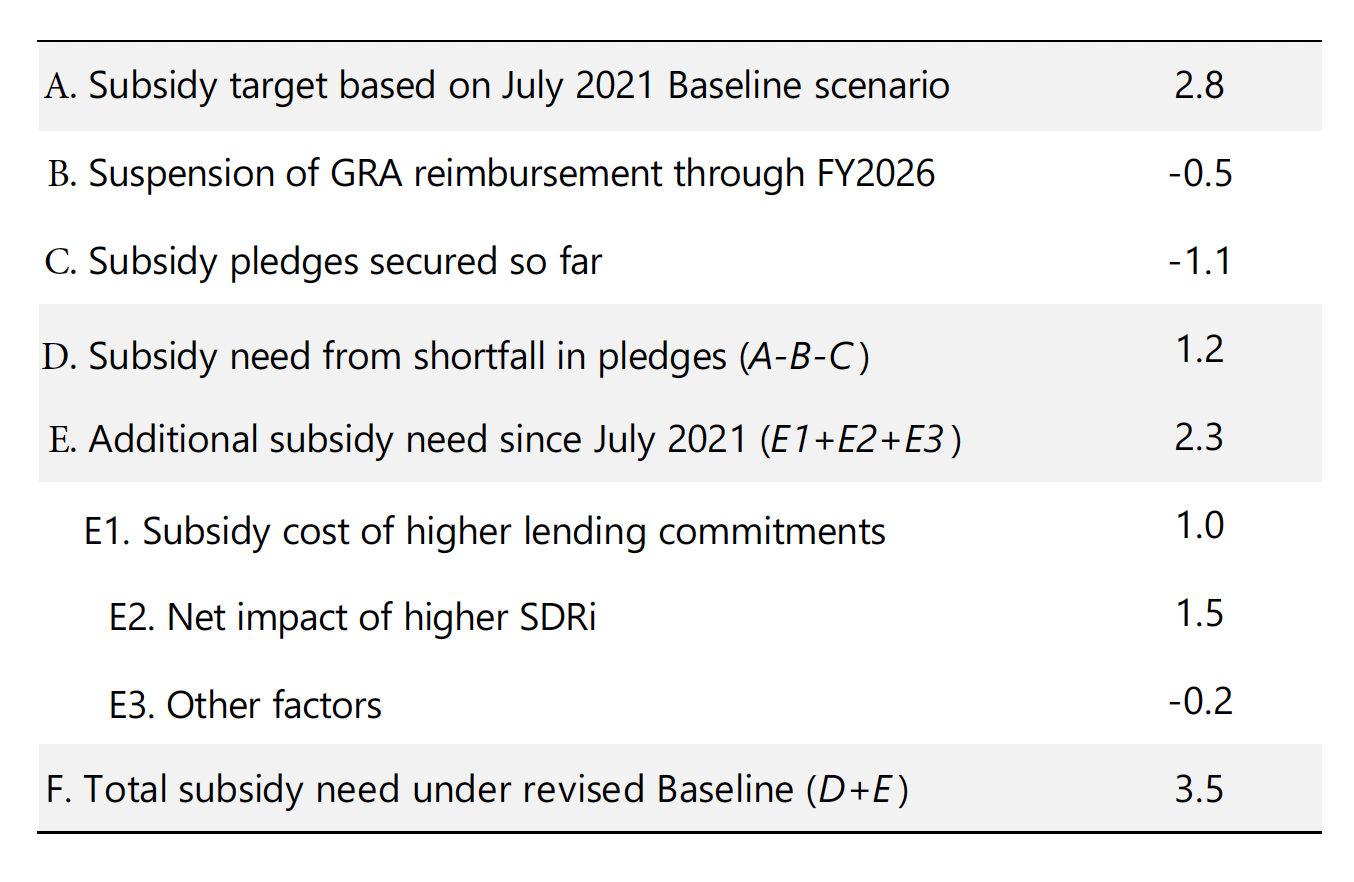

In July 2021, the IMF set a target for new subsidy resources in the PRGT of SDR 2.8 billion. This would allow the PRGT to continue lending at elevated levels through 2024 and then be able to lend at a rate of SDR 1.65 billion per year in perpetuity from 2025. However as of the end of 2022, only SDR 1.6 billion has been secured, including SDR 1.1 billion from secured pledges and SDR 0.5 billion from the suspension of GRA reimbursement. (In its design, the PRGT is to reimburses the GRA for the administrative costs of running the PRGT, including staff costs. This reimbursement is from time to time suspended. A recent blog calls this suspension to be made permanent).

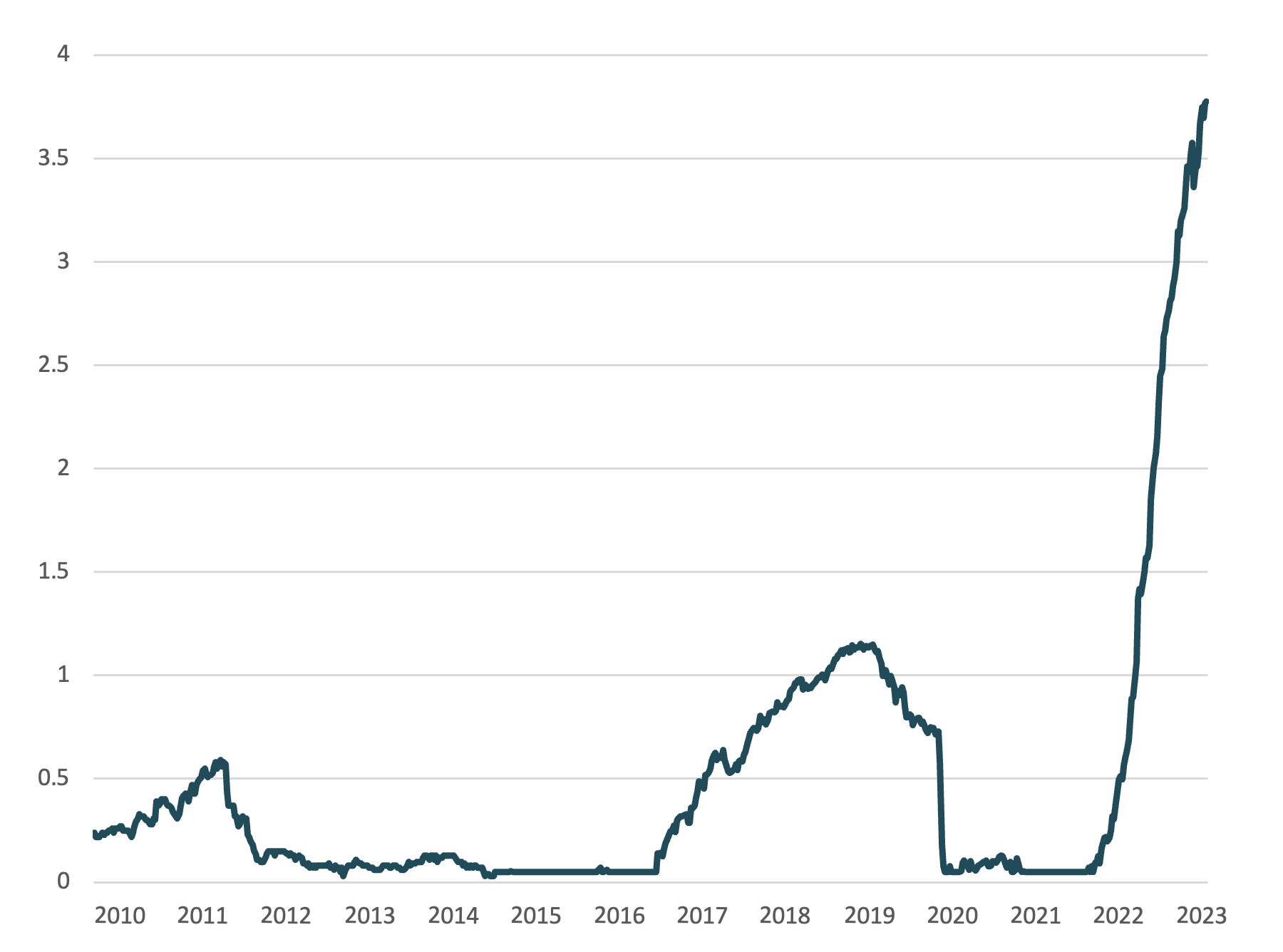

In addition to this significant SDR 1.2 billion shortfall, additional challenges have emerged. The higher lending commitments of the PRGT coupled with higher interest rates necessitate an additional SDR 2.3 billion SDR if lending levels of SDR 1.65 billion are to be maintained from 2025. Therefore, under the revised baseline, the total subsidy need amounts to SDR 3.5 billion (Table 1).

Table 1. PRGT Subsidy Account needs (SDR billion, as end-2022)

Source: IMF, 2023 review of Resource Adequacy of the PRGT, RST, and DRT

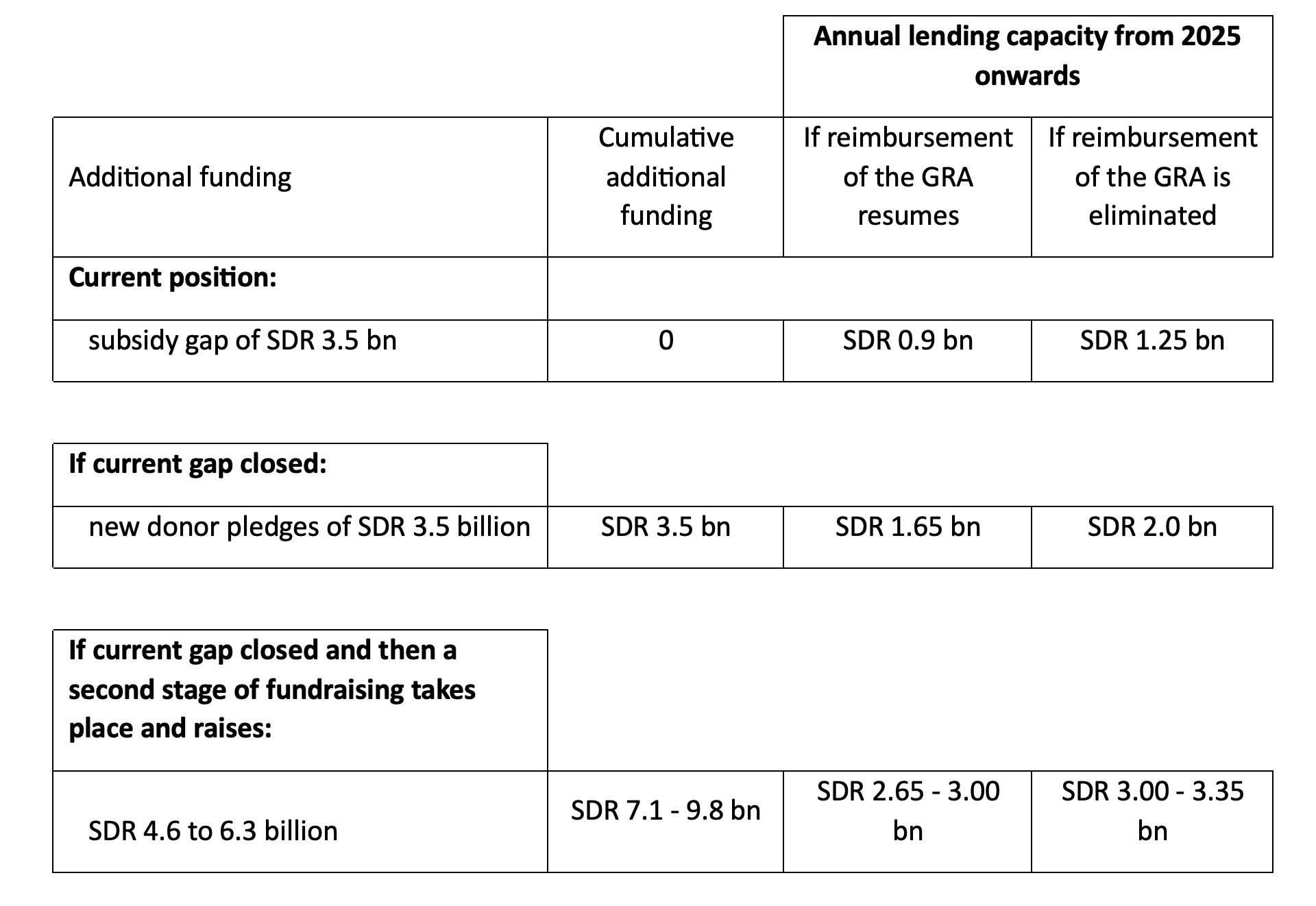

If donors do not provide the SDR 3.5 billion of subsidy resources needed under the revised baseline, and GRA reimbursement resumes, the PRGT will only be able to lend SDR 0.9 billion per year starting in 2025, or less than a quarter of the average annual lending level since the start of the pandemic.

In fact, given the current financing needs of low-income countries, the donor community should be considering how to ramp up lending from the PRGT. Table 2 illustrates how many subsidy resources it would take to increase the PRGT’s capacity by up to SDR 3 billion per year.

In subsequent blogs, we will explore alternative methods for bridging the gap in subsidy resources.

Table 2. Subsidy contributions and the future lending capacity of the PRGT

Source: Authors’ calculations

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.