Approximately 15 million people are displaced outside of their home countries. Most refugees are not able to return home for many years, often more than a decade. But just 8% of these refugees are resettled safely to third countries. So without focused actions, today’s internationally displaced people are likely to be part of the growing “refugee caseload” for many years, neither able to return home nor able to settle permanently elsewhere. That not only deprives refugees of the ability to live full, productive lives, but is also overwhelming the world’s humanitarian aid budgets. Although the real value of global aid has grown 9% in the last five years, all of that increase (and then some) has been eaten up by the rising costs of humanitarian aid and refugees.

Instead of condemning more and more people to a long-term future as aid-dependent refugees, what if we turned the support they would receive from donors over many years into an endowment that would enable them to start a new life in a new country? By capitalising future humanitarian aid spending and borrowing on capital markets, we could invest in these people. This could simultaneously make it more politically palatable for countries to take in people fleeing violence, radically improve those refugees’ lives, and reduce long-run humanitarian costs for donors. That’s the basic thinking behind the Humanitarian Investment Fund, an idea that could perhaps help Kenya, for example, which this week threatened to close the Dadaab refugee camp, to see the 300,000 Somalis living there as an opportunity rather than a threat.

In the long run, refugees can make significant economic and social contributions to countries that choose to resettle them. But in the short run, facilitating their arrival and integration involves a cost to the government – resources like housing and language classes come with a price tag. Although costs decline as refugees integrate into labour markets, the issue remains one of the most politically challenging today. Newspaper coverage focuses on the (usually exaggerated) short-term fiscal effects and while ignoring the longer-term benefits that young, entrepreneurial workers can bring to aging workforces. This mismatch between short-run costs and long-term benefits creates an opportunity for financial innovation that can leave everyone better off.

Consider a Syrian living in Jordan. Like many professionals forced to flee their homes, she is probably relatively well-educated, but struggles to find formal employment. She can't go back: the risks are too great, and there may be precious little of her old life left to return to. The humanitarian response plan to accommodate Syrians in Jordan indicates that donors pay an average of $1,210 a year to support her. Instead of paying her that money year after year to maintain a (bad) status quo, we could invest in her up front by allowing her to resettle in a safe third country. This might result in a short-run cost for that country – but it would also generate long-term benefits.

Imagine a framework under which she is endowed with a sum of money to offset the (temporary) costs she and her future host government incur for her resettlement. Potential host countries anywhere in the world – perhaps those with labor market or demographic needs – can offer to accept her and receive the associated endowment.

This scheme might be particularly attractive to developing countries, which could especially benefit from both the voucher payment and the skills that refugees could contribute to their labor markets. For every refugee currently living overseas and supported by humanitarian aid, a fund could pay this one-off "voucher" to any country able and willing to accept them. By accepting the payment, the receiving country would be obliged to grant the refugee the same status it accords other migrants for whom it doesn't receive any payment. At a minimum, this would mean granting the right to work and access to public services (not currently guaranteed in all potential host countries). So returning to the example of the Kenyan government, which cites security concerns as its reason to close the Dadaab refugee camp, viewing the 300,000 Somali refugees as representing a potential investment in Kenya might change the political and fiscal algebra, or at least have better options for relocation.

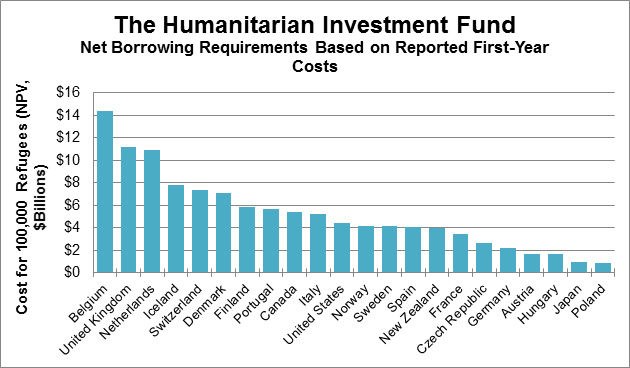

We call this framework the "Humanitarian Investment Fund." What might it cost? We can get an idea by comparing the amount countries pay to support refugees overseas and the costs they report incurring when they resettle them. Looking at those differences in today’s money (net present value terms) and considering a scheme that would work for 100,000 refugees gives us a rough idea of the range of capitalisations we’re discussing. (We do this for OECD countries that report the first year costs for refugee resettlement, and leave out countries that don’t report this figure, like Australia, or reported an implausibly low figure).

For the median case, we estimate that 100,000 refugees could be resettled for about $4 billion dollars, or $40,000 per refugee. That’s squarely in the ballpark of problems that the global public sector can get its arms around. For example, if we were able to capitalise a $4 billion fund with a bond paying 2.5% a year, the nominal interest cost of permanently moving people off the global refugee caseload would be just $1,000 per person per year. And borrowing $4 billion dollars is not a high hurdle: in 2014, global aid commitments were just over $135 billion; the UN High Commissioner for Refugees’ 2014 budget was $3.6 billion (and that was only half funded).

More generally, these are conservative estimates for three reasons:

Quantity: Assuming 100,000 potential beneficiaries is an overstatement, at least to start. In reality, less than a tenth of refugees are designated eligible for resettlement. In 2014 in Jordan, only eight-tenths of one percent of the total Syrian refugee population was resettled overseas (6,084 of 623,112).

Price: Our calculations assume gently declining costs each year for a decade, tied to OECD countries’ first-year refugee costs. In fact, most refugees receive this level of benefits for only in their first year in most of Europe, between six months and five years in the US (it varies across an alphabet soup of programmes), and six months to three years in Canada. So we are being conservative in attributing this scale of cost to refugees for a decade, and only slightly optimistic in assuming that they decrease slowly over time, pricing in payoffs as refugees integrate into local labour markets (which could be much greater in practice).

Time: These figures assume that in the absence of this scheme, a person would spend 10 years on the international refugee caseload. In reality, we have a shaky idea of how long the average refugee spends in and out of camps overseas. The oft-quoted figure of 17 years, for example, turns out to be a zombie fact that has gained currency by virtue of repetition. The assumption of ten years is reasonable but ultimately just that – an assumption.

These numbers seem especially reasonable in light of the European Commission’s proposed scheme to fine countries as much as €250,000 for every asylum-seeker that they should admit, but refuse to. That scheme is intended to be a stick, punishing countries which fail to meet their commitments to share in the “burden” of hosting a small number of refugees. Our proposed system would instead operate as a carrot, creating healthy and fair incentives for countries to go above and beyond this minimum hurdle to the mutual benefit of all involved.

The program could be expanded to many more potential refugees – without reducing commitments to those already on the caseload – by pooling these costs and borrowing from capital markets, backed by donors’ promises to repay. This method of using private capital, repaid from future government budgets, builds on other successful financial innovations. For example, IFFIm is an international fund which borrows from capital markets to pay for vaccination programs, with donors repaying the costs of borrowing over time. IFFIm’s "vaccine bonds" borrow cheaply because donors are largely wealthy OECD countries with strong credit ratings.

The proposed system creates a "triple-win." Potential host countries would have more control over who they admit, and be able to alleviate up-front short term costs. Refugees would be able to escape the long-term destitution and disempowerment of refugee camps and dependence on humanitarian aid; with a job in a safe third country, they would be able to apply their skills and create positive spillover effects for their families and home communities. Donors would assume no additional expenses, transferring the long-run costs of a substantial and growing caseload of humanitarian aid into upfront resettlement investments.

A scheme like this would likely need to have at least three core features in order to be politically viable, and attractive for the refugees themselves. It would need to be

Voluntary: Both refugees and host countries must agree to participate. Under a matching system, refugees would make a list of places they would like to live, while host countries would be asked to identify who they would most like to admit, likely based on labor market needs and integration capacity. The fiscal voucher each refugee brings with them lowers the "relative cost" to potential host countries. (Countries could use the endowment to provide for local services where the refugees are resettled, perhaps reducing possible sources of friction with local communities.) This system would enroll refugees from their current country of residence (Syrians in Jordan), rather than individuals who have arrived in the EU seeking asylum, as proposed by Will Jones and Alex Teytelboym of the University of Oxford.

Additional: People eligible for this scheme would still have to qualify for refugee status in prospective host countries, even though they would be enrolled overseas. Refugee status granted to individuals overseas by UNHCR does not necessarily align with the criteria in place in host countries. To be eligible for this scheme, refugees would have to qualify under both UNHCR and host country rules.

Valuable: In order to earn the lump-sum payment, receiving countries would have to confer real benefits to their new arrivals. In particular, the receiving country would have to grant refugees the right to work and access to public services.

Refugees are a net financial win for receiving countries, paying more into public treasuries than they cost in services. The economic arguments in favour of accepting refugees from Syria – a middle income country before this crisis unfolded, with high levels of education and healthy civic social capital – is not complicated. As our colleague Lant Pritchett explains, Europe’s aging populations are living longer than ever, creating larger cohorts of pensioners and thereby placing increasing tax burdens on dwindling numbers of younger, productive workers.

But as our colleagues Michael Clemens and Justin Sandefur have discussed, “countries struggle to absorb refugee flows when those flows are sudden and concentrated in a limited area.” In other words, the greatest tension comes up front, when host countries scramble to find the time, money, and compassion to facilitate arrival and integration. Those difficulties are compounded by the fact that resettlement schemes are usually centrally-run while pressure on local services is local. This proposed framework slackens the immediate financial constraint, empowering governments and communities to determine where these funds are best spent – a fiscal release valve for some of these pressures.

There are a number of reasons that some countries are unwilling to accept refugees. Some of these may reflect simple-minded xenophobia. But a dab of financial chemistry could at least tackle the fiscal case against doing so, putting a thumb on the political scale in favour of compassion, and helping many people secure better, safer, and more productive lives.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.