On September 19, the Center for Global Development will convene representatives from the leading multilateral development funds, their donors and recipients, and independent experts to discuss the next round of negotiations that will determine how much money these funds will have available in the years ahead and how they will spend it. To better inform the upcoming gathering, we’ve prepared a mapping note of the multilateral funds: how much money they raise, from whom, and how they spend it.

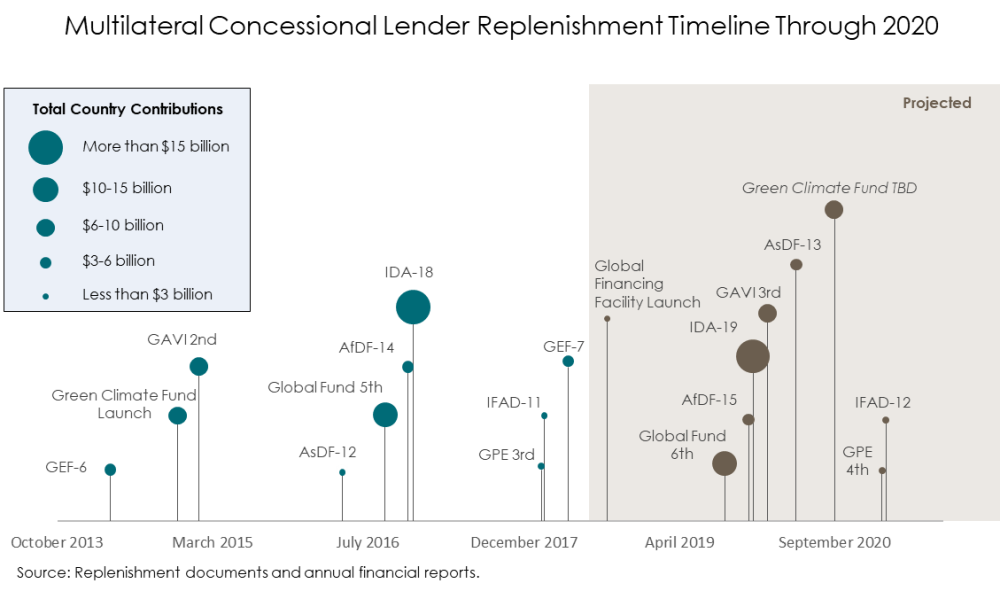

Between April 2019 and December 2020, an unprecedented number of multilateral and thematic funds will undergo a concentration of replenishments without the gap that separated previous cycles. In addition to the older multilateral funds such as the International Development Association (IDA), the African Development Fund (AfDF), and the Asian Development Fund (AsDF), the growth of newer funds such as Gavi, the Vaccine Alliance (Gavi) and the Global Partnership for Education (GPE) and the entrance of new funds such as the Global Financing Facility (GFF) and the Green Climate Fund (GCF) will enhance competition between funds vying for resources. This timeline, along with global changes in the concessional financing landscape, promises to create new challenges for this upcoming round of replenishments.

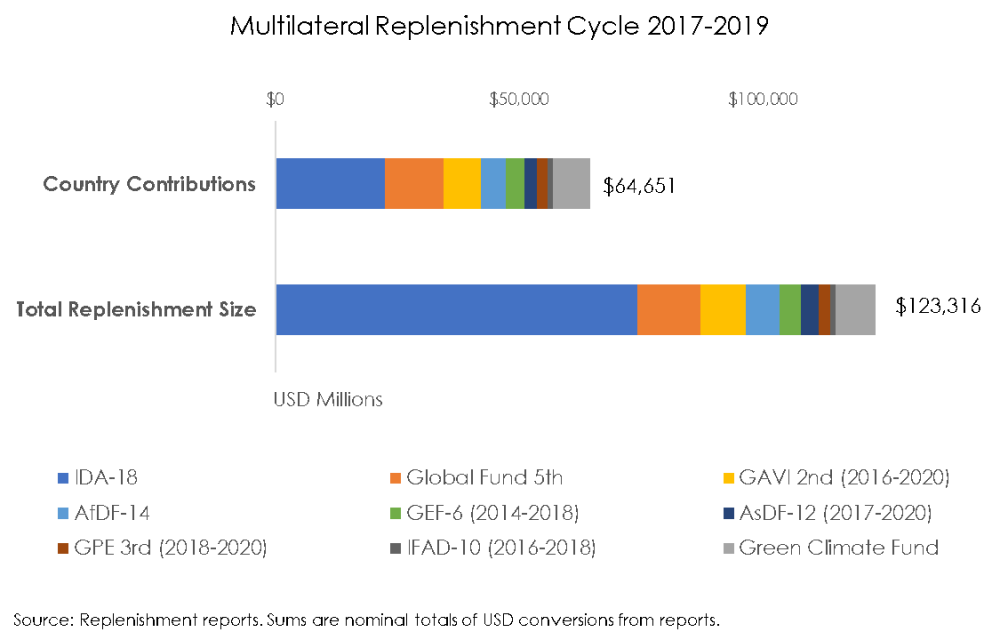

As a group, these multilateral funds—which include the World Bank’s IDA, the International Fund for Agricultural Development (IFAD), and the Asian Development Fund—account for the lion’s share of concessional financing available to developing countries. In the last round of “replenishments” of these funds, nearly $125 billion in concessional resources (grants and zero or low-interest loans) were made available for spending, mostly in low-income countries. This level of financing was based on donor contributions half as large, suggesting that the funds themselves have considerable leverage, IDA more so than any other fund.

As these funds face a new round of fundraising, they will also set operational policy frameworks for the years ahead. What factors should determine countries’ eligibility for concessional resources, and should these factors be aligned across the concessional finance institutions? How do growing concerns about debt sustainability affect the operations of these institutions? Which sectors are priorities when it comes to country demand for concessional resources? Are these the same priorities expressed by donors in their allocations to the various concessional finance institutions and funds?

Stay tuned for more from CGD on the issues discussed at this conference and what they mean for the development finance agenda in the years ahead.

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise.

CGD is a nonpartisan, independent organization and does not take institutional positions.