Recommended

The World Bank’s Independent Evaluation Group has just issued a “Focused Assessment” of the IDA Private Sector Window, looking at the PSW’s first five years of operation. The PSW, launched in 2018, uses $5.6 billion of World Bank IDA financing to subsidize IFC and MIGA investments in the private sector through mechanisms including local currency financing and first loss guarantees. Six years after launch, it is still hard to do a proper analysis of the Window’s development impact—not least because only 20 PSW projects have closed and none have been subject to evaluation. But that doesn’t prevent the IEG report from coming to the conclusion that things are going well. The Assessment has only two suggestions for improving the PSW: enhanced risk modelling and financial management reporting. That reflects a broadly positive tone throughout, with fulsome descriptions of intended impacts and potential returns. Sadly, it is too good to be true.

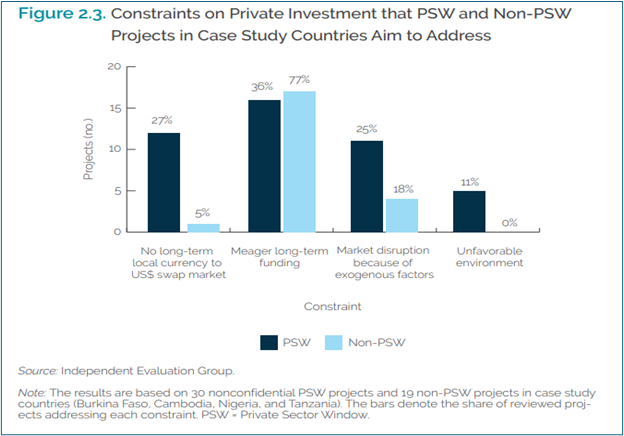

The IEG Assessment tries hard to be supportive. The report’s Figure 2.3 is a great example. It displays the number of different market constraints that a subset of PSW projects (dark blue) are designed to address compared to a subset of non-PSW projects (light blue) in the same countries. The bars certainly make it look like PSW projects are addressing a lot more market constraints. But that’s mostly because the sample includes 30 PSW projects and only 19 non-PSW projects (to be fair, the text does a better job of explaining that is what’s going on).

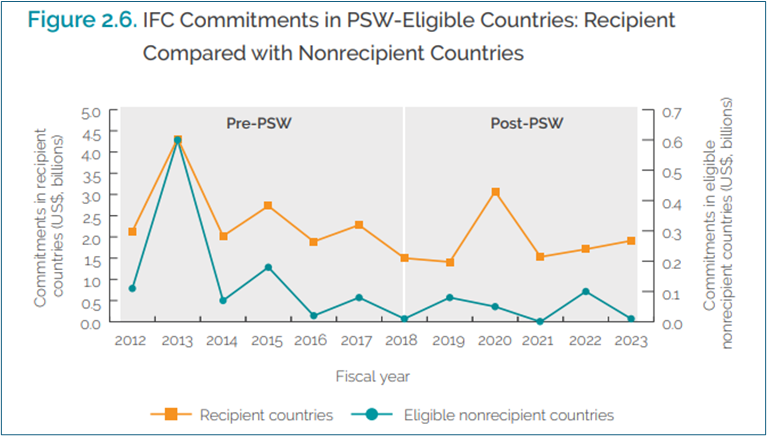

Again, the assessment suggests that “[a]mid multiple crises—such as the COVID-19, energy, food, and debt sustainability crises—since 2018, the PSW has allowed IFC to commit at a larger scale in eligible countries than it might otherwise have.” It concludes “[s]tatistical evidence indicates that the scale-up would not have happened without PSW funds.” Given that IFC commitments have been falling over time in PSW-eligible countries, this conclusion about a scale-up seems generous to a fault, but even the idea that the PSW ensured commitments were less scaled-down may be over-kind.

In eligible countries that received PSW support, IFC’s annual average commitments fell by 28 percent between the six years before the PSW was introduced (2012–2017) and the six years after that (2018–23). But, notes the report, they fell by 77 percent between the same periods in eligible countries that did not host a PSW-supported project: a grim IFC performance would have been even worse absent the PSW, it suggests. This conclusion, and the analysis that underlies it, is worth a little more unpacking.

Figure 2.6 from the report shows the trends in commitments. Notice the two y-axes: on the left, on a scale that reaches $5 billion, the aggregate for 41 countries that were home to PSW recipients on or after 2018 (the orange line); on the right, on a scale that reaches $0.7 billion, the aggregate for 26 countries that were eligible for PSW support on or after 2018 but have not hosted a PSW project (the teal line). 2013 was an outlier year for both, but from 2014 onward, PSW-eligible, non-recipient countries got somewhere around $100 million a year in IFC commitments before the PSW was put in place and a little less afterward. PSW-eligible countries that hosted a PSW-financed project saw commitments around $2.5 billion before the PSW was put in place, dropping perhaps closer to $2 billion a year after 2017. A bunch of countries that hardly received any IFC investments before the PSW continued to receive hardly any IFC investments after the introduction of the PSW while a bunch of countries that saw a few IFC investments before the PSW saw somewhat fewer IFC investments after the PSW was introduced. (It should be noted that Yemen didn’t see any IFC investments in the pre-PSW period and then there was an IFC investment in 2021 with PSW support –but this is, I think, the only example of a country switching from one category to the other).

Given the IEG Assessment also managed to create a sample of 97 PSW projects and 231 non-PSW projects that were matched on country and sector, it would be a reach to claim that any and all IFC investment in a country (or indeed country-sector) required PSW support. But the report carries out regression analysis which, it says, “confirms that the PSW has helped increase IFC engagements at the country level.” To do that, it shows that IFC total commitment volume was statistically significantly higher in a country in the year that there was an IFC investment commitment backed by the PSW than it was in countries that only received a PSW-backed investment in a later year.

As most PSW-eligible countries in most years do not attract an IFC investment and any PSW investment involving the IFC necessarily comes alongside an IFC commitment, it should come as no surprise that IFC commitment volumes were higher in countries that saw a PSW-backed investment in a given year. And so the question remains as to whether the PSW involvement was causally necessary to sustain IFC commitment volumes, as suggested. The Assessment methodology appendix explains how this problem was addressed: “the team theorized a priori that the level of IFCs investment in a given country is a function of… the status of PSW usage.” PSW usage is assumed to be an independent variable driving commitments.

To be sure, surveys of IFC staff and deal sponsors led to widespread assurances that PSW finance was necessary for projects to go ahead. Internal IFC ratings suggest that PSW projects are particularly risky—and so it is quite plausible that IFC staff and management felt a lot more comfortable moving forward with these marginal projects when they included a PSW subsidy. And that may be why PSW projects attract a lot less interest from non-subsidized investors: they mobilize 60 percent less private capital per dollar of IFC investment than IFC projects in the same countries that do not rely on the PSW. This, the report suggests, demonstrates that the projects will help generate information about viability for the wider market. Let us hope so. But it still might well be that the PSW simply subsidized the IFC to back the marginal projects in a shrinking portfolio pipeline that remained little changed by the advent of the Window.

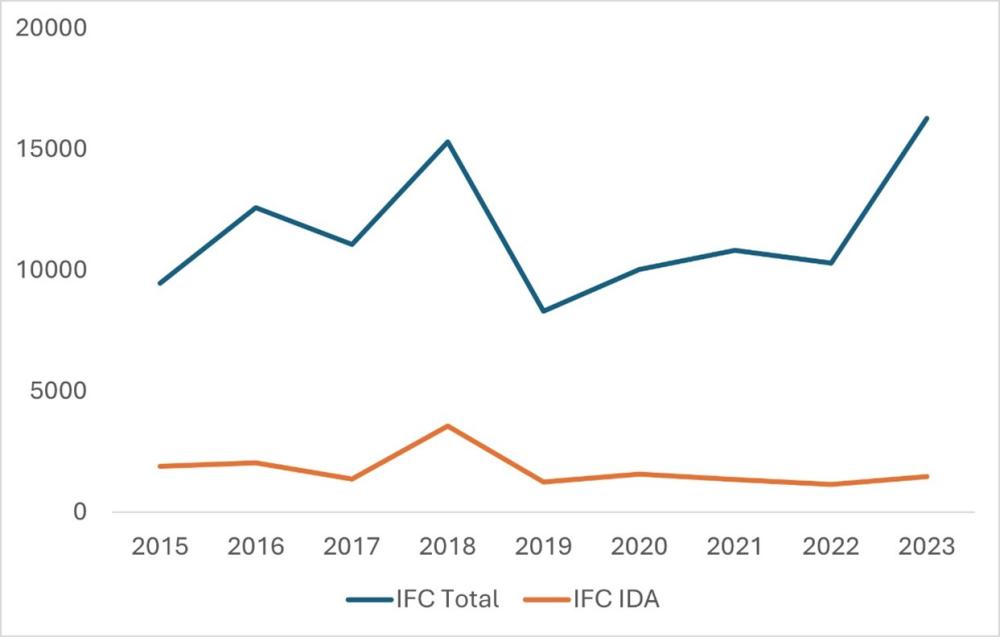

Did the PSW help mitigate tough external circumstances, protecting IFC investments from a more precipitous fall? For example, did IFC investments in IDA countries climb as a percentage of total IFC investments over time with the backing of the subsidy mechanism? The answer is no: the share has dropped from about 20 percent in 2015 to nine percent today.

Figure: IFC Total and IDA Country Board Approved Investments $m

Or have IFC investments in IDA countries held up well in comparison to other DFI activities or FDI? It is true that FDI in IDA countries did fall by 8 percent between the three years 2016-18 and the three years 2019-2021. But other DFIs apparently still managed to increase their operations in IDA countries. OECD data on total MDB and Development Finance Institution mobilization –questionable though it is with regard to causality—suggests funds mobilized in IDA countries over the three years 2019-2021 was 84 percent above the three years prior (admittedly that number would be a lot lower without a very large energy investment in Mozambique). Over the same periods, IFC board-approved investments in IDA countries were down nearly 40 percent (that’s five times the percentage decline of FDI). It isn’t clear, then, that the IFC would have done even less in IDA countries absent the PSW, even though it is clear the IFC did less in IDA countries than it did before the PSW (when it didn’t do very much in IDA countries).

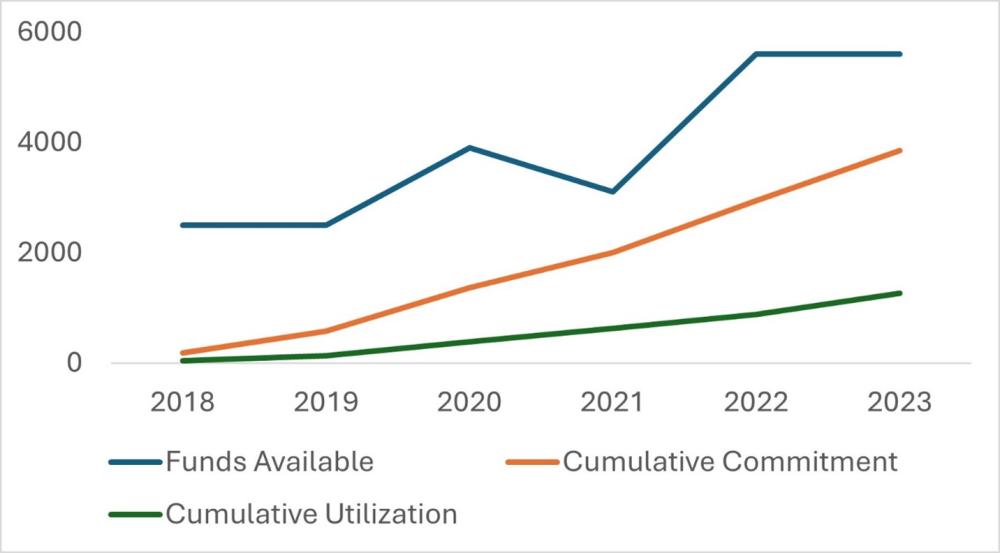

Meanwhile, for the PSW as a whole, commitments are not the same as actual financial flows, and in the case of the PSW, even though most of the money only needs flow as far as the IFC or MIGA to be utilized, the commitment and utilization numbers are still markedly different. While based on commitment data, the report argues that uptake of IDA PSW funds has been rapidly increasing, using actual utilization the picture is not reassuring. The PSW has been funneling increasing sums to cross-country ‘envelopes’ and ‘facilities’: these pre-authorize investments largely into existing IFC client companies to help them respond to shocks, or to ‘keep the private sector going’ in the term preferred by the Assessment. Of course, it could only help keep going a very small part the private sector in IDA countries, because much of it is only available to existing IFC clients. And as it turns out, there is limited demand for more IFC finance in that very limited portion of the private sector. That helps to account for the fact that six years into its operation, cumulative utilization of PSW funds is only at 33 percent of cumulative commitments (and 23 percent of funds available). It appears the IFC simply can’t find very many actual projects it wants to support in PSW countries, even with the support of the PSW subsidy.

Figure: PSW Funds Available, Commitments, and Utilization ($m)

Data from IDA annual financial statements

On the quality of investments, it is a little surprising that the IEG appears unconcerned about PSW projects that utterly ignore best practice as defined by the World Bank on issues like competitive award. And although it suffers from a lack of sufficient evaluated PSW projects to explore, the IEG does have data on overall trends in IFC project performance that could be illustrative about development impact. The IEG’s RAP 2023 reports a “notable decline” in outcomes from IFC projects in IDA countries in recent years. In the first half of the 2010s, over half of IFC projects in IDA countries were rated satisfactory. Now it is 36 percent (for non-IDA countries it is 58 percent). IFC Projects in fragile states have collapsed from above 60 percent satisfactory in the mid 2010s to 11 percent in the latest data. Compare actual IDA projects with governments, where the proportion satisfactory is 82 percent, up from 72 percent in 2015. So, along with lower volumes in IDA-PSW countries, we’re seeing IFC outcomes that are far worse than, and further diverging from, core IDA projects.

The PSW has been very slow in utilizing resources, it hasn’t stopped a slide in IFC commitments in the world’s poorest and most fragile countries while other development finance institutions appear to be ramping up, and IFC’s projects in those countries are performing worse than ever. Under the circumstances, I don’t think it is plausible to be as sanguine as the Independent Evaluation Group Assessment appears to me about the impact and direction of the PSW. And that matters: the window is up for renewal as part of the IDA 21 negotiations. The Focused Assessment was a missed opportunity to call for real change.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Image credit for social media/web: zephyr_p / Adobe Stock